- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1277

Discovering 3 Undiscovered Gems in Hong Kong

Reviewed by Simply Wall St

In recent weeks, the Hong Kong market has experienced mixed performance, with the Hang Seng Index declining slightly amid weak manufacturing data and broader global economic concerns. Despite these challenges, opportunities still exist for discerning investors willing to look beyond the headlines. In this context, identifying stocks with strong fundamentals and growth potential can be particularly rewarding. Here are three undiscovered gems in Hong Kong that merit closer attention.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 23.22% | 6.87% | 31.81% | ★★★★★★ |

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Xin Point Holdings | 2.03% | 9.80% | 15.04% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited (SEHK:1277) is an investment holding company involved in the extraction and sale of coal products in the People’s Republic of China, with a market cap of HK$9.02 billion.

Operations: Kinetic Development Group generates revenue primarily from the extraction and sale of coal products in China. The company reported a gross profit margin of 35.42% for the latest fiscal year, with total revenue amounting to CN¥4.75 billion.

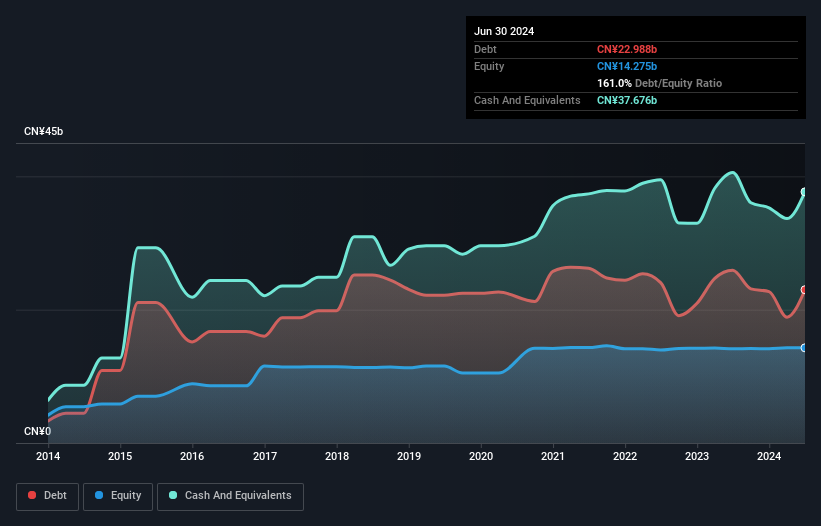

Kinetic Development Group's debt to equity ratio improved from 26.6% to 17.6% over five years, reflecting better financial health. Despite negative earnings growth of -22%, the company trades at 29.3% below its estimated fair value, suggesting potential undervaluation. Interest payments are well covered by EBIT (55.7x). Recent amendments to their memorandum and articles of association were approved on May 7, 2024, alongside a final dividend declaration of HKD0.05 per share for FY2023.

- Click to explore a detailed breakdown of our findings in Kinetic Development Group's health report.

Learn about Kinetic Development Group's historical performance.

Central China Securities (SEHK:1375)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Central China Securities Co., Ltd. is a securities company involved in brokerage, credit, futures, proprietary trading, investment banking and management with a market cap of HK$14.66 billion.

Operations: Central China Securities generates revenue primarily from its brokerage, credit, futures, proprietary trading, investment banking, and management businesses. The company has a market capitalization of HK$14.66 billion.

Central China Securities has demonstrated notable financial improvements, with its debt-to-equity ratio falling from 191.8% to 132.2% over the past five years. The company repurchased shares in the latest year and approved a final cash dividend of RMB 0.14 per 10 shares, payable on August 6, 2024. Despite recent auditor changes and executive reshuffling, earnings grew by an impressive 71.4% last year, significantly outperforming the industry's -28.3%.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in China with a market cap of HK$8.68 billion.

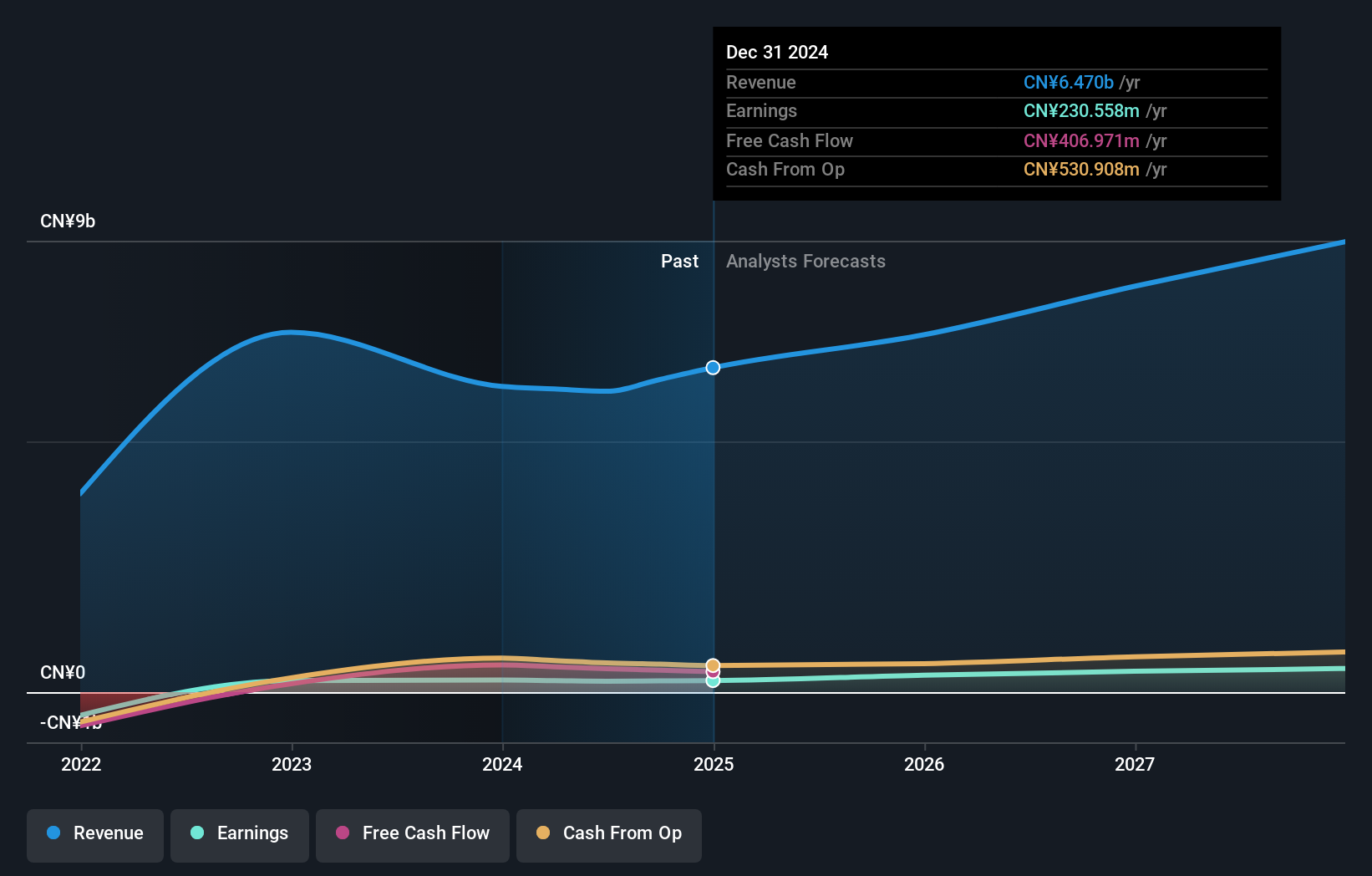

Operations: Guoquan Food (Shanghai) Co., Ltd. generates revenue primarily from retail sales through grocery stores, amounting to CN¥6.09 billion. The company's financial performance is influenced by its cost structure and operational efficiency, impacting its net profit margin.

Guoquan Food (Shanghai) has shown promising growth, with earnings increasing by 4.2% over the past year, outpacing the Consumer Retailing industry’s 1.6%. Their levered free cash flow turned positive in 2022 at RMB 167.31M and surged to RMB 543.34M in recent months of 2024. The company also approved a final dividend of RMB 0.0521 per share for FY2023, reflecting solid shareholder returns despite recent executive changes and amendments to their articles of association.

- Take a closer look at Guoquan Food (Shanghai)'s potential here in our health report.

Gain insights into Guoquan Food (Shanghai)'s past trends and performance with our Past report.

Seize The Opportunity

- Get an in-depth perspective on all 174 SEHK Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinetic Development Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1277

Kinetic Development Group

An investment holding company, engages in the extraction and sale of coal products in the People’s Republic of China.

Excellent balance sheet and good value.