- Hong Kong

- /

- Capital Markets

- /

- SEHK:1945

Earnings Not Telling The Story For Zero2IPO Holdings Inc. (HKG:1945) After Shares Rise 66%

Zero2IPO Holdings Inc. (HKG:1945) shareholders have had their patience rewarded with a 66% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 44% in the last year.

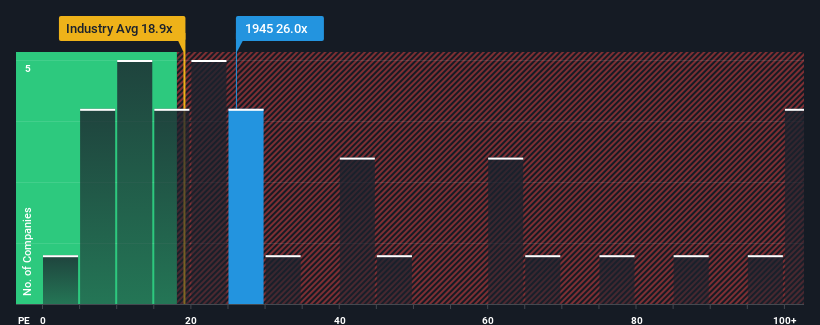

Since its price has surged higher, Zero2IPO Holdings' price-to-earnings (or "P/E") ratio of 26x might make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 9x and even P/E's below 5x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Zero2IPO Holdings over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for Zero2IPO Holdings

Is There Enough Growth For Zero2IPO Holdings?

Zero2IPO Holdings' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 48%. This means it has also seen a slide in earnings over the longer-term as EPS is down 66% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 22% shows it's an unpleasant look.

In light of this, it's alarming that Zero2IPO Holdings' P/E sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Final Word

The strong share price surge has got Zero2IPO Holdings' P/E rushing to great heights as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Zero2IPO Holdings currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You need to take note of risks, for example - Zero2IPO Holdings has 5 warning signs (and 1 which is a bit concerning) we think you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zero2IPO Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1945

Zero2IPO Holdings

An investment holding company, provides integrated equity investment services in the People’s Republic of China.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives