- Hong Kong

- /

- Hospitality

- /

- SEHK:2255

Market Participants Recognise Haichang Ocean Park Holdings Ltd.'s (HKG:2255) Revenues Pushing Shares 27% Higher

Haichang Ocean Park Holdings Ltd. (HKG:2255) shares have continued their recent momentum with a 27% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 14% is also fairly reasonable.

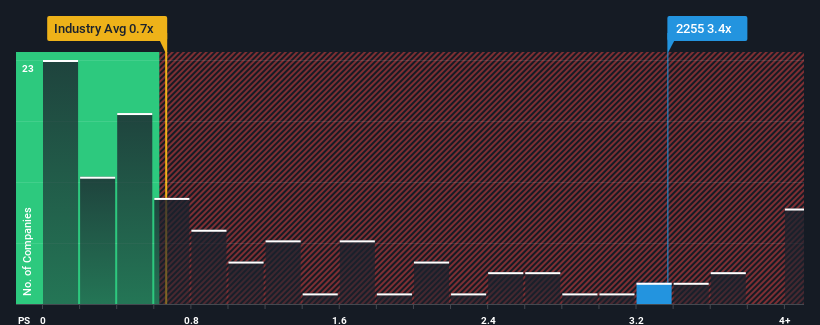

After such a large jump in price, you could be forgiven for thinking Haichang Ocean Park Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.4x, considering almost half the companies in Hong Kong's Hospitality industry have P/S ratios below 0.7x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

We check all companies for important risks. See what we found for Haichang Ocean Park Holdings in our free report.View our latest analysis for Haichang Ocean Park Holdings

What Does Haichang Ocean Park Holdings' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Haichang Ocean Park Holdings has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Haichang Ocean Park Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is Haichang Ocean Park Holdings' Revenue Growth Trending?

Haichang Ocean Park Holdings' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 26% decline in revenue over the last three years in total. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 66% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 15%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Haichang Ocean Park Holdings' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Haichang Ocean Park Holdings' P/S

Haichang Ocean Park Holdings' P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Haichang Ocean Park Holdings' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Haichang Ocean Park Holdings with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Haichang Ocean Park Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2255

Haichang Ocean Park Holdings

Engages in developing and constructing theme parks in the People’s Republic of China.

Reasonable growth potential with imperfect balance sheet.

Market Insights

Community Narratives