Stock Analysis

- Hong Kong

- /

- Hospitality

- /

- SEHK:880

Strong week for SJM Holdings (HKG:880) shareholders doesn't alleviate pain of three-year loss

Investing in stocks inevitably means buying into some companies that perform poorly. But the long term shareholders of SJM Holdings Limited (HKG:880) have had an unfortunate run in the last three years. So they might be feeling emotional about the 71% share price collapse, in that time. And more recent buyers are having a tough time too, with a drop of 50% in the last year. Shareholders have had an even rougher run lately, with the share price down 13% in the last 90 days.

While the stock has risen 6.6% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for SJM Holdings

Because SJM Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, SJM Holdings' revenue dropped 18% per year. That means its revenue trend is very weak compared to other loss making companies. The swift share price decline at an annual compound rate of 20%, reflects this weak fundamental performance. We prefer leave it to clowns to try to catch falling knives, like this stock. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

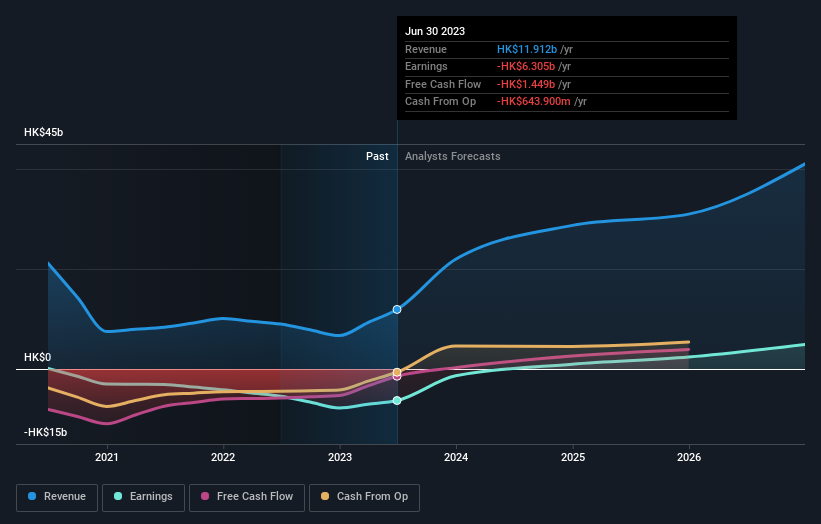

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

SJM Holdings is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

While the broader market lost about 20% in the twelve months, SJM Holdings shareholders did even worse, losing 50%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand SJM Holdings better, we need to consider many other factors. Even so, be aware that SJM Holdings is showing 1 warning sign in our investment analysis , you should know about...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether SJM Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:880

SJM Holdings

An investment holding company, owns, develops, and operates casinos and related facilities in Macau.

Good value with reasonable growth potential.