- Hong Kong

- /

- Hospitality

- /

- SEHK:265

Even after rising 18% this past week, Orient Victory Smart urban Services Holding (HKG:265) shareholders are still down 81% over the past five years

It's nice to see the Orient Victory Smart urban Services Holding Limited (HKG:265) share price up 18% in a week. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. In fact, the share price has tumbled down a mountain to land 81% lower after that period. The recent bounce might mean the long decline is over, but we are not confident. The real question is whether the business can leave its past behind and improve itself over the years ahead. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

While the stock has risen 18% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Orient Victory Smart urban Services Holding

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Orient Victory Smart urban Services Holding moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

It could be that the revenue decline of 9.5% per year is viewed as evidence that Orient Victory Smart urban Services Holding is shrinking. This has probably encouraged some shareholders to sell down the stock.

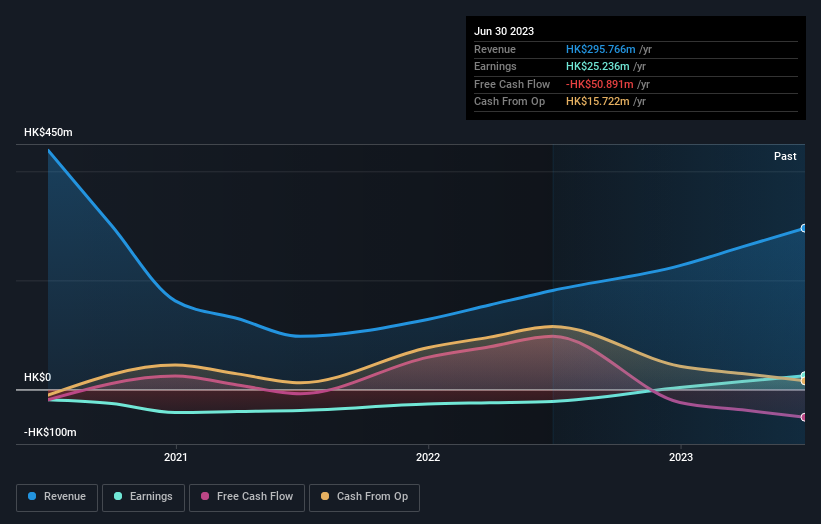

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Orient Victory Smart urban Services Holding's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 5.1% in the last year, Orient Victory Smart urban Services Holding shareholders lost 21%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 13% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Orient Victory Smart urban Services Holding (1 is potentially serious) that you should be aware of.

Orient Victory Smart urban Services Holding is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:265

Orient Victory Smart urban Services Holding

An investment holding company, provides property management and leasing services for residential and commercial properties in Mainland China.

Flawless balance sheet with solid track record.