- Hong Kong

- /

- Consumer Services

- /

- SEHK:2469

Despite recent sales, Fenbi Ltd. (HKG:2469) insiders own 31% shares but recent downturn may have set them back

Key Insights

- Significant insider control over Fenbi implies vested interests in company growth

- 52% of the business is held by the top 5 shareholders

- Insiders have been selling lately

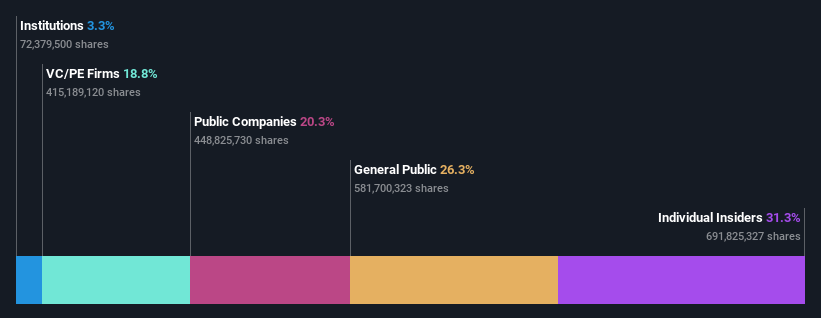

If you want to know who really controls Fenbi Ltd. (HKG:2469), then you'll have to look at the makeup of its share registry. And the group that holds the biggest piece of the pie are individual insiders with 31% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

Despite recent sales, insiders own the most shares in the company. As a result, the group bore the brunt of last week’s HK$796m market cap loss.

Let's take a closer look to see what the different types of shareholders can tell us about Fenbi.

View our latest analysis for Fenbi

What Does The Institutional Ownership Tell Us About Fenbi?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

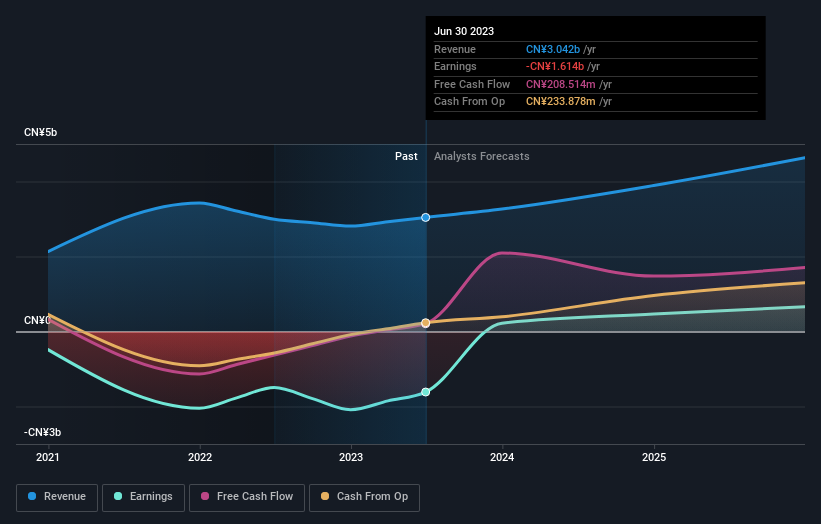

Since institutions own only a small portion of Fenbi, many may not have spent much time considering the stock. But it's clear that some have; and they liked it enough to buy in. If the business gets stronger from here, we could see a situation where more institutions are keen to buy. It is not uncommon to see a big share price rise if multiple institutional investors are trying to buy into a stock at the same time. So check out the historic earnings trajectory, below, but keep in mind it's the future that counts most.

Fenbi is not owned by hedge funds. Tencent Holdings Limited is currently the company's largest shareholder with 13% of shares outstanding. The second and third largest shareholders are Yong Li and Xiaolong Zhang, with an equal amount of shares to their name at 12%. Xiaolong Zhang, who is the third-largest shareholder, also happens to hold the title of Chairman of the Board.

Our research also brought to light the fact that roughly 52% of the company is controlled by the top 5 shareholders suggesting that these owners wield significant influence on the business.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of Fenbi

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

It seems insiders own a significant proportion of Fenbi Ltd.. Insiders own HK$3.3b worth of shares in the HK$11b company. That's quite meaningful. Most would be pleased to see the board is investing alongside them. You may wish to access this free chart showing recent trading by insiders.

General Public Ownership

With a 26% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Fenbi. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Equity Ownership

With an ownership of 19%, private equity firms are in a position to play a role in shaping corporate strategy with a focus on value creation. Some might like this, because private equity are sometimes activists who hold management accountable. But other times, private equity is selling out, having taking the company public.

Public Company Ownership

Public companies currently own 20% of Fenbi stock. It's hard to say for sure but this suggests they have entwined business interests. This might be a strategic stake, so it's worth watching this space for changes in ownership.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Fenbi better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Fenbi you should be aware of.

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2469

Fenbi

An investment holding company, provides non-formal vocational education and training services in the People’s Republic of China.

Flawless balance sheet with high growth potential.