- Hong Kong

- /

- Hospitality

- /

- SEHK:1314

Is Now The Time To Put Tsui Wah Holdings (HKG:1314) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Tsui Wah Holdings (HKG:1314). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Tsui Wah Holdings with the means to add long-term value to shareholders.

Tsui Wah Holdings' Improving Profits

In the last three years Tsui Wah Holdings' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Tsui Wah Holdings' EPS shot up from HK$0.019 to HK$0.027; a result that's bound to keep shareholders happy. That's a impressive gain of 42%.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The previous 12 months are something that Tsui Wah Holdings will want to put behind them after seeing a drop in EBIT margin and revenue for the period. That will not make it easy to grow profits, to say the least.

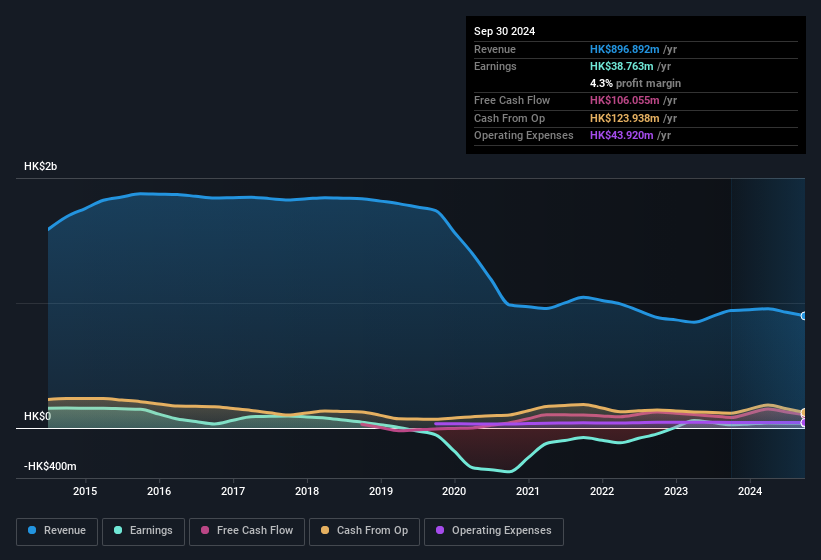

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Check out our latest analysis for Tsui Wah Holdings

Tsui Wah Holdings isn't a huge company, given its market capitalisation of HK$284m. That makes it extra important to check on its balance sheet strength .

Are Tsui Wah Holdings Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. The median total compensation for CEOs of companies similar in size to Tsui Wah Holdings, with market caps under HK$1.6b is around HK$1.8m.

The CEO of Tsui Wah Holdings only received HK$567k in total compensation for the year ending March 2024. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is Tsui Wah Holdings Worth Keeping An Eye On?

You can't deny that Tsui Wah Holdings has grown its earnings per share at a very impressive rate. That's attractive. Strong EPS growth is a great look for the company and reasonable CEO compensation sweetens the deal for investors ass it alludes to management being conscious of frivolous spending. So this stock is well worth an addition to your watchlist as it has the potential to provide great value to shareholders. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Tsui Wah Holdings , and understanding these should be part of your investment process.

Although Tsui Wah Holdings certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Hong Kong companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Tsui Wah Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1314

Tsui Wah Holdings

An investment holding company, engages in the operation of restaurants and sale of food in Hong Kong, Mainland China, and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives