The harsh reality for Haichang Ocean Park Holdings Ltd. (HKG:2255) shareholders is that its auditors, Ernst & Young LLP, expressed doubts about its ability to continue as a going concern, in its reported results to December 2020. Thus we can say that, based on the results to that date, the company should raise capital or otherwise raise cash, without much delay.

Given its situation, it may not be in a good position to raise capital on favorable terms. So it is suddenly extremely important to consider whether the company is taking too much risk on its balance sheet. Debt is always a risk factor in these cases, as creditors could be in a position to wind up the company, in the worst case scenario.

Check out our latest analysis for Haichang Ocean Park Holdings

What Is Haichang Ocean Park Holdings's Debt?

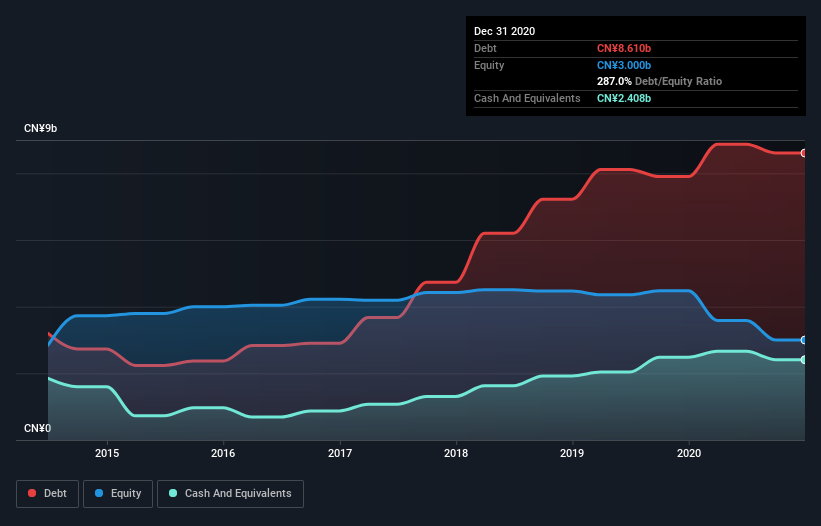

You can click the graphic below for the historical numbers, but it shows that as of December 2020 Haichang Ocean Park Holdings had CN¥8.61b of debt, an increase on CN¥7.90b, over one year. On the flip side, it has CN¥2.41b in cash leading to net debt of about CN¥6.20b.

How Healthy Is Haichang Ocean Park Holdings' Balance Sheet?

The latest balance sheet data shows that Haichang Ocean Park Holdings had liabilities of CN¥5.48b due within a year, and liabilities of CN¥7.94b falling due after that. Offsetting this, it had CN¥2.41b in cash and CN¥262.7m in receivables that were due within 12 months. So it has liabilities totalling CN¥10.7b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the CN¥2.33b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Haichang Ocean Park Holdings would likely require a major re-capitalisation if it had to pay its creditors today. There's no doubt that we learn most about debt from the balance sheet. But it is Haichang Ocean Park Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Haichang Ocean Park Holdings had a loss before interest and tax, and actually shrunk its revenue by 58%, to CN¥1.2b. To be frank that doesn't bode well.

Caveat Emptor

While Haichang Ocean Park Holdings's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Its EBIT loss was a whopping CN¥769m. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. Of course, it may be able to improve its situation with a bit of luck and good execution. But we think that is unlikely, given it is low on liquid assets, and burned through CN¥79m in the last year. So we consider this a high risk stock and we wouldn't be at all surprised if the company asks shareholders for money before long. We're too cautious to want to invest in a company after an auditor has expressed doubts about its ability to continue as a going concern. That's because companies should always make sure the auditor has confidence that the company will continue as a going concern, in our view. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 4 warning signs for Haichang Ocean Park Holdings you should be aware of, and 3 of them are potentially serious.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Haichang Ocean Park Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2255

Haichang Ocean Park Holdings

Engages in developing and constructing theme parks in the People’s Republic of China.

Reasonable growth potential with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success