- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:1797

Here's Why We're Watching Koolearn Technology Holding's (HKG:1797) Cash Burn Situation

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So, the natural question for Koolearn Technology Holding (HKG:1797) shareholders is whether they should be concerned by its rate of cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for Koolearn Technology Holding

How Long Is Koolearn Technology Holding's Cash Runway?

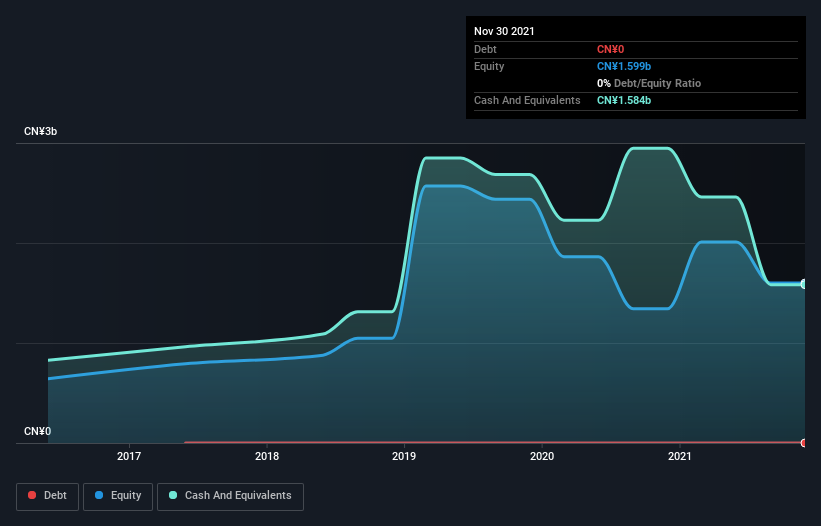

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Koolearn Technology Holding last reported its balance sheet in November 2021, it had zero debt and cash worth CN¥1.6b. Importantly, its cash burn was CN¥1.5b over the trailing twelve months. Therefore, from November 2021 it had roughly 13 months of cash runway. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. The image below shows how its cash balance has been changing over the last few years.

How Well Is Koolearn Technology Holding Growing?

Some investors might find it troubling that Koolearn Technology Holding is actually increasing its cash burn, which is up 49% in the last year. At least the revenue was up 11% during the period, even if it wasn't up by much. Considering both these factors, we're not particularly excited by its growth profile. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Koolearn Technology Holding To Raise More Cash For Growth?

Koolearn Technology Holding seems to be in a fairly good position, in terms of cash burn, but we still think it's worthwhile considering how easily it could raise more money if it wanted to. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of CN¥2.6b, Koolearn Technology Holding's CN¥1.5b in cash burn equates to about 56% of its market value. From this perspective, it seems that the company spent a huge amount relative to its market value, and we'd be very wary of a painful capital raising.

So, Should We Worry About Koolearn Technology Holding's Cash Burn?

On this analysis of Koolearn Technology Holding's cash burn, we think its revenue growth was reassuring, while its cash burn relative to its market cap has us a bit worried. Summing up, we think the Koolearn Technology Holding's cash burn is a risk, based on the factors we mentioned in this article. On another note, Koolearn Technology Holding has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

Valuation is complex, but we're here to simplify it.

Discover if East Buy Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1797

East Buy Holding

An investment holding company, engages in the livestreaming e-commerce business for sale of private label products in the People's Republic of China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success