Global markets have experienced a volatile week, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating, while small-cap stocks showed resilience amid a flurry of earnings reports and economic data. In such a dynamic market landscape, identifying promising investment opportunities requires keen analysis and understanding of underlying financials. Penny stocks, often overlooked due to their smaller size or newer status, can offer unique growth potential when backed by strong fundamentals. Here, we explore several penny stocks that stand out for their financial robustness and potential for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR337.78M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.81B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR136.84M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$533.22M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$138.53M | ★★★★☆☆ |

| Seafco (SET:SEAFCO) | THB2.22 | THB1.85B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.60 | A$69.75M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR756.88M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.255 | £849.6M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.78 | £207.57M | ★★★★★★ |

Click here to see the full list of 5,776 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

China Travel International Investment Hong Kong (SEHK:308)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Travel International Investment Hong Kong Limited offers travel and tourism services, with a market cap of HK$5.70 billion.

Operations: The company's revenue is primarily derived from tourist attraction and related operations (HK$2.28 billion), passenger transportation operations (HK$1.09 billion), hotel operations (HK$746.12 million), and travel document and related operations (HK$435.27 million).

Market Cap: HK$5.7B

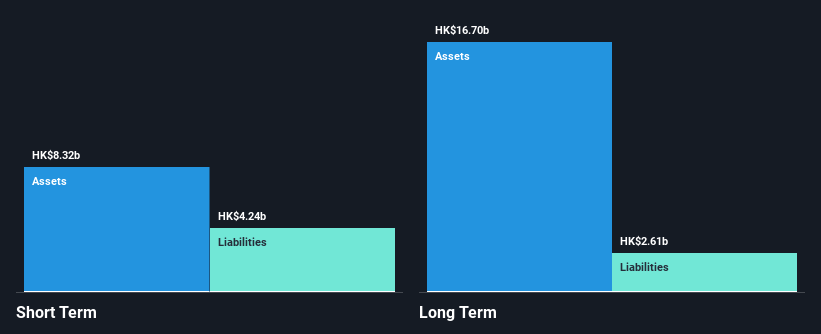

China Travel International Investment Hong Kong Limited, with a market cap of HK$5.70 billion, recently experienced a decline in net income to HK$63.23 million for the first half of 2024, down from HK$224.23 million the previous year, partly due to a significant one-off loss impacting its financial results. Despite this setback and being dropped from the FTSE All-World Index in September 2024, the company maintains strong liquidity with short-term assets exceeding both long-term and short-term liabilities by substantial margins (HK$8.3 billion vs HK$2.6 billion and HK$4.2 billion respectively). The board is experienced but earnings have been declining over five years at an average rate of 9.7% annually, though future earnings are forecasted to grow significantly at 39% per year according to consensus estimates.

- Take a closer look at China Travel International Investment Hong Kong's potential here in our financial health report.

- Learn about China Travel International Investment Hong Kong's future growth trajectory here.

Greenland Hong Kong Holdings (SEHK:337)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Greenland Hong Kong Holdings Limited is an investment holding company involved in property development, property and hotel investment, and property management in the People’s Republic of China, with a market cap of approximately HK$913.83 million.

Operations: The company generates revenue from various segments, including CN¥21.82 billion from property sales, CN¥1.98 billion from property management and related services, CN¥300.71 million from leasing properties, and CN¥78.93 million through hotel and related services.

Market Cap: HK$913.83M

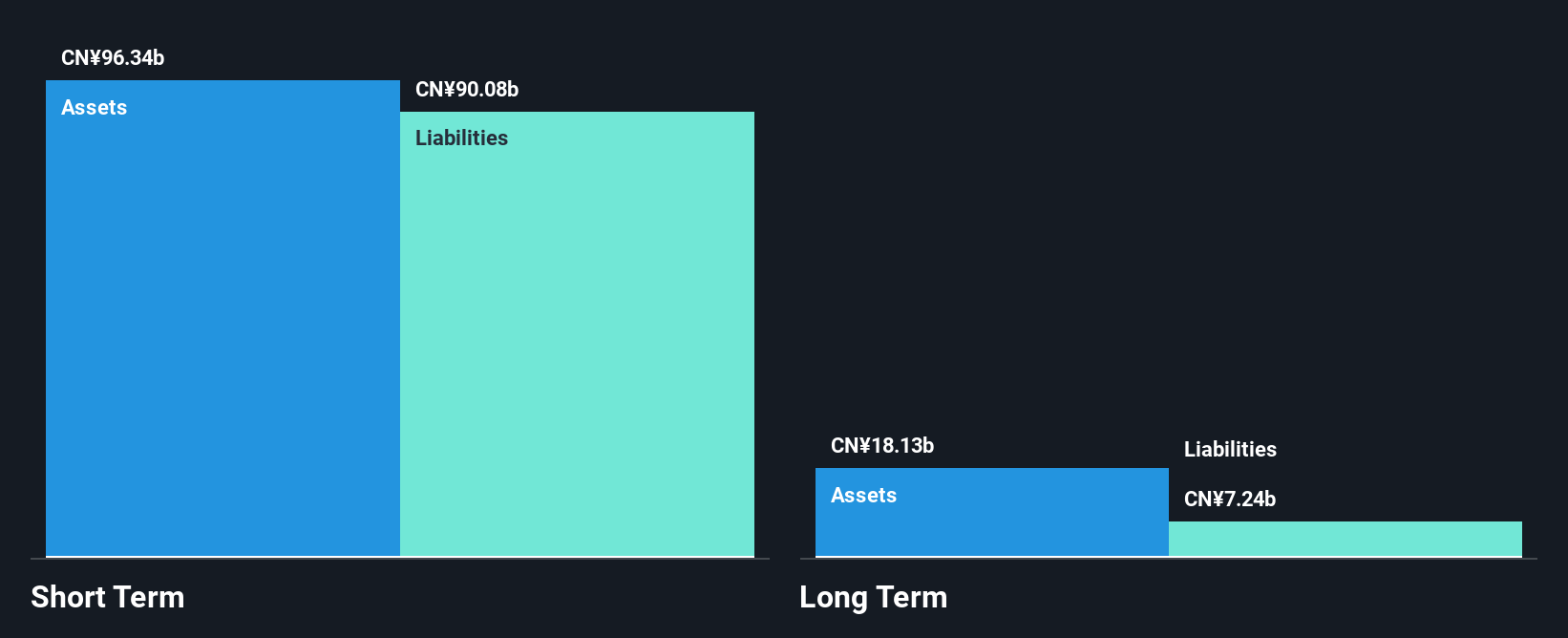

Greenland Hong Kong Holdings Limited, with a market cap of HK$913.83 million, faces challenges as its earnings have declined significantly over the past five years. The company reported a net loss of CN¥439.27 million for the first half of 2024, contrasting with a profit in the previous year due to decreased property deliveries and reduced gross profit margins. Despite this, Greenland's short-term assets exceed both short- and long-term liabilities by substantial margins (CN¥104.8 billion vs CN¥99.9 billion and CN¥5.2 billion), indicating robust liquidity amid financial volatility and high debt levels impacting overall stability.

- Navigate through the intricacies of Greenland Hong Kong Holdings with our comprehensive balance sheet health report here.

- Evaluate Greenland Hong Kong Holdings' historical performance by accessing our past performance report.

Fufeng Group (SEHK:546)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fufeng Group Limited is an investment holding company that manufactures and sells fermentation-based food additives, biochemical products, and starch-based products in China and internationally, with a market cap of HK$11.12 billion.

Operations: The company's revenue is primarily derived from its Food Additives segment, generating CN¥13.85 billion, followed by Animal Nutrition at CN¥9.00 billion, High-End Amino Acid at CN¥2.22 billion, and Colloid products contributing CN¥2.09 billion.

Market Cap: HK$11.12B

Fufeng Group Limited, with a market cap of HK$11.12 billion, is experiencing mixed financial dynamics. The company reported a decrease in net income to CN¥1.04 billion for the first half of 2024 from CN¥1.54 billion the previous year, reflecting challenges despite high-quality earnings and satisfactory debt levels with a net debt to equity ratio of 8.8%. Recent strategic moves include share buybacks and executive changes, potentially signaling efforts to stabilize performance amid declining profit margins and dividend reductions. Its short-term assets comfortably cover liabilities, suggesting solid liquidity in navigating current volatility in earnings growth.

- Click here to discover the nuances of Fufeng Group with our detailed analytical financial health report.

- Explore Fufeng Group's analyst forecasts in our growth report.

Taking Advantage

- Unlock more gems! Our Penny Stocks screener has unearthed 5,773 more companies for you to explore.Click here to unveil our expertly curated list of 5,776 Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:546

Fufeng Group

An investment holding company, engages in the manufacture and sale of fermentation-based food additive, and biochemical and starch-based products in the People’s Republic of China and internationally.

Undervalued with excellent balance sheet and pays a dividend.