- Hong Kong

- /

- Oil and Gas

- /

- SEHK:934

Three Undiscovered Gems In Hong Kong For Savvy Investors

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape, the Hong Kong market has shown resilience with the Hang Seng Index up 1.99% recently, reflecting cautious optimism among investors. Amid this backdrop, identifying promising stocks requires a keen eye for companies with robust fundamentals and growth potential. In this article, we explore three lesser-known stocks in Hong Kong that stand out due to their strong financial health and strategic positioning within their respective industries.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 23.22% | 6.87% | 31.81% | ★★★★★★ |

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Xin Point Holdings | 2.03% | 9.80% | 15.04% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Time Interconnect Technology (SEHK:1729)

Simply Wall St Value Rating: ★★★★☆☆

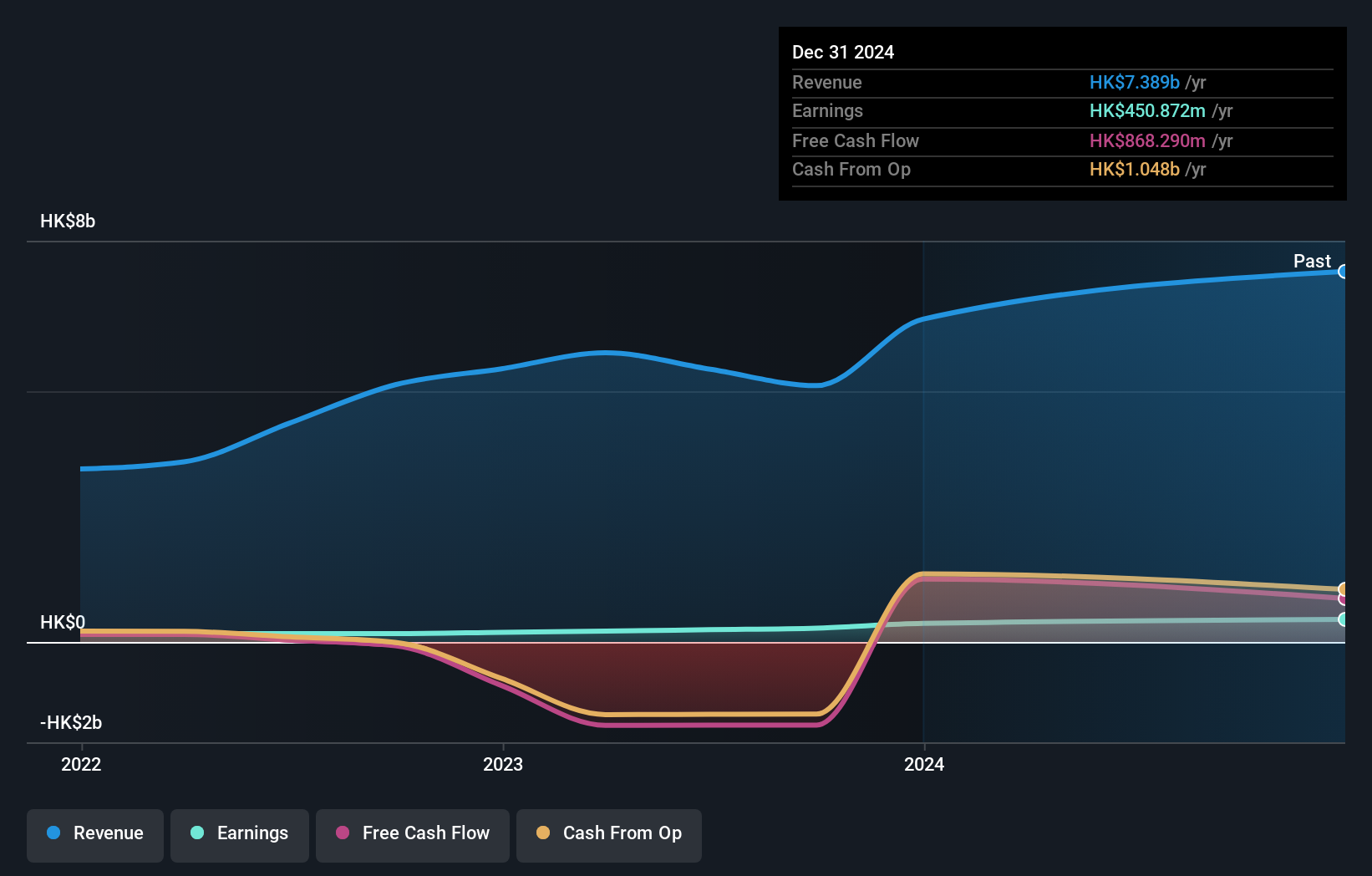

Overview: Time Interconnect Technology Limited, an investment holding company with a market cap of HK$6.95 billion, manufactures and sells cable assembly and networking cable products in various international markets including China, the United States, and the Netherlands.

Operations: Time Interconnect Technology generates revenue primarily from its Server (HK$2.98 billion), Digital Cable (HK$1.18 billion), and Cable Assembly (HK$2.31 billion) segments, with some eliminations (-HK$25.44 million). The company operates across multiple international markets including China, the United States, and the Netherlands.

Time Interconnect Technology, a small cap in Hong Kong's electrical industry, has seen its earnings grow by 93.1% over the past year, outpacing the industry's 11%. Despite a high net debt to equity ratio of 184.9%, interest payments are well covered by EBIT at 9x coverage. The company recently announced an expected net profit increase of 30%-40% for H1 2024 due to higher revenue from medical equipment and data center cable assembly sectors, along with a final dividend of HK$0.007 per share for FY2023.

Scholar Education Group (SEHK:1769)

Simply Wall St Value Rating: ★★★★★★

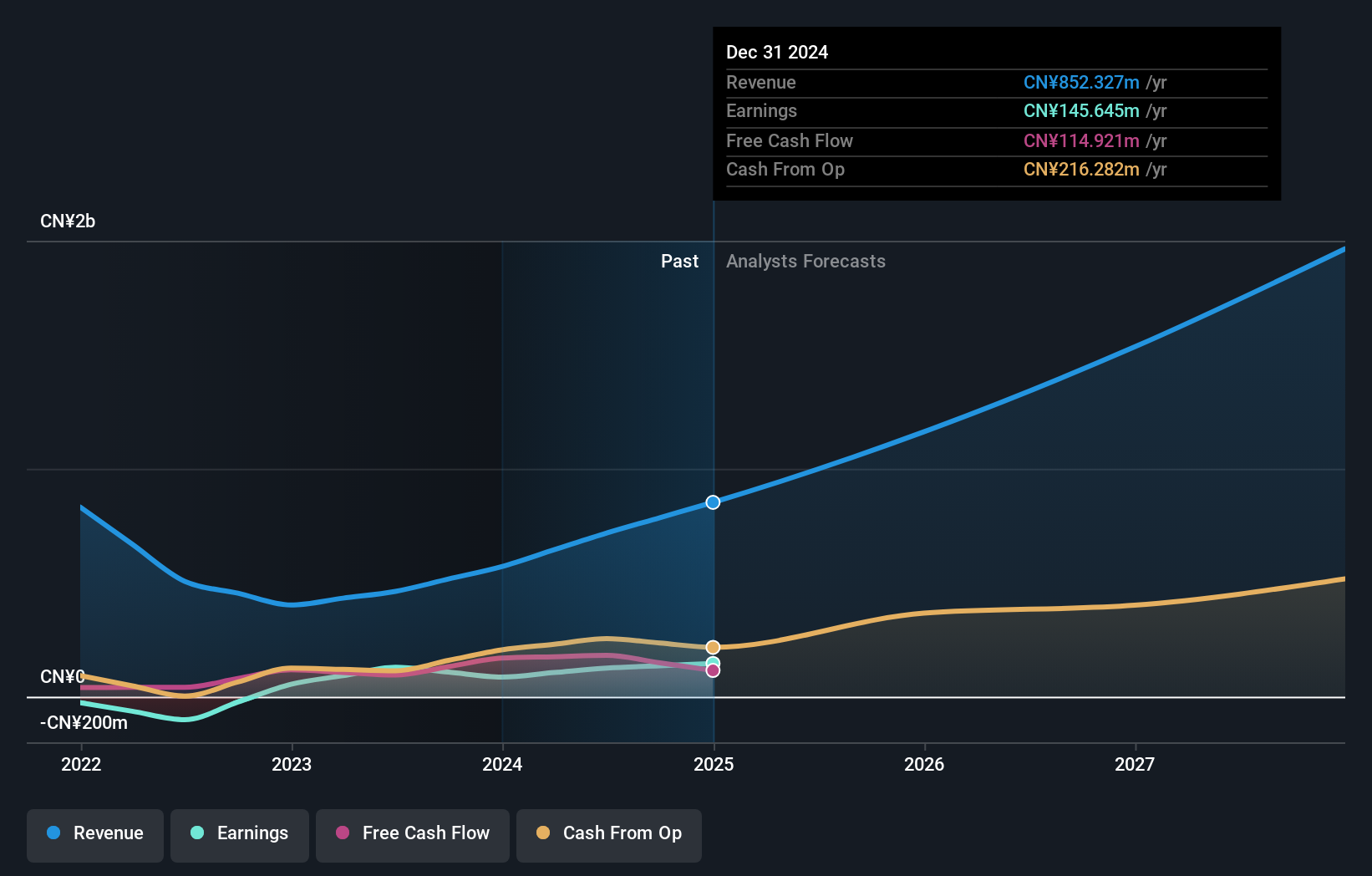

Overview: Scholar Education Group, an investment holding company with a market cap of HK$3.21 billion, provides K-12 after-school education services in the People’s Republic of China.

Operations: Scholar Education Group generates revenue primarily from K-12 after-school education services in the People’s Republic of China. The company has a market cap of HK$3.21 billion.

Scholar Education Group's recent earnings report for the half year ended June 30, 2024, revealed sales of CNY 399.11 million, up from CNY 251.32 million a year ago. Net income also improved to CNY 82.65 million compared to CNY 42.94 million previously. Basic earnings per share rose to CNY 0.1521 from last year's CNY 0.0773, while diluted earnings per share increased to CNY 0.1476 from CNY 0.0766 in the same period last year.

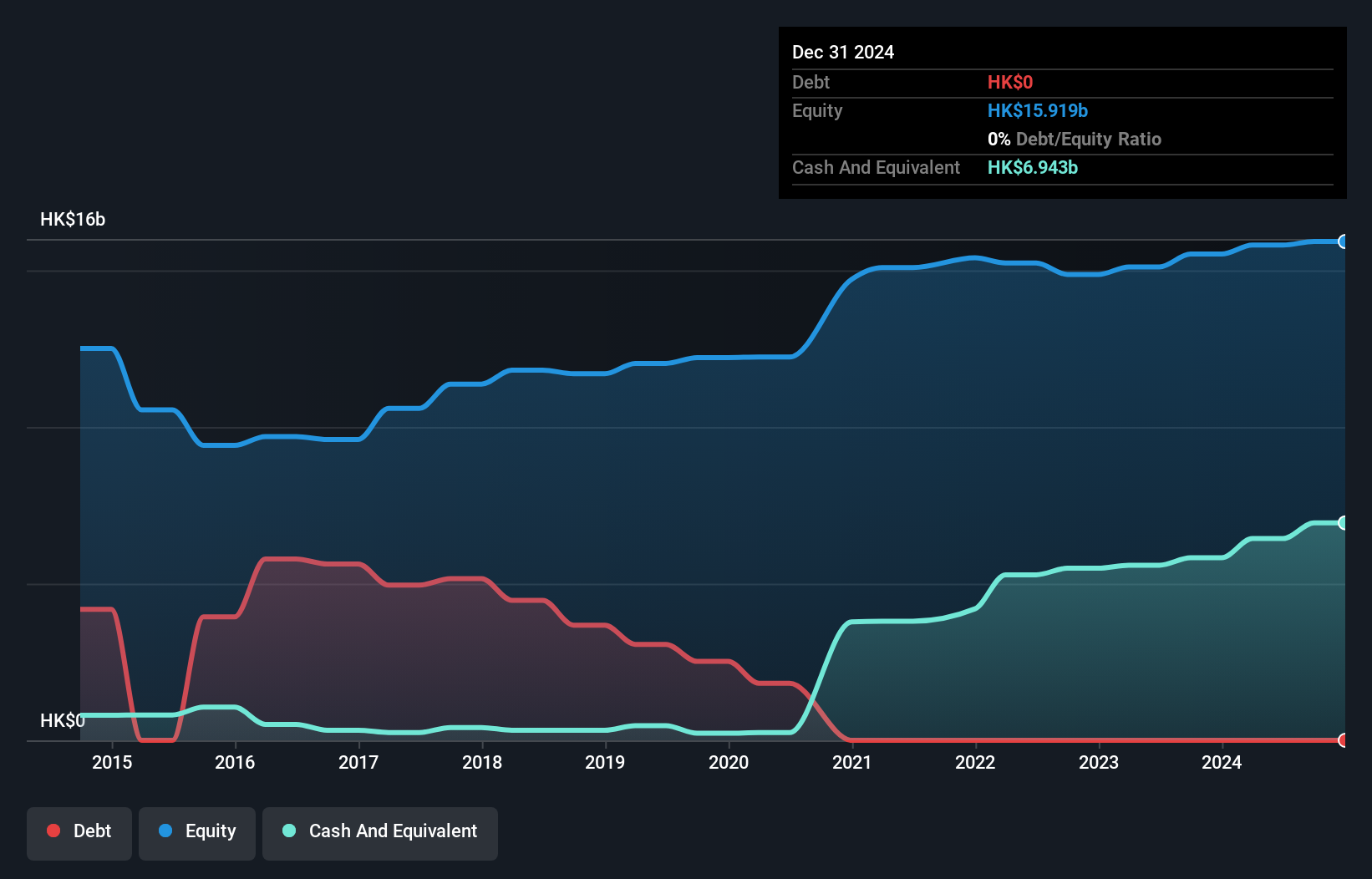

Sinopec Kantons Holdings (SEHK:934)

Simply Wall St Value Rating: ★★★★★★

Overview: Sinopec Kantons Holdings Limited, an investment holding company, provides crude oil jetty services and has a market cap of HK$11.39 billion.

Operations: The company generates revenue primarily from crude oil jetty and storage services, amounting to HK$609.87 million. Net profit margin for the latest period is 18%.

Sinopec Kantons Holdings has seen earnings surge by 198.6% in the past year, far outpacing the Oil and Gas industry’s -6.8%. The company is debt-free, a significant improvement from its 31.4% debt-to-equity ratio five years ago. Currently trading at 77.2% below its estimated fair value, Sinopec Kantons offers strong potential for value investors. The recent appointment of Mr. Zhong Fuliang as Chairman suggests experienced leadership to navigate future growth prospects, with earnings forecasted to grow by 4% annually.

Key Takeaways

- Gain an insight into the universe of 170 SEHK Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:934

Sinopec Kantons Holdings

An investment holding company, provides crude oil jetty services.

Flawless balance sheet with proven track record and pays a dividend.