- Hong Kong

- /

- Consumer Services

- /

- SEHK:382

Investors Don't See Light At End Of Edvantage Group Holdings Limited's (HKG:382) Tunnel And Push Stock Down 26%

Edvantage Group Holdings Limited (HKG:382) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 41% in that time.

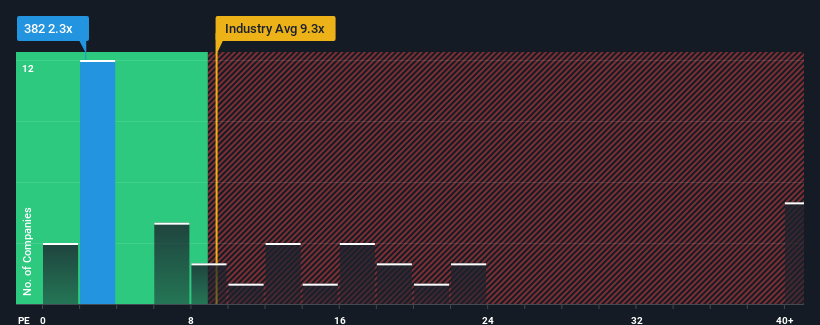

Although its price has dipped substantially, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 11x, you may still consider Edvantage Group Holdings as a highly attractive investment with its 2.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Our free stock report includes 1 warning sign investors should be aware of before investing in Edvantage Group Holdings. Read for free now.Recent times have been advantageous for Edvantage Group Holdings as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Edvantage Group Holdings

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Edvantage Group Holdings would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered a decent 12% gain to the company's bottom line. This was backed up an excellent period prior to see EPS up by 59% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 3.3% per annum during the coming three years according to the three analysts following the company. That's shaping up to be materially lower than the 14% each year growth forecast for the broader market.

With this information, we can see why Edvantage Group Holdings is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Edvantage Group Holdings' P/E

Edvantage Group Holdings' P/E looks about as weak as its stock price lately. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Edvantage Group Holdings' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Edvantage Group Holdings that you should be aware of.

If you're unsure about the strength of Edvantage Group Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Edvantage Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:382

Edvantage Group Holdings

An investment holding company, operates private higher and vocational education institutions in the People’s Republic of China, Australia, and Singapore.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives