Stock Analysis

- Hong Kong

- /

- Consumer Services

- /

- SEHK:1851

What Type Of Returns Would China Gingko Education Group's(HKG:1851) Shareholders Have Earned If They Purchased Their SharesYear Ago?

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in China Gingko Education Group Company Limited (HKG:1851) have tasted that bitter downside in the last year, as the share price dropped 16%. That's disappointing when you consider the market returned 7.6%. China Gingko Education Group hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. In the last ninety days we've seen the share price slide 37%.

Check out our latest analysis for China Gingko Education Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

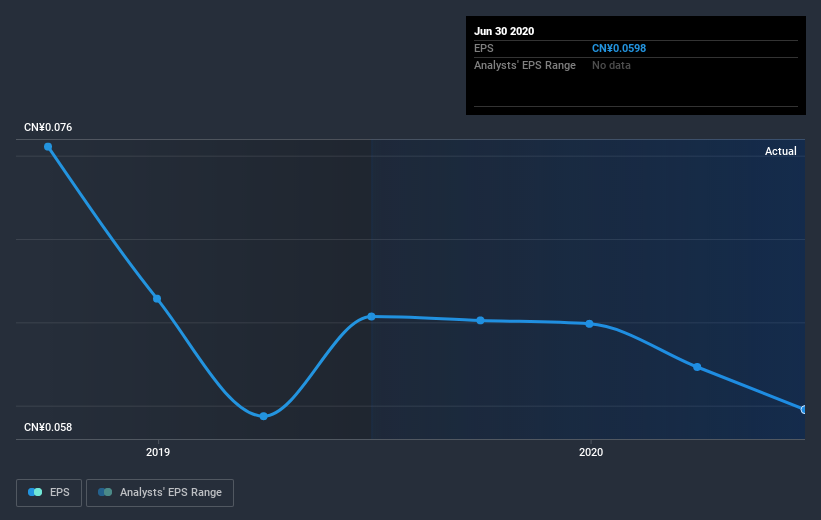

Unhappily, China Gingko Education Group had to report a 8.6% decline in EPS over the last year. The share price decline of 16% is actually more than the EPS drop. This suggests the EPS fall has made some shareholders are more nervous about the business.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of China Gingko Education Group's earnings, revenue and cash flow.

A Different Perspective

Given that the market gained 7.6% in the last year, China Gingko Education Group shareholders might be miffed that they lost 16%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's worth noting that the last three months did the real damage, with a 37% decline. So it seems like some holders have been dumping the stock of late - and that's not bullish. It's always interesting to track share price performance over the longer term. But to understand China Gingko Education Group better, we need to consider many other factors. Even so, be aware that China Gingko Education Group is showing 4 warning signs in our investment analysis , and 3 of those are a bit unpleasant...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade China Gingko Education Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether China Gingko Education Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1851

China Gingko Education Group

An investment holding company, engages in the provision of private higher education and vocational training services in the People's Republic of China.

Solid track record and good value.