- Hong Kong

- /

- Hospitality

- /

- SEHK:355

One Century City International Holdings Insider Raised Their Stake In The Previous Year

Insiders were net buyers of Century City International Holdings Limited's (HKG:355 ) stock during the past year. That is, insiders bought more stock than they sold.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we would consider it foolish to ignore insider transactions altogether.

View our latest analysis for Century City International Holdings

The Last 12 Months Of Insider Transactions At Century City International Holdings

The Executive Chairman & CEO Yuk Sui Lo made the biggest insider purchase in the last 12 months. That single transaction was for HK$11m worth of shares at a price of HK$0.26 each. That means that an insider was happy to buy shares at around the current price of HK$0.27. That means they have been optimistic about the company in the past, though they may have changed their mind. If someone buys shares at well below current prices, it's a good sign on balance, but keep in mind they may no longer see value. Happily, the Century City International Holdings insider decided to buy shares at close to current prices. The only individual insider to buy over the last year was Yuk Sui Lo.

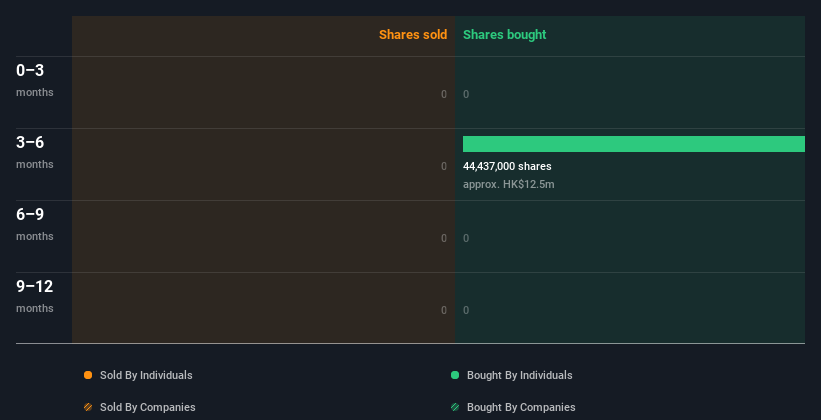

Yuk Sui Lo bought a total of 44.44m shares over the year at an average price of HK$0.26. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

Century City International Holdings is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Does Century City International Holdings Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. A high insider ownership often makes company leadership more mindful of shareholder interests. Century City International Holdings insiders own 67% of the company, currently worth about HK$553m based on the recent share price. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

What Might The Insider Transactions At Century City International Holdings Tell Us?

There haven't been any insider transactions in the last three months -- that doesn't mean much. But insiders have shown more of an appetite for the stock, over the last year. It would be great to see more insider buying, but overall it seems like Century City International Holdings insiders are reasonably well aligned (owning significant chunk of the company's shares) and optimistic for the future. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Century City International Holdings. Case in point: We've spotted 2 warning signs for Century City International Holdings you should be aware of.

Of course Century City International Holdings may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:355

Century City International Holdings

An investment holding company, engages in the property, construction and building, hotel, asset management, aircraft ownership and leasing, and investment businesses in Hong Kong, Mainland China, and internationally.

Good value with mediocre balance sheet.