- Hong Kong

- /

- Capital Markets

- /

- SEHK:388

Should You Be Adding Hong Kong Exchanges and Clearing (HKG:388) To Your Watchlist Today?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Hong Kong Exchanges and Clearing (HKG:388). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Hong Kong Exchanges and Clearing

How Fast Is Hong Kong Exchanges and Clearing Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Hong Kong Exchanges and Clearing managed to grow EPS by 10% per year, over three years. That's a good rate of growth, if it can be sustained.

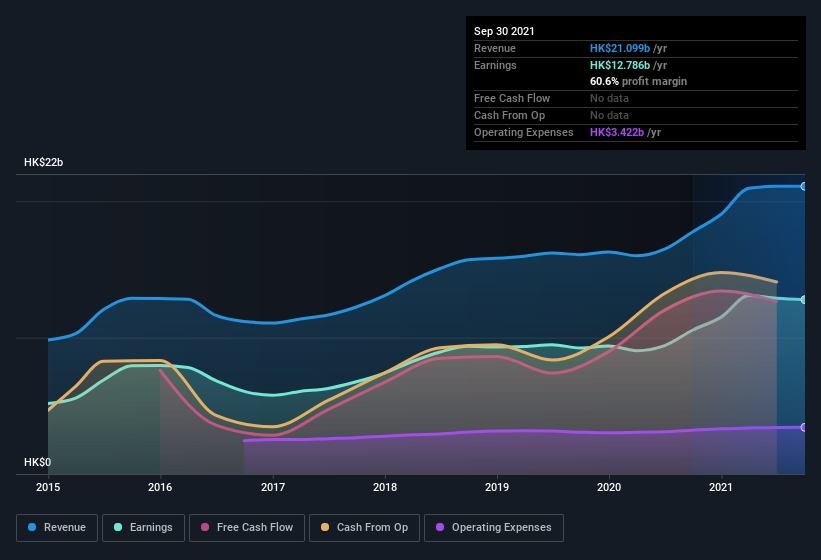

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Hong Kong Exchanges and Clearing's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Hong Kong Exchanges and Clearing maintained stable EBIT margins over the last year, all while growing revenue 19% to HK$21b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Hong Kong Exchanges and Clearing.

Are Hong Kong Exchanges and Clearing Insiders Aligned With All Shareholders?

Since Hong Kong Exchanges and Clearing has a market capitalization of HK$567b, we wouldn't expect insiders to hold a large percentage of shares. But we are reassured by the fact they have invested in the company. Indeed, they hold HK$306m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.05% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is Hong Kong Exchanges and Clearing Worth Keeping An Eye On?

As I already mentioned, Hong Kong Exchanges and Clearing is a growing business, which is what I like to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Hong Kong Exchanges and Clearing is trading on a high P/E or a low P/E, relative to its industry.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hong Kong Exchanges and Clearing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:388

Hong Kong Exchanges and Clearing

Owns and operates stock exchanges and futures exchanges, and related clearing houses in Hong Kong, Mainland China, and the United Kingdom.

Excellent balance sheet with acceptable track record.