Stock Analysis

- Hong Kong

- /

- Hospitality

- /

- SEHK:27

Investors in Galaxy Entertainment Group (HKG:27) have unfortunately lost 29% over the last three years

As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Galaxy Entertainment Group Limited (HKG:27) shareholders have had that experience, with the share price dropping 29% in three years, versus a market decline of about 16%. The falls have accelerated recently, with the share price down 12% in the last three months.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

View our latest analysis for Galaxy Entertainment Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Galaxy Entertainment Group moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

We think that the revenue decline over three years, at a rate of 14% per year, probably had some shareholders looking to sell. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

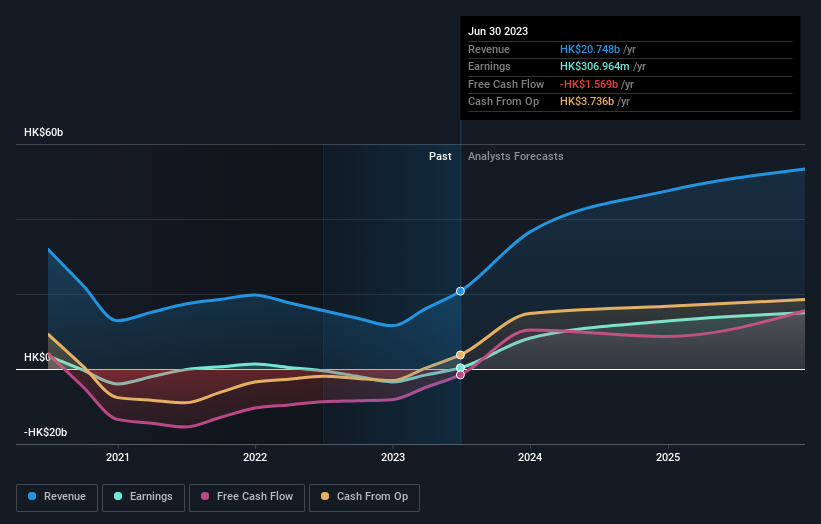

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Galaxy Entertainment Group is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Galaxy Entertainment Group stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Galaxy Entertainment Group shareholders are up 1.6% for the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 1.2% endured over half a decade. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Galaxy Entertainment Group better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Galaxy Entertainment Group , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Galaxy Entertainment Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:27

Galaxy Entertainment Group

An investment holding company, engages in the gaming and entertainment businesses in Macau, Hong Kong, and Mainland China.

Flawless balance sheet with moderate growth potential.