Stock Analysis

As global markets navigate through a period of fluctuating inflation and interest rate expectations, the Hong Kong market has shown resilience with notable gains in key indices. In this context, exploring growth companies in the SEHK with high insider ownership can provide valuable insights into firms that potentially have aligned interests between management and shareholders, fostering robust governance and strategic agility in uncertain times.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| iDreamSky Technology Holdings (SEHK:1119) | 20.2% | 104.1% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Fenbi (SEHK:2469) | 32.8% | 43% |

| Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

| Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

| DPC Dash (SEHK:1405) | 38.2% | 90.2% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

| Beijing Airdoc Technology (SEHK:2251) | 28.7% | 83.9% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

| Ocumension Therapeutics (SEHK:1477) | 23.1% | 93.7% |

Let's explore several standout options from the results in the screener.

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★★☆

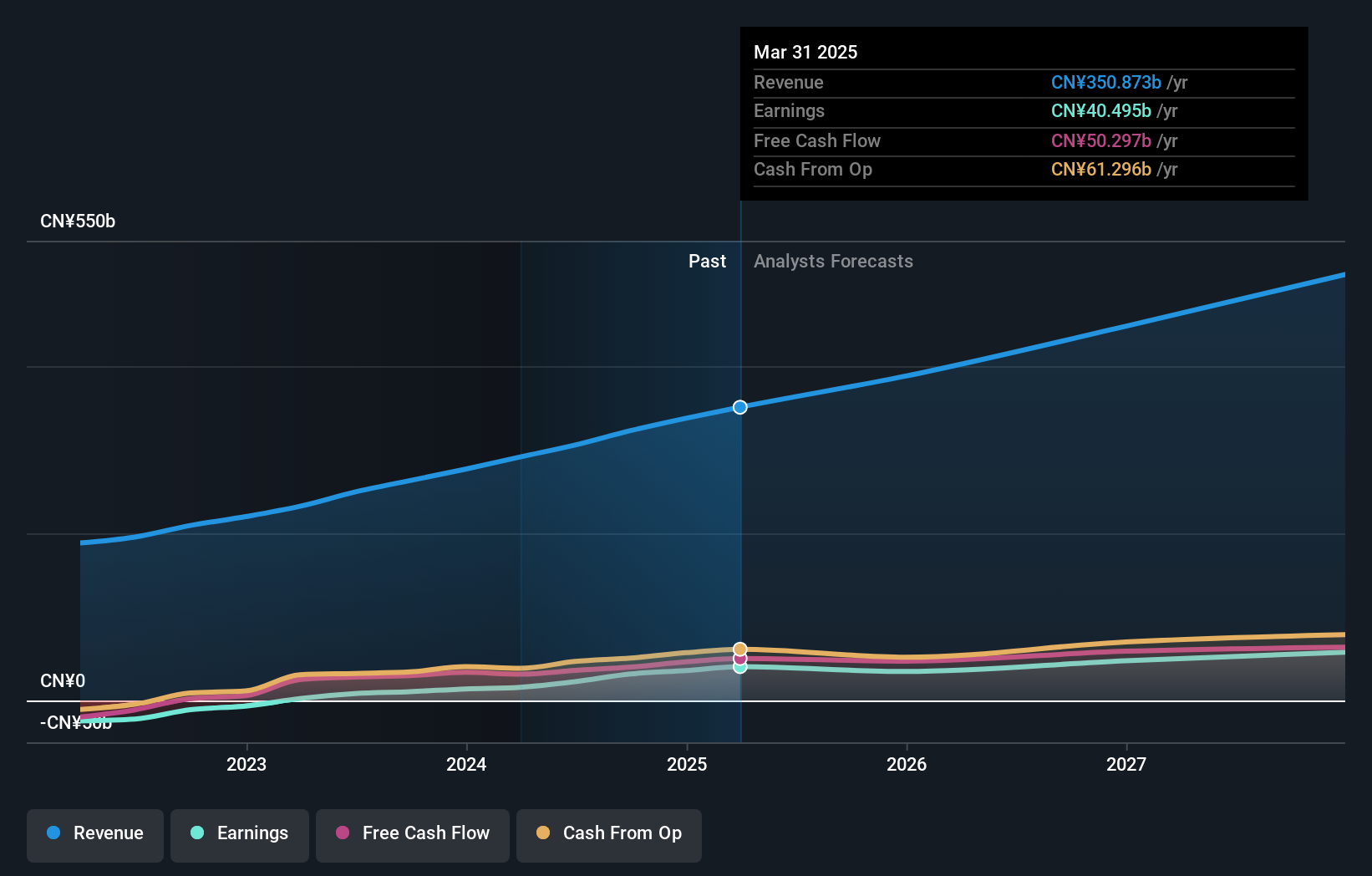

Overview: Meituan is a technology retail company based in the People’s Republic of China, with a market capitalization of approximately HK$728.63 billion.

Operations: The revenue segments for this firm are not specified in the provided text.

Insider Ownership: 11.5%

Meituan has demonstrated robust financial performance with first-quarter sales rising to CNY 73.28 billion, a significant increase from the previous year. The company's net income also saw a substantial rise to CNY 5.37 billion. Despite no major insider buying in the past three months, Meituan has initiated a share repurchase program valued at US$2 billion, underscoring confidence in its valuation, which is currently perceived as markedly below fair value. However, growth in earnings and revenue is projected to be substantial but slower than some market expectations.

- Click here to discover the nuances of Meituan with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Meituan's share price might be too optimistic.

Vobile Group (SEHK:3738)

Simply Wall St Growth Rating: ★★★★★☆

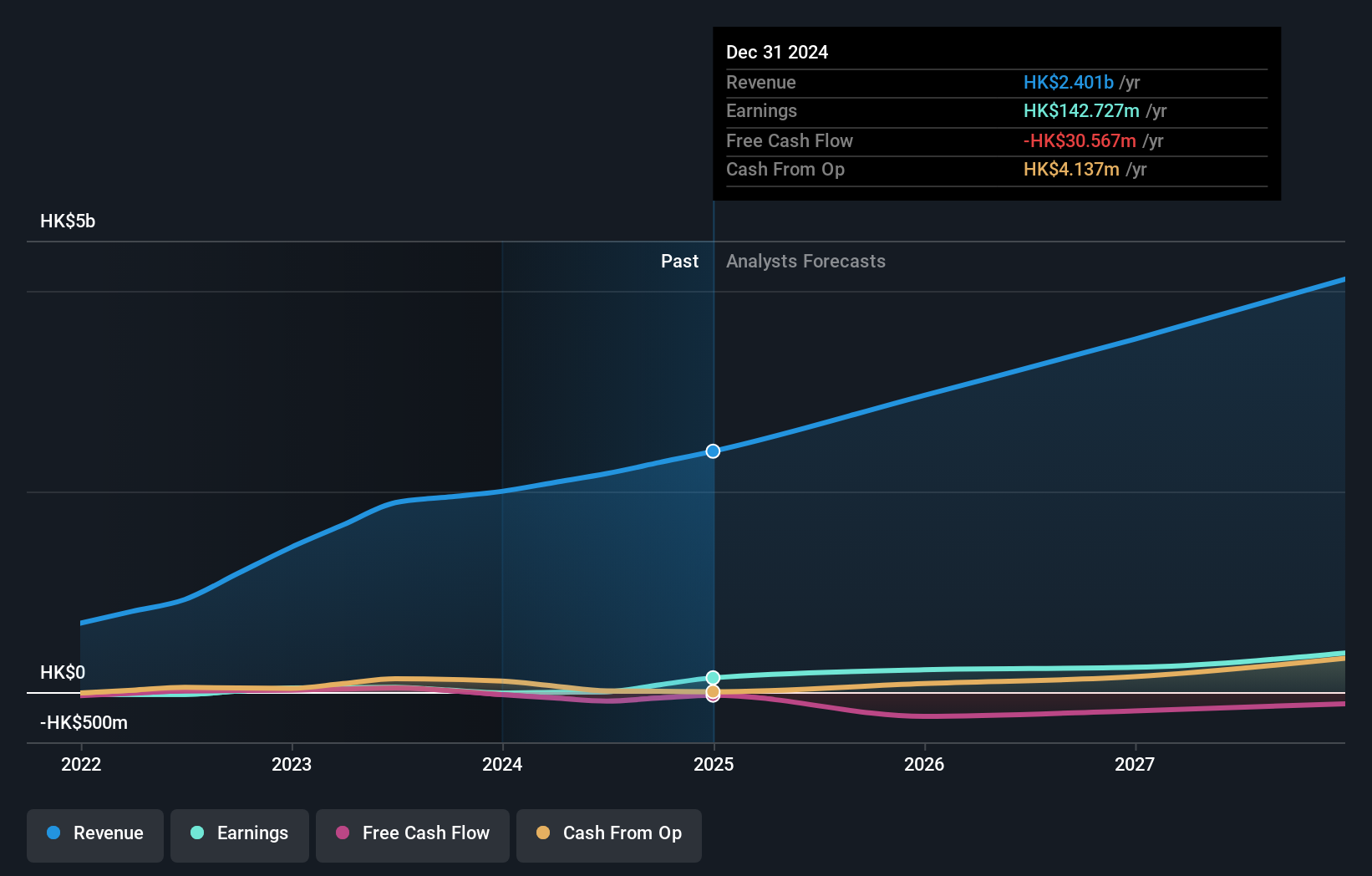

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content assets protection and transaction across the United States, Japan, Mainland China, and other international markets, with a market capitalization of approximately HK$2.85 billion.

Operations: The company generates revenue primarily through its SaaS offerings, totaling approximately HK$2.00 billion.

Insider Ownership: 23.2%

Vobile Group, a growth-oriented company in Hong Kong, is expected to turn profitable within three years with revenue growth forecasts outpacing the local market at 21.7% annually. Recent corporate activities include adopting new company bylaws and securing HK$159.97 million through convertible bonds, indicating strategic financial maneuvering despite past shareholder dilution. However, its projected return on equity remains low at 6.6%, signaling potential challenges in generating shareholder returns efficiently.

- Click here and access our complete growth analysis report to understand the dynamics of Vobile Group.

- Upon reviewing our latest valuation report, Vobile Group's share price might be too pessimistic.

Techtronic Industries (SEHK:669)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Techtronic Industries Company Limited, with a market cap of HK$183.25 billion, specializes in designing, manufacturing, and marketing power tools, outdoor power equipment, and floorcare and cleaning products across North America, Europe, and other international markets.

Operations: The company's revenue is primarily derived from its power equipment segment, which generated $12.79 billion, and its floorcare and cleaning products segment, which contributed $0.97 billion.

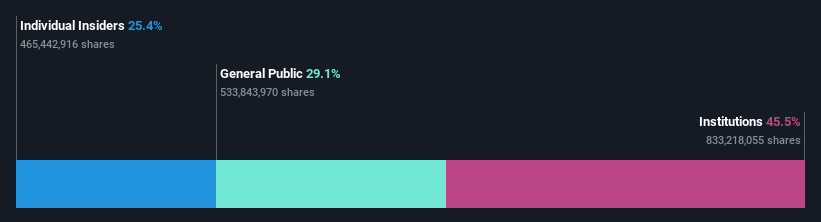

Insider Ownership: 25.4%

Techtronic Industries, a company with significant insider buying in the last three months, shows promising financial health with earnings expected to grow by 14.93% annually. Despite slower revenue growth forecasts of 8.1% per year compared to other high-growth markets, it exceeds Hong Kong's average of 7.7%. Recent leadership changes include Steven Richman's appointment as CEO following Joseph Galli Jr.'s retirement, alongside a shareholder-approved share repurchase program aimed at enhancing shareholder value.

- Take a closer look at Techtronic Industries' potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Techtronic Industries is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Discover the full array of 54 Fast Growing SEHK Companies With High Insider Ownership right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Techtronic Industries is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:669

Techtronic Industries

Engages in the design, manufacture, and marketing of power tools, outdoor power equipment, and floorcare and cleaning products in the North America, Europe, and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.