Stock Analysis

- Hong Kong

- /

- Consumer Services

- /

- SEHK:2138

EC Healthcare (HKG:2138) Could Be Struggling To Allocate Capital

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. However, after investigating EC Healthcare (HKG:2138), we don't think it's current trends fit the mold of a multi-bagger.

What is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for EC Healthcare:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

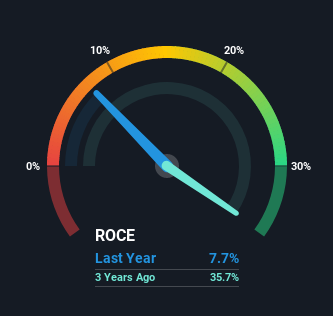

0.077 = HK$189m ÷ (HK$3.8b - HK$1.3b) (Based on the trailing twelve months to March 2021).

Therefore, EC Healthcare has an ROCE of 7.7%. On its own, that's a low figure but it's around the 7.5% average generated by the Consumer Services industry.

See our latest analysis for EC Healthcare

Above you can see how the current ROCE for EC Healthcare compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for EC Healthcare.

What The Trend Of ROCE Can Tell Us

We weren't thrilled with the trend because EC Healthcare's ROCE has reduced by 74% over the last five years, while the business employed 237% more capital. Usually this isn't ideal, but given EC Healthcare conducted a capital raising before their most recent earnings announcement, that would've likely contributed, at least partially, to the increased capital employed figure. It's unlikely that all of the funds raised have been put to work yet, so as a consequence EC Healthcare might not have received a full period of earnings contribution from it.

What We Can Learn From EC Healthcare's ROCE

In summary, EC Healthcare is reinvesting funds back into the business for growth but unfortunately it looks like sales haven't increased much just yet. Yet to long term shareholders the stock has gifted them an incredible 568% return in the last five years, so the market appears to be rosy about its future. Ultimately, if the underlying trends persist, we wouldn't hold our breath on it being a multi-bagger going forward.

Like most companies, EC Healthcare does come with some risks, and we've found 5 warning signs that you should be aware of.

While EC Healthcare may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether EC Healthcare is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2138

EC Healthcare

An investment holding company, engages in the provision of medical and healthcare services in Hong Kong, Macau, and the People’s Republic of China.

Good value with reasonable growth potential.