- Hong Kong

- /

- Capital Markets

- /

- SEHK:1835

Shanghai Realway Capital Assets Management's(HKG:1835) Share Price Is Down 13% Over The Past Year.

Investors can approximate the average market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. For example, the Shanghai Realway Capital Assets Management Co., Ltd. (HKG:1835) share price is down 13% in the last year. That's disappointing when you consider the market returned 12%. Shanghai Realway Capital Assets Management may have better days ahead, of course; we've only looked at a one year period. It's down 3.3% in the last seven days.

Check out our latest analysis for Shanghai Realway Capital Assets Management

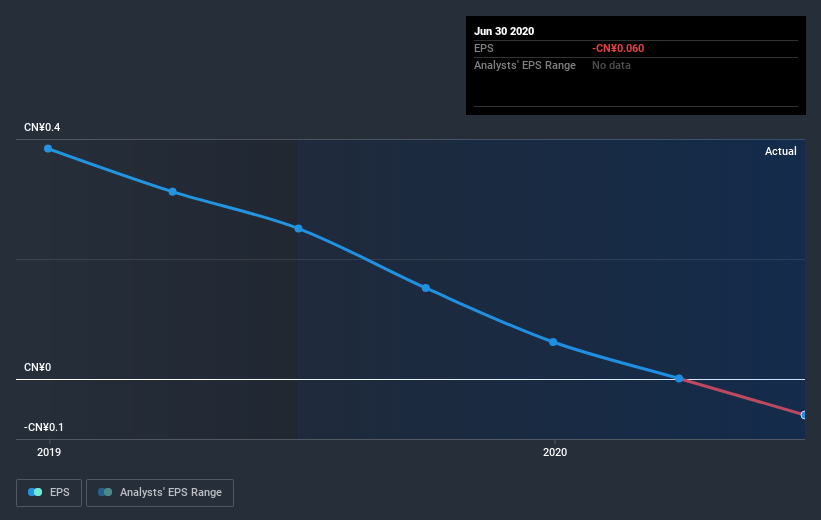

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Shanghai Realway Capital Assets Management saw its earnings per share drop below zero. Some investors no doubt dumped the stock as a result. However, there may be an opportunity for investors if the company can recover.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Given that the market gained 12% in the last year, Shanghai Realway Capital Assets Management shareholders might be miffed that they lost 13%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 2.5%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Shanghai Realway Capital Assets Management you should be aware of, and 1 of them is concerning.

But note: Shanghai Realway Capital Assets Management may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade Shanghai Realway Capital Assets Management, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1835

Shanghai Realway Capital Assets Management

Shanghai Realway Capital Assets Management Co., Ltd.

Excellent balance sheet with low risk.

Market Insights

Community Narratives