- Hong Kong

- /

- Hospitality

- /

- SEHK:3690

Exploring SEHK Growth Companies With High Insider Ownership: BYD Leads The Way

Reviewed by Simply Wall St

As global markets navigate through fluctuating inflation rates and policy adjustments, the Hong Kong market has also experienced its share of volatility, with the Hang Seng Index recently showing a notable decline. In such an environment, growth companies with high insider ownership in Hong Kong can offer investors potential resilience and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

| New Horizon Health (SEHK:6606) | 16.6% | 62.3% |

| Fenbi (SEHK:2469) | 32.1% | 43% |

| Meitu (SEHK:1357) | 38% | 33.7% |

| DPC Dash (SEHK:1405) | 38.2% | 89.7% |

| Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.5% | 79.3% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

| Beijing Airdoc Technology (SEHK:2251) | 27.9% | 83.9% |

| Ocumension Therapeutics (SEHK:1477) | 17.7% | 93.7% |

Let's uncover some gems from our specialized screener.

BYD (SEHK:1211)

Simply Wall St Growth Rating: ★★★★☆☆

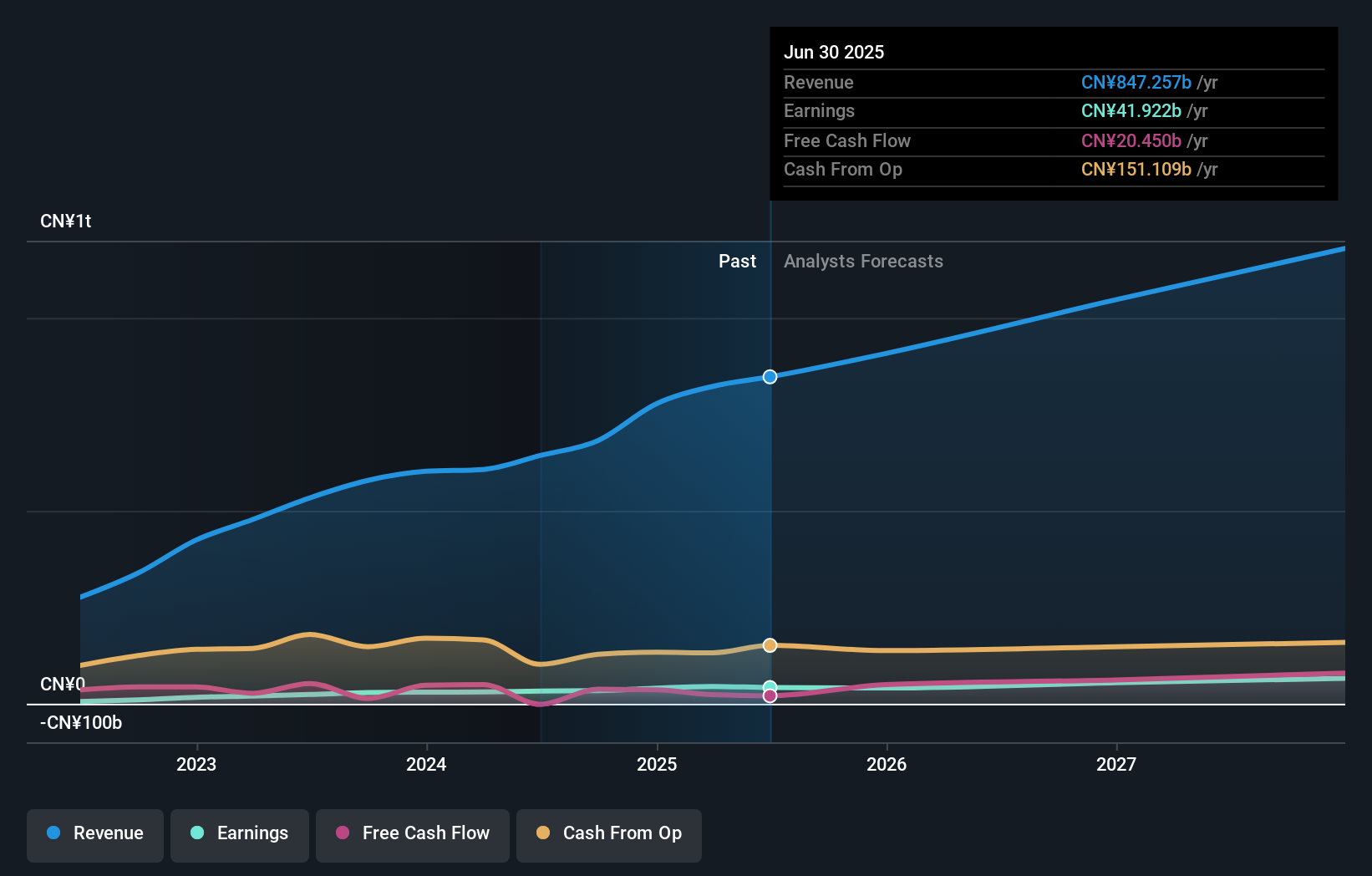

Overview: BYD Company Limited operates in the automobile and battery sectors across China, including Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$715.83 billion.

Operations: The company's revenue is generated from its automobile and battery sectors across various regions including China, Hong Kong, Macau, Taiwan, and internationally.

Insider Ownership: 30.1%

BYD, a Hong Kong-listed growth company with high insider ownership, is trading at 30.8% below its estimated fair value, signaling potential undervaluation. While its revenue and earnings growth forecasts of 14.5% and 14.67% respectively are robust, they do not exceed the significant growth threshold of 20%. However, BYD's earnings are expected to outpace the broader Hong Kong market's average. Recent expansions into new markets with products like the BYD SHARK pickup highlight strategic diversification efforts despite a backdrop of moderate insider trading activity in recent months.

- Dive into the specifics of BYD here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of BYD shares in the market.

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★★☆

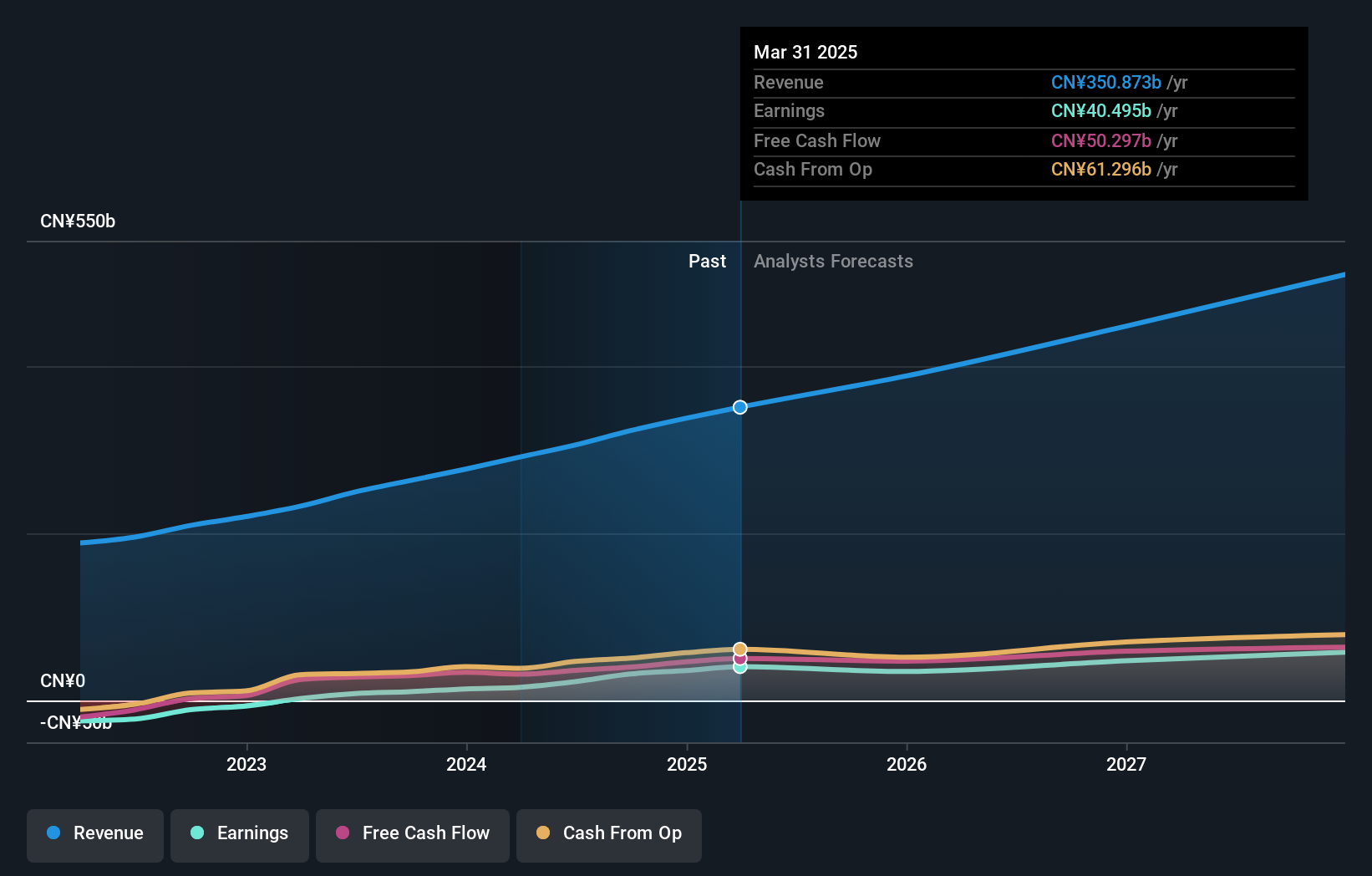

Overview: Meituan is a technology retail company based in the People's Republic of China, with a market capitalization of approximately HK$698.33 billion.

Operations: The company's revenue is primarily derived from Core Local Commerce and New Initiatives, generating CN¥206.91 billion and CN¥69.84 billion respectively.

Insider Ownership: 12.2%

Meituan, a Hong Kong growth company with significant insider transactions, is currently trading at 64.9% below its estimated fair value. Despite no substantial insider purchases recently, the firm's financial results show strong performance with a recent report of sales reaching CNY 73.28 billion and net income of CNY 5.37 billion for Q1 2024. Meituan's earnings are expected to grow by 33.2% annually over the next three years, outpacing the Hong Kong market average significantly.

- Get an in-depth perspective on Meituan's performance by reading our analyst estimates report here.

- The analysis detailed in our Meituan valuation report hints at an inflated share price compared to its estimated value.

Techtronic Industries (SEHK:669)

Simply Wall St Growth Rating: ★★★★☆☆

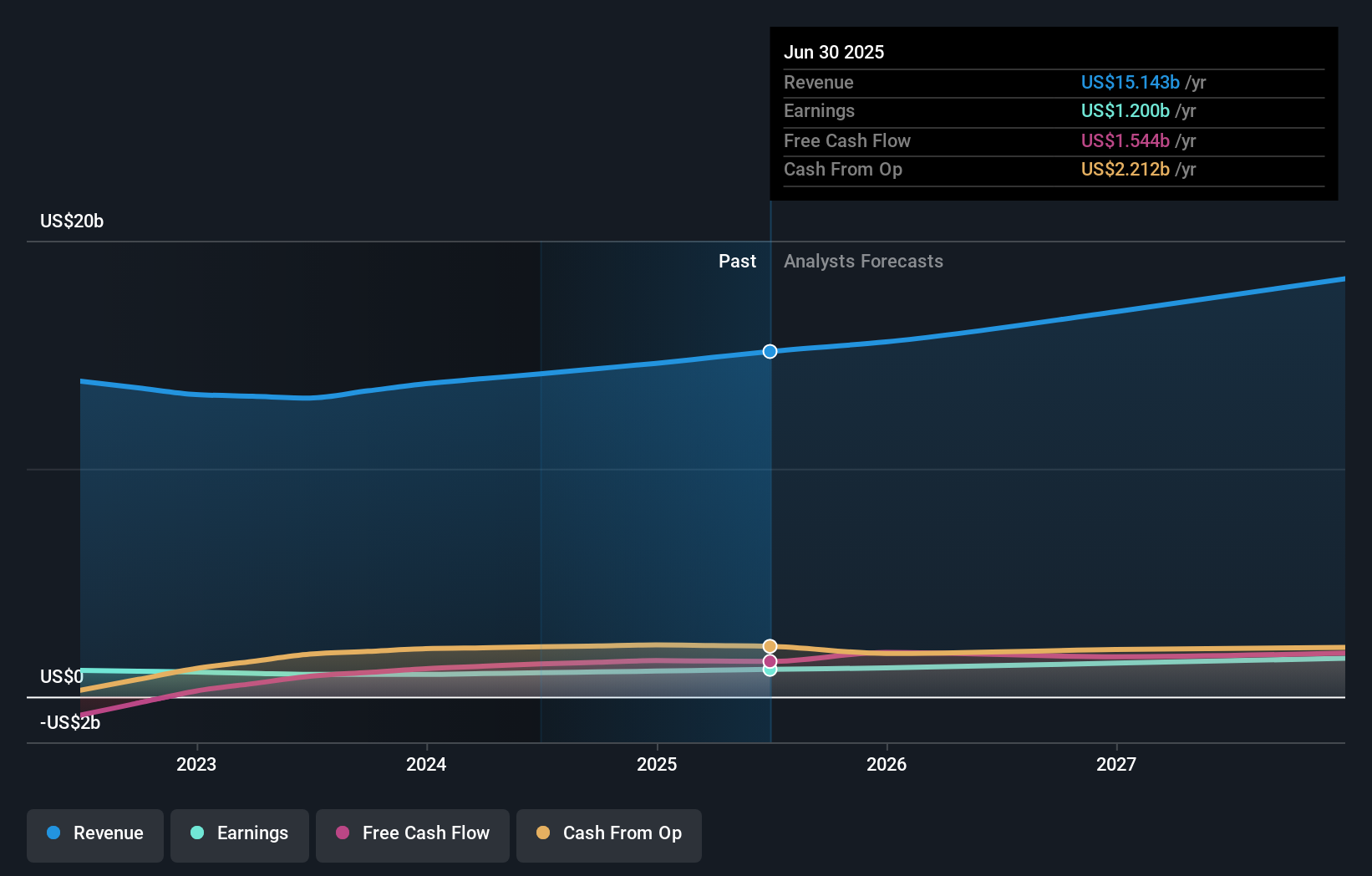

Overview: Techtronic Industries Company Limited, with a market capitalization of HK$183 billion, operates globally in designing, manufacturing, and marketing power tools, outdoor power equipment, and floorcare and cleaning products primarily in North America and Europe.

Operations: The company's revenue is primarily derived from its power equipment segment, which generated $12.79 billion, and its floorcare and cleaning products segment, which contributed $0.97 billion.

Insider Ownership: 25.3%

Techtronic Industries, a Hong Kong-based company, is experiencing robust growth with earnings forecasted to increase by 15.9% annually, surpassing the local market's average. Despite this positive outlook and a recent share buyback initiative aimed at boosting shareholder value, there has been significant insider selling over the past three months with no substantial purchases reported by insiders during the same period. This pattern of insider activity could raise concerns about long-term confidence among those closest to the company.

- Click to explore a detailed breakdown of our findings in Techtronic Industries' earnings growth report.

- The valuation report we've compiled suggests that Techtronic Industries' current price could be inflated.

Make It Happen

- Discover the full array of 53 Fast Growing SEHK Companies With High Insider Ownership right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3690

Meituan

Operates as a technology driven retail company in the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives