- Hong Kong

- /

- Consumer Finance

- /

- SEHK:1577

Cautious Investors Not Rewarding Quanzhou Huixin Micro-credit Co., Ltd.'s (HKG:1577) Performance Completely

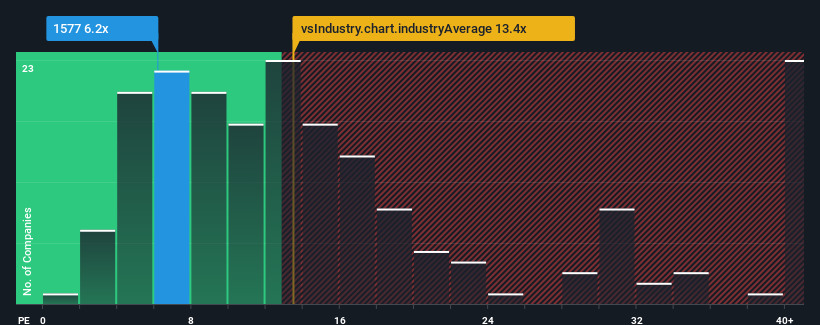

With a price-to-earnings (or "P/E") ratio of 6.2x Quanzhou Huixin Micro-credit Co., Ltd. (HKG:1577) may be sending bullish signals at the moment, given that almost half of all companies in Hong Kong have P/E ratios greater than 12x and even P/E's higher than 23x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Quanzhou Huixin Micro-credit certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Quanzhou Huixin Micro-credit

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Quanzhou Huixin Micro-credit would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 41%. The strong recent performance means it was also able to grow EPS by 118% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 18% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that Quanzhou Huixin Micro-credit is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Quanzhou Huixin Micro-credit revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Quanzhou Huixin Micro-credit you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Quanzhou Huixin Micro-credit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1577

Quanzhou Huixin Micro-credit

A microfinance company, provides various short-term financing solutions to entrepreneurial individuals, small and medium-sized enterprises, and microenterprises in the People’s Republic of China.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives