- Hong Kong

- /

- Consumer Finance

- /

- SEHK:2858

Market Participants Recognise Yixin Group Limited's (HKG:2858) Earnings Pushing Shares 26% Higher

Yixin Group Limited (HKG:2858) shares have continued their recent momentum with a 26% gain in the last month alone. The last 30 days were the cherry on top of the stock's 328% gain in the last year, which is nothing short of spectacular.

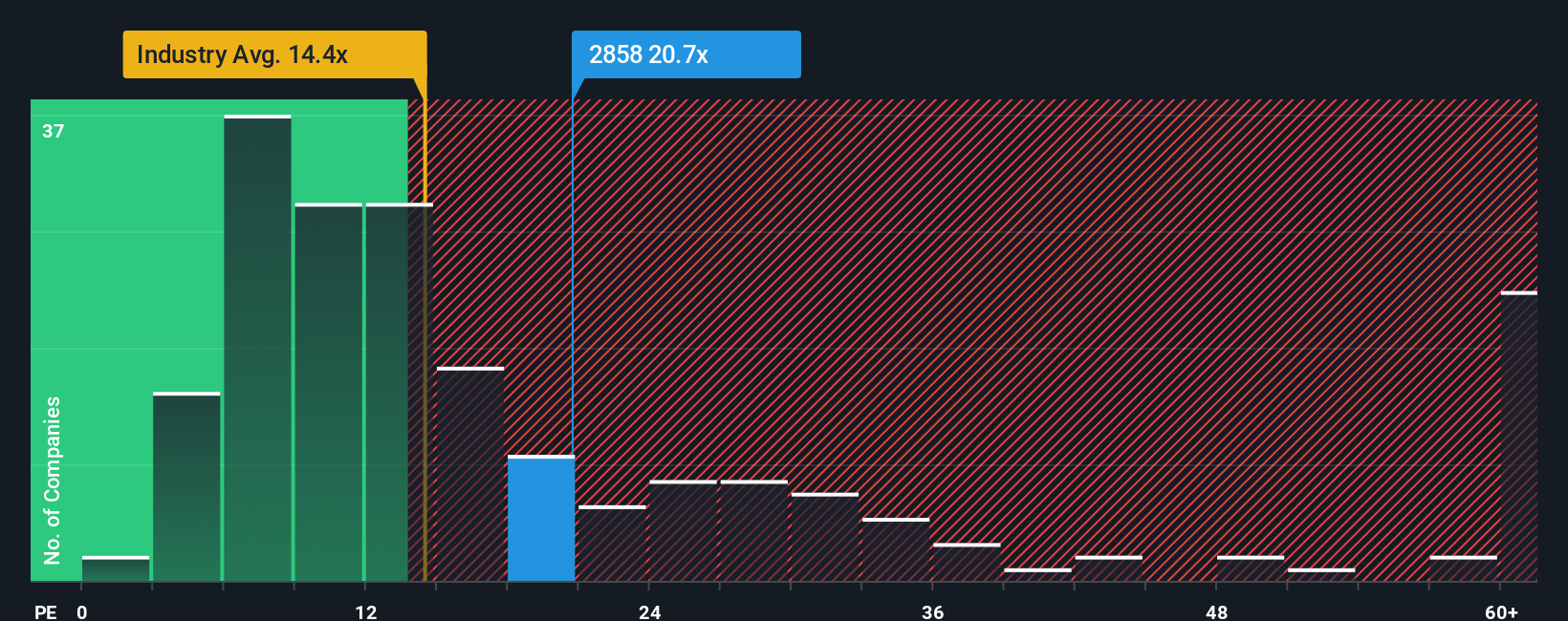

Since its price has surged higher, Yixin Group may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 20.7x, since almost half of all companies in Hong Kong have P/E ratios under 12x and even P/E's lower than 7x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's superior to most other companies of late, Yixin Group has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Yixin Group

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Yixin Group's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 33% last year. Pleasingly, EPS has also lifted 210% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 23% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 15% each year, which is noticeably less attractive.

In light of this, it's understandable that Yixin Group's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Yixin Group's P/E?

Yixin Group's P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Yixin Group maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 1 warning sign for Yixin Group that you need to take into consideration.

If these risks are making you reconsider your opinion on Yixin Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2858

Yixin Group

Operates as an online automobile finance transaction platform in China.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives