- Hong Kong

- /

- Hospitality

- /

- SEHK:2255

How Much Did Haichang Ocean Park Holdings'(HKG:2255) Shareholders Earn From Share Price Movements Over The Last Five Years?

Haichang Ocean Park Holdings Ltd. (HKG:2255) shareholders should be happy to see the share price up 20% in the last month. But that doesn't change the fact that the returns over the last half decade have been disappointing. In that time the share price has delivered a rude shock to holders, who find themselves down 70% after a long stretch. Some might say the recent bounce is to be expected after such a bad drop. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

See our latest analysis for Haichang Ocean Park Holdings

Haichang Ocean Park Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, Haichang Ocean Park Holdings saw its revenue increase by 11% per year. That's a pretty good rate for a long time period. The share price, meanwhile, has fallen 11% compounded, over five years. That suggests the market is disappointed with the current growth rate. A pessimistic market can create opportunities.

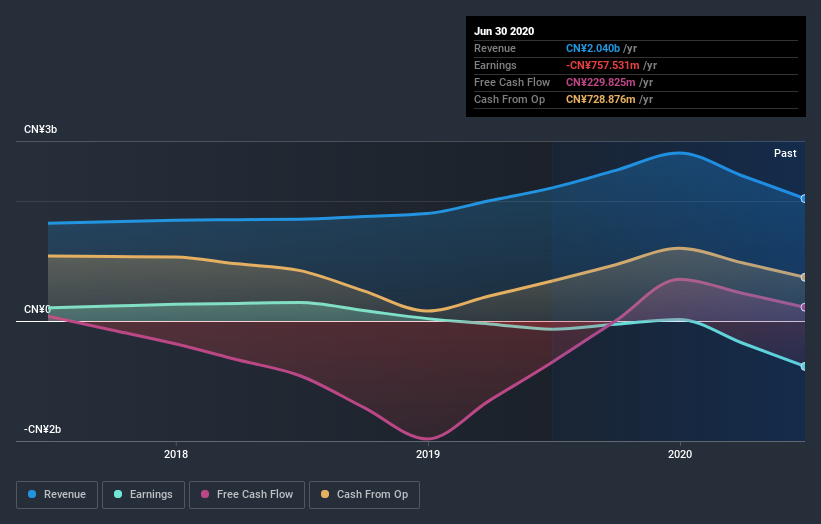

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Haichang Ocean Park Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Haichang Ocean Park Holdings shareholders are down 48% for the year, but the market itself is up 7.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Haichang Ocean Park Holdings .

We will like Haichang Ocean Park Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade Haichang Ocean Park Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Haichang Ocean Park Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:2255

Haichang Ocean Park Holdings

Engages in developing and constructing theme parks in the People’s Republic of China.

Reasonable growth potential with imperfect balance sheet.

Market Insights

Community Narratives