- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:677

How Many Golden Resources Development International Limited (HKG:677) Shares Did Insiders Buy, In The Last Year?

We often see insiders buying up shares in companies that perform well over the long term. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So before you buy or sell Golden Resources Development International Limited (HKG:677), you may well want to know whether insiders have been buying or selling.

Do Insider Transactions Matter?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, such insiders must disclose their trading activities, and not trade on inside information.

We don't think shareholders should simply follow insider transactions. But it is perfectly logical to keep tabs on what insiders are doing. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year'.

View our latest analysis for Golden Resources Development International

Golden Resources Development International Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider purchase was by Chairman of the Board Kwing Chee Lam for HK$1.6m worth of shares, at about HK$0.59 per share. That means that an insider was happy to buy shares at around the current price of HK$0.63. Of course they may have changed their mind. But this suggests they are optimistic. If someone buys shares at well below current prices, it's a good sign on balance, but keep in mind they may no longer see value. In this case we're pleased to report that the insider bought shares at close to current prices. Kwing Chee Lam was the only individual insider to buy shares in the last twelve months. Notably Kwing Chee Lam was also the biggest seller.

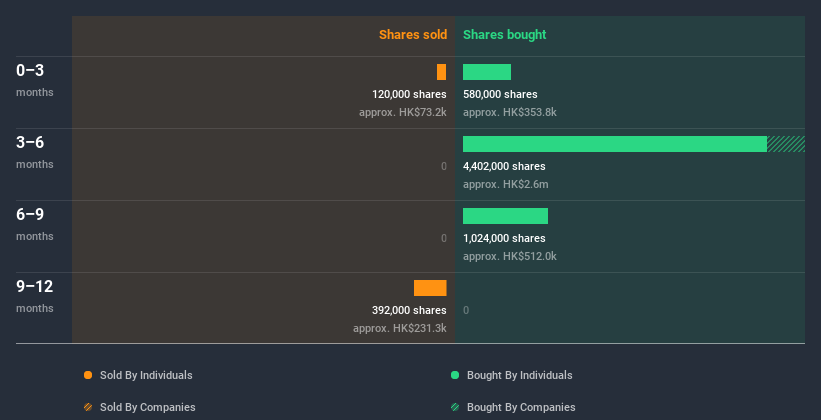

Kwing Chee Lam purchased 5.26m shares over the year. The average price per share was HK$0.57. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Insiders at Golden Resources Development International Have Bought Stock Recently

Over the last three months, we've seen a bit of insider buying at Golden Resources Development International. Chairman of the Board Kwing Chee Lam bought HK$354k worth of shares in that time. However, Chairman of the Board Kwing Chee Lam netted HK$73k for sales. While it's good to see the insider buying, the net amount bought isn't enough for us to gain much confidence from it.

Insider Ownership of Golden Resources Development International

For a common shareholder, it is worth checking how many shares are held by company insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Golden Resources Development International insiders own about HK$114m worth of shares. That equates to 11% of the company. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Does This Data Suggest About Golden Resources Development International Insiders?

It's certainly positive to see the recent insider purchase. We also take confidence from the longer term picture of insider transactions. However, we note that the company didn't make a profit over the last twelve months, which makes us cautious. When combined with notable insider ownership, these factors suggest Golden Resources Development International insiders are well aligned, and quite possibly think the share price is too low. That's what I like to see! While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. Be aware that Golden Resources Development International is showing 2 warning signs in our investment analysis, and 1 of those is a bit unpleasant...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Golden Resources Development International or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:677

Golden Resources Development International

An investment holding company, engages in the sourcing, importing, wholesaling, processing, packaging, marketing, and distributing of rice and food products in Hong Kong, Vietnam, Mainland China, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success