- Hong Kong

- /

- Consumer Services

- /

- SEHK:3650

Some Confidence Is Lacking In Keep Inc. (HKG:3650) As Shares Slide 40%

Keep Inc. (HKG:3650) shares have had a horrible month, losing 40% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 13% in that time.

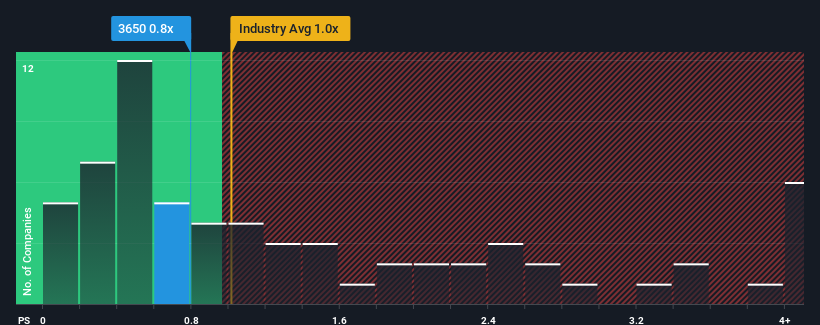

Although its price has dipped substantially, there still wouldn't be many who think Keep's price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S in Hong Kong's Consumer Services industry is similar at about 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Keep

How Has Keep Performed Recently?

While the industry has experienced revenue growth lately, Keep's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Keep will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Keep?

The only time you'd be comfortable seeing a P/S like Keep's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.4%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 28% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 5.6% per year over the next three years. That's shaping up to be materially lower than the 13% per year growth forecast for the broader industry.

With this information, we find it interesting that Keep is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Keep's P/S?

Following Keep's share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given that Keep's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Keep that you should be aware of.

If these risks are making you reconsider your opinion on Keep, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Keep might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3650

Keep

An investment holding company, operates an integrated online and offline platform for fitness service and online retail of fitness related products in the People’s Republic of China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives