- Hong Kong

- /

- Capital Markets

- /

- SEHK:1428

What Can We Conclude About Bright Smart Securities & Commodities Group's (HKG:1428) CEO Pay?

This article will reflect on the compensation paid to Yik Bun Hui who has served as CEO of Bright Smart Securities & Commodities Group Limited (HKG:1428) since 2016. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Bright Smart Securities & Commodities Group

Comparing Bright Smart Securities & Commodities Group Limited's CEO Compensation With the industry

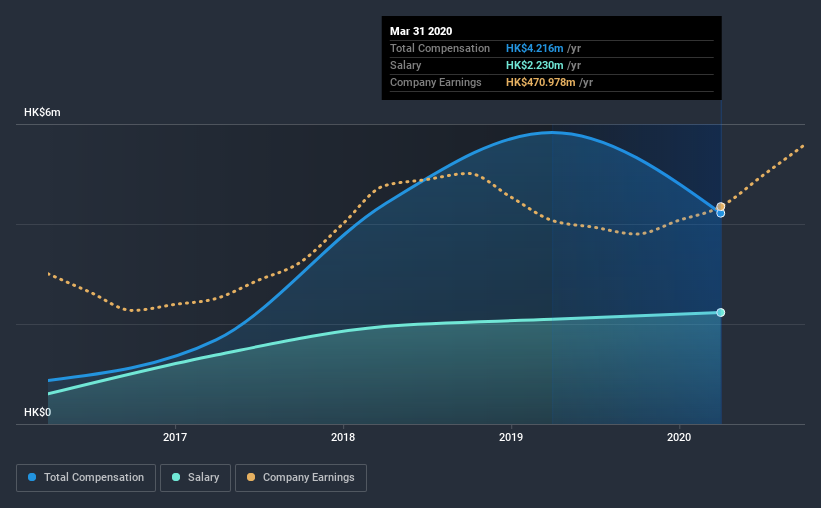

Our data indicates that Bright Smart Securities & Commodities Group Limited has a market capitalization of HK$3.3b, and total annual CEO compensation was reported as HK$4.2m for the year to March 2020. We note that's a decrease of 28% compared to last year. Notably, the salary which is HK$2.23m, represents most of the total compensation being paid.

On comparing similar companies from the same industry with market caps ranging from HK$1.6b to HK$6.2b, we found that the median CEO total compensation was HK$1.6m. This suggests that Yik Bun Hui is paid more than the median for the industry. What's more, Yik Bun Hui holds HK$1.2m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$2.2m | HK$2.1m | 53% |

| Other | HK$2.0m | HK$3.7m | 47% |

| Total Compensation | HK$4.2m | HK$5.8m | 100% |

On an industry level, roughly 75% of total compensation represents salary and 25% is other remuneration. Bright Smart Securities & Commodities Group pays a modest slice of remuneration through salary, as compared to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Bright Smart Securities & Commodities Group Limited's Growth

Over the past three years, Bright Smart Securities & Commodities Group Limited has seen its earnings per share (EPS) grow by 20% per year. Its revenue is up 28% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Bright Smart Securities & Commodities Group Limited Been A Good Investment?

Most shareholders would probably be pleased with Bright Smart Securities & Commodities Group Limited for providing a total return of 74% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

As we touched on above, Bright Smart Securities & Commodities Group Limited is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. However, Bright Smart Securities & Commodities Group has produced strong EPS growth and shareholder returns over the last three years. Considering such exceptional results for the company, we'd venture to say CEO compensation is fair. Given the strong history of shareholder returns, the shareholders are probably very happy with Yik Bun's performance.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 1 warning sign for Bright Smart Securities & Commodities Group that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Bright Smart Securities & Commodities Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bright Smart Securities & Commodities Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1428

Bright Smart Securities & Commodities Group

An investment holding company, provides financial services in Hong Kong.

Acceptable track record and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success