Stock Analysis

- Hong Kong

- /

- Capital Markets

- /

- SEHK:1973

Exploring Three SEHK Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

Amid a backdrop of fluctuating global markets, Hong Kong's Hang Seng Index has shown resilience with a notable gain of 3.11% recently. In such an environment, growth companies with significant insider ownership in Hong Kong can offer unique investment appeal, as high insider stakes often align shareholder interests with management, potentially leading to more prudent corporate governance and long-term strategic planning.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

| New Horizon Health (SEHK:6606) | 16.6% | 61% |

| Meitu (SEHK:1357) | 38% | 34.3% |

| Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

| DPC Dash (SEHK:1405) | 38.2% | 91.5% |

| Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.2% | 75.4% |

| Beijing Airdoc Technology (SEHK:2251) | 27.2% | 83.9% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 15.7% | 100.1% |

| Ocumension Therapeutics (SEHK:1477) | 17.7% | 93.7% |

Let's explore several standout options from the results in the screener.

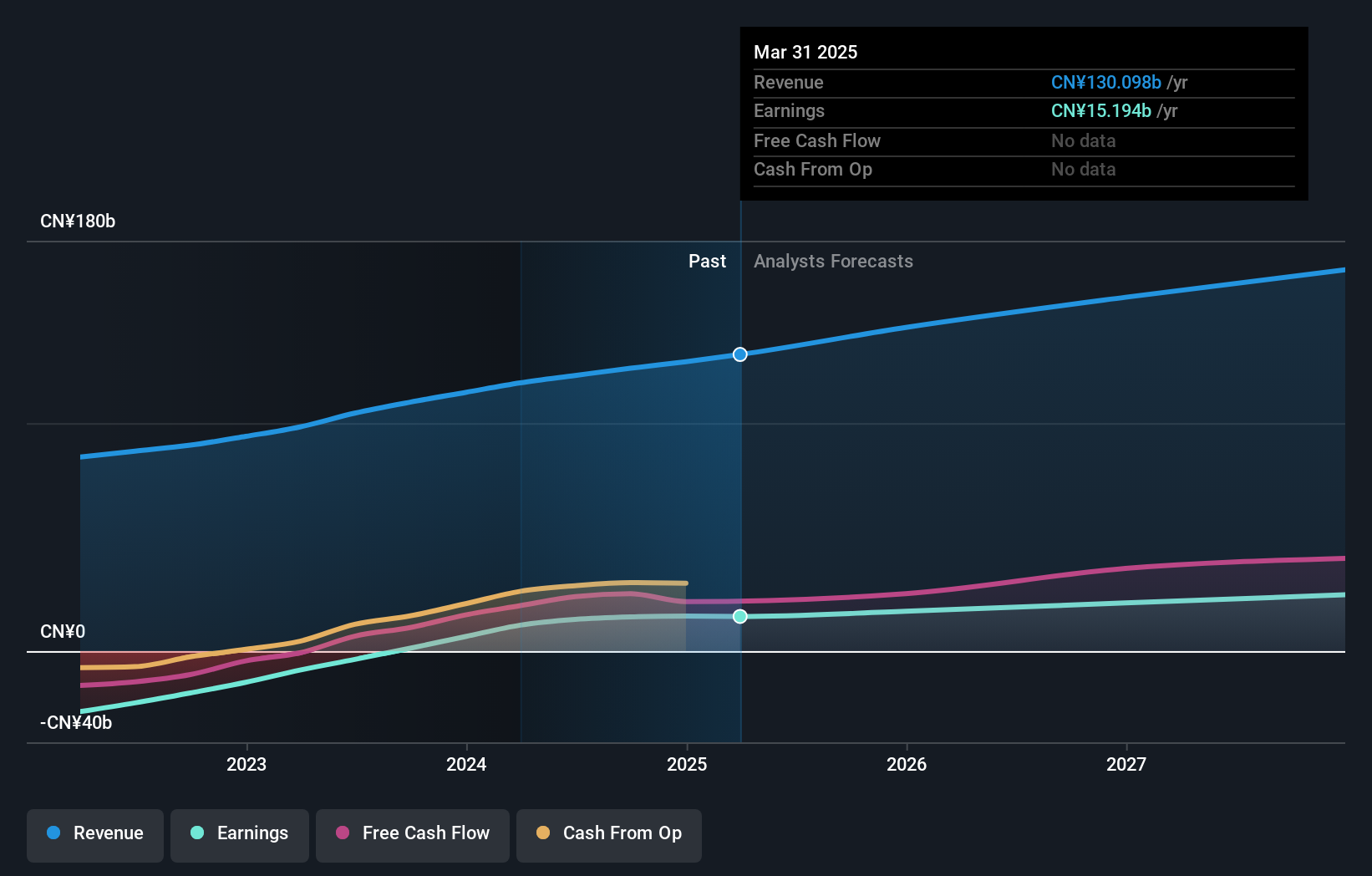

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kuaishou Technology operates as an investment holding company in the People's Republic of China, offering services such as live streaming and online marketing, with a market capitalization of approximately HK$256.42 billion.

Operations: The company generates revenue primarily through live streaming and online marketing services.

Insider Ownership: 19.3%

Earnings Growth Forecast: 23.6% p.a.

Kuaishou Technology, a Hong Kong-based growth company with significant insider ownership, recently announced a substantial share repurchase program valued at HK$16 billion, signaling strong confidence from its board. The company has transitioned to profitability this year, with first-quarter sales rising to CNY 29.41 billion and net income reaching CNY 4.12 billion—a stark improvement from last year's losses. Analysts predict a promising future with earnings expected to grow by 23.6% annually and the stock trading at 38% below its estimated fair value, indicating potential undervaluation.

- Get an in-depth perspective on Kuaishou Technology's performance by reading our analyst estimates report here.

- The analysis detailed in our Kuaishou Technology valuation report hints at an deflated share price compared to its estimated value.

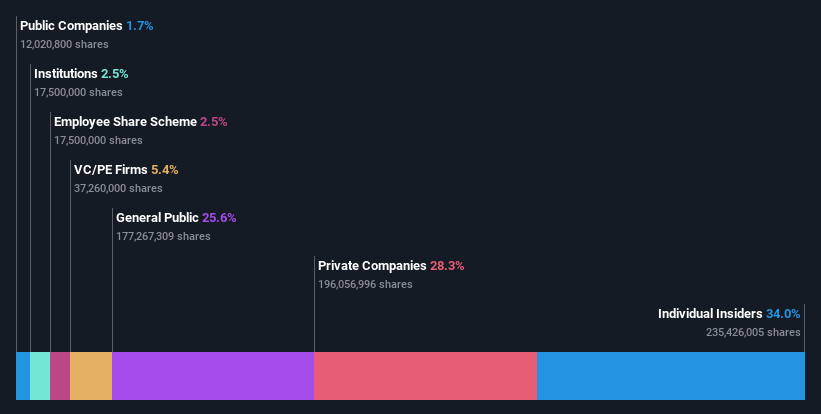

Tian Tu Capital (SEHK:1973)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tian Tu Capital Co., Ltd. is a private equity and venture capital firm focusing on early-stage, mature, and Pre-IPO investments in small and medium-sized companies, with a market capitalization of approximately HK$2.79 billion.

Operations: The firm's revenue from asset management is approximately CN¥-0.77 billion.

Insider Ownership: 34%

Earnings Growth Forecast: 70.5% p.a.

Tian Tu Capital, despite its high volatility and low revenue of less than US$1m (CN¥-769M), is poised for significant growth with earnings forecasted to surge by 70.47% annually. The company is trading at 68.5% below its estimated fair value, suggesting a potential undervaluation. Recent executive changes, including the appointment of Wang Shilin as an independent non-executive director, indicate a strategic refresh in leadership amid forecasts of profitability and revenue growth well above the market average over the next three years.

- Click here to discover the nuances of Tian Tu Capital with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Tian Tu Capital is trading behind its estimated value.

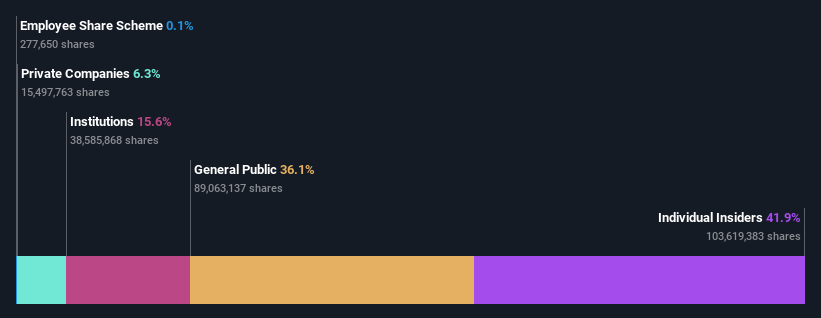

CanSino Biologics (SEHK:6185)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CanSino Biologics Inc. is a company based in the People’s Republic of China that focuses on developing, manufacturing, and commercializing vaccines, with a market capitalization of approximately HK$9.66 billion.

Operations: The company generates revenue primarily through its segment focused on the research and development of vaccine products for human use, totaling CN¥370.81 million.

Insider Ownership: 27.9%

Earnings Growth Forecast: 124.6% p.a.

CanSino Biologics, despite a recent net loss of CNY 170.1 million, is advancing with promising vaccine developments such as the Hib and PBPV vaccines, showing potential in high-growth markets. The company's high insider ownership aligns interests with shareholders but faces challenges with a low forecasted Return on Equity of 5.1%. Trading at 88.5% below its estimated fair value suggests undervaluation amidst expectations of revenue growth significantly outpacing the market at 34.3% annually.

- Dive into the specifics of CanSino Biologics here with our thorough growth forecast report.

- The valuation report we've compiled suggests that CanSino Biologics' current price could be inflated.

Turning Ideas Into Actions

- Get an in-depth perspective on all 52 Fast Growing SEHK Companies With High Insider Ownership by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Tian Tu Capital is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1973

Tian Tu Capital

A private equity and venture capital firm specializing in investments in small and medium sized companies in early-stage, mature, and Pre-IPO stages.

High growth potential and good value.