- Hong Kong

- /

- Diversified Financial

- /

- SEHK:2598

3 SEHK Growth Companies With High Insider Ownership And 22% Revenue Growth

Reviewed by Simply Wall St

As global markets navigate a period of economic uncertainty, Hong Kong's Hang Seng Index has experienced fluctuations influenced by broader economic trends and local market dynamics. Despite these challenges, growth companies with significant insider ownership continue to attract attention due to their potential for robust performance and alignment with shareholder interests. In the current market environment, stocks that demonstrate strong revenue growth and high insider ownership can be particularly appealing. These attributes often signal confidence from those closest to the company and suggest a commitment to long-term success.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 34.7% |

| Akeso (SEHK:9926) | 20.5% | 54.7% |

| Fenbi (SEHK:2469) | 33.1% | 22.4% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.8% | 69.8% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 78.9% |

| Beijing Airdoc Technology (SEHK:2251) | 29.1% | 93.4% |

| DPC Dash (SEHK:1405) | 38.2% | 104.2% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

| RemeGen (SEHK:9995) | 16.1% | 52.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

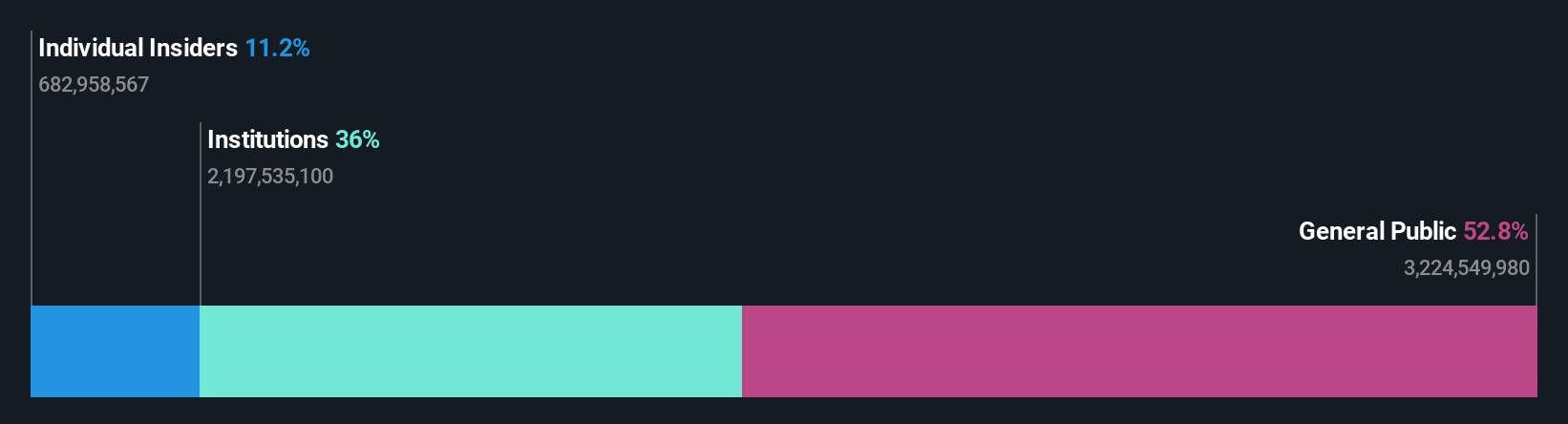

BYD (SEHK:1211)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited, with a market cap of HK$776.81 billion, operates in the automobiles and batteries sector across the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Operations: Revenue Segments (in millions of CN¥): Automobiles and Related Products and Other Products: 507.52 billion, Mobile Handset Components, Assembly Service and Other Products: 154.49 billion

Insider Ownership: 30.1%

Revenue Growth Forecast: 14.1% p.a.

BYD has demonstrated strong growth, with earnings increasing by 36.2% over the past year and revenue forecasted to grow at 14.1% annually, outpacing the Hong Kong market's 7.3%. Insider ownership remains high, indicating confidence in future prospects. Recent production and sales figures show significant increases year-over-year, reinforcing its growth trajectory. Additionally, a strategic partnership with Uber aims to deploy 100,000 new electric vehicles globally, further enhancing BYD's market presence and potential profitability.

- Get an in-depth perspective on BYD's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that BYD's current price could be inflated.

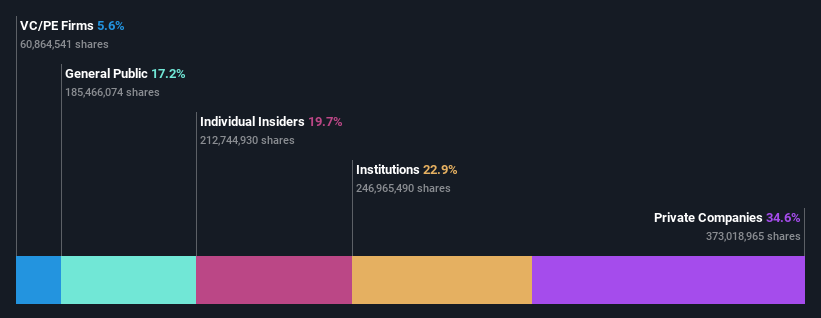

Lianlian DigiTech (SEHK:2598)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lianlian DigiTech Co., Ltd., along with its subsidiaries, offers digital payment and value-added services to small and midsized merchants and enterprises in China, with a market cap of HK$9.71 billion.

Operations: The company's revenue segments include Global Payment (CN¥722.95 million), Domestic Payment (CN¥309.92 million), and Value-Added Services (CN¥153.01 million).

Insider Ownership: 19.7%

Revenue Growth Forecast: 22.9% p.a.

Lianlian DigiTech has shown promising growth, with revenue increasing from CNY 440.59 million to CNY 617.39 million year-over-year, despite a net loss reduction to CNY 351.29 million. Insider ownership remains high, reflecting strong internal confidence in the company’s future prospects. Revenue is forecasted to grow at 22.9% annually, significantly outpacing the Hong Kong market's average of 7.3%. Recent amendments in company bylaws aim to enhance governance and operational clarity, supporting its growth trajectory further.

- Dive into the specifics of Lianlian DigiTech here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Lianlian DigiTech's share price might be too optimistic.

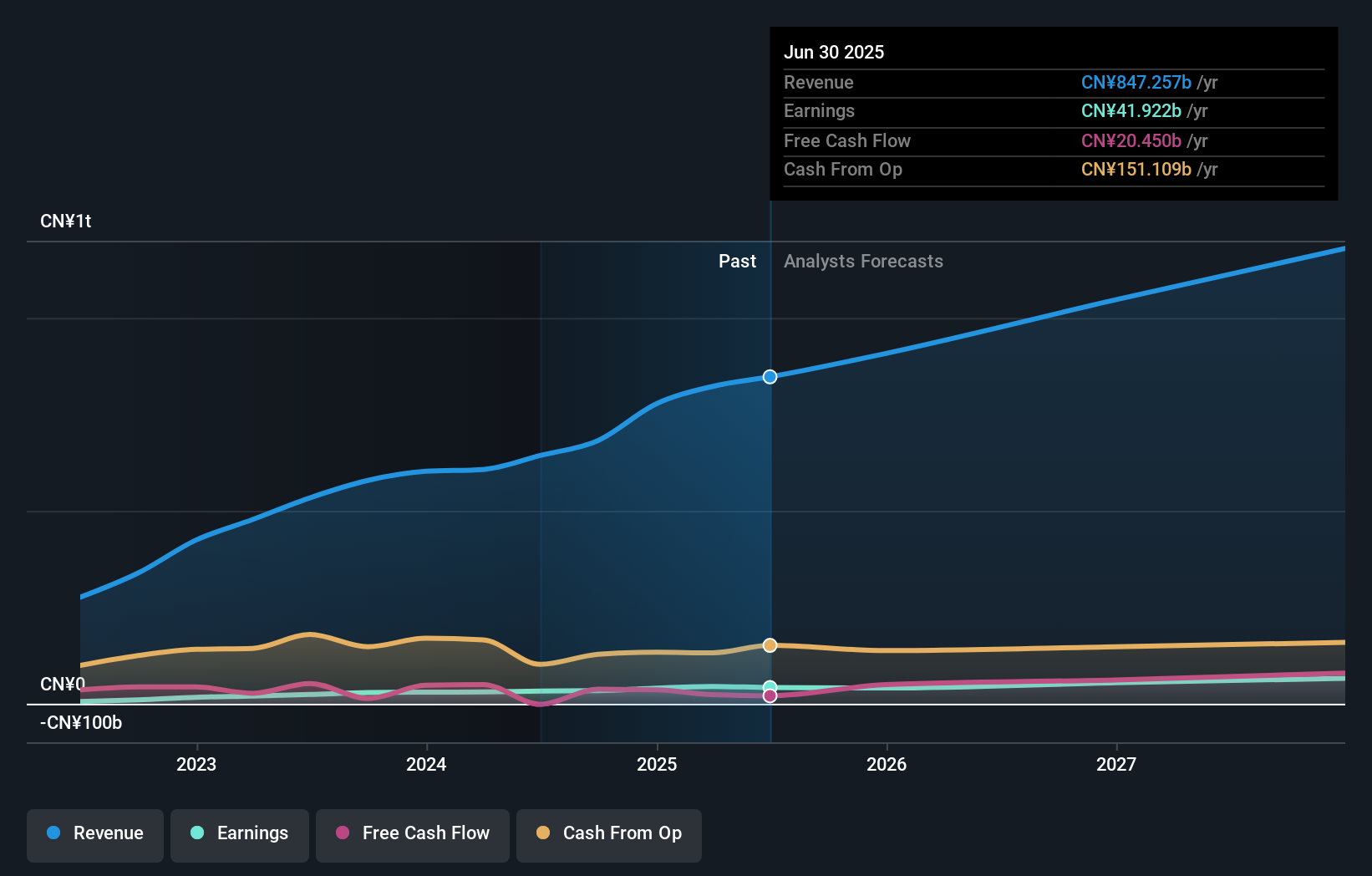

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meituan operates as a technology retail company in the People's Republic of China with a market cap of approximately HK$809.17 billion.

Operations: The company's revenue segments include CN¥228.13 billion from Core Local Commerce and CN¥77.56 billion from New Initiatives.

Insider Ownership: 11.6%

Revenue Growth Forecast: 12.9% p.a.

Meituan's recent performance underscores its potential as a growth company with high insider ownership. The company reported significant earnings growth, with net income rising to CNY 16.72 billion for the first half of 2024, up from CNY 8.05 billion a year ago. Meituan has actively engaged in share buybacks, repurchasing over 139 million shares worth $2 billion recently, signaling confidence in its valuation and future prospects. Revenue is forecasted to grow at 12.9% annually, outpacing the Hong Kong market average of 7.3%.

- Click to explore a detailed breakdown of our findings in Meituan's earnings growth report.

- Our comprehensive valuation report raises the possibility that Meituan is priced higher than what may be justified by its financials.

Summing It All Up

- Gain an insight into the universe of 46 Fast Growing SEHK Companies With High Insider Ownership by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2598

Lianlian DigiTech

Provides digital payment services and value-added services to small and midsized merchants and enterprises in China.

High growth potential with adequate balance sheet.