- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2517

Three Undiscovered Gems In Hong Kong To Enhance Your Investment Portfolio

Reviewed by Simply Wall St

As the Hong Kong market navigates a period of mixed economic signals and fluctuating investor sentiment, small-cap stocks have shown resilience amidst broader market volatility. In this environment, identifying high-potential stocks that are under the radar can be a strategic move for enhancing your investment portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| Sundart Holdings | 0.01% | -2.76% | -4.34% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Xin Point Holdings | 2.03% | 9.80% | 15.04% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Mulsanne Group Holding | 186.88% | -12.02% | -43.54% | ★★★★☆☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Xiamen Yan Palace Bird's Nest Industry (SEHK:1497)

Simply Wall St Value Rating: ★★★★★★

Overview: Xiamen Yan Palace Bird's Nest Industry Co., Ltd., along with its subsidiaries, focuses on the research, development, production, and marketing of edible bird’s nest products in China and has a market cap of HK$7.03 billion.

Operations: The company's revenue streams include sales to online distributors (CN¥16.75 million), offline distributors (CN¥509.04 million), direct sales to online customers (CN¥824.40 million), direct sales to offline customers (CN¥351.17 million), and direct sales to e-commerce platforms (CN¥262.89 million).

Xiamen Yan Palace Bird's Nest Industry, a small cap in Hong Kong, has shown resilience with earnings growing 4.9% over the past year, outpacing the Food industry’s 4.1%. The company is debt-free, contrasting its position five years ago when its debt to equity ratio was 10.5%. Despite a challenging first half of 2024, revenue grew between RMB 1.05 billion and RMB 1.09 billion due to strong online sales growth. However, net profit is expected to drop by around 40% to 50%, reflecting operational challenges amidst this growth phase.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in China with a market cap of HK$7.86 billion.

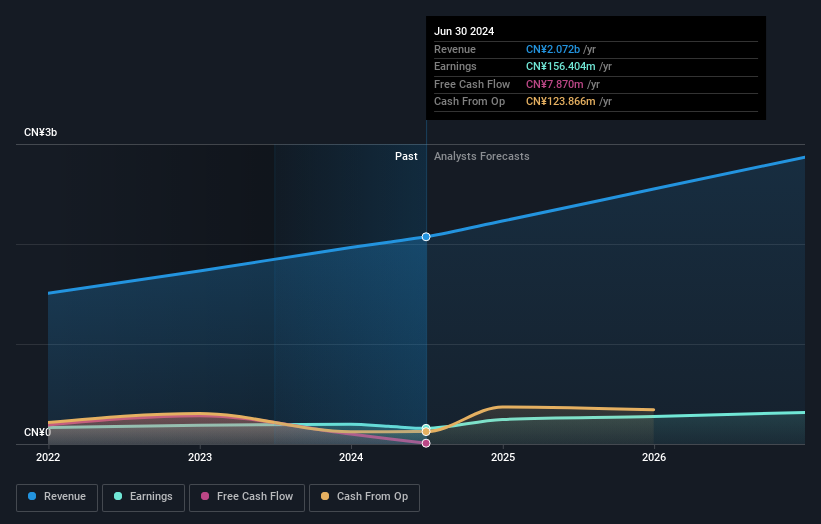

Operations: Guoquan Food (Shanghai) Co., Ltd. generates revenue primarily from retail sales in grocery stores, amounting to CN¥6.09 billion. The company's market cap stands at HK$7.86 billion.

Guoquan Food (Shanghai) has shown promising growth, with earnings increasing by 4.2% over the past year, outpacing the Consumer Retailing industry's 1.6%. The company repurchased shares in 2024 and has more cash than its total debt. Recent developments include a final dividend of RMB 0.0521 per share for 2023 and significant executive changes, including appointing Mr. Cheung Kai Cheong Willie as Joint Company Secretary and Mr. Wang Hui as CFO since February 2024.

First Tractor (SEHK:38)

Simply Wall St Value Rating: ★★★★★★

Overview: First Tractor Company Limited is involved in the research, development, manufacture, and sale of agricultural and power machinery along with related spare parts globally, with a market cap of HK$14.61 billion.

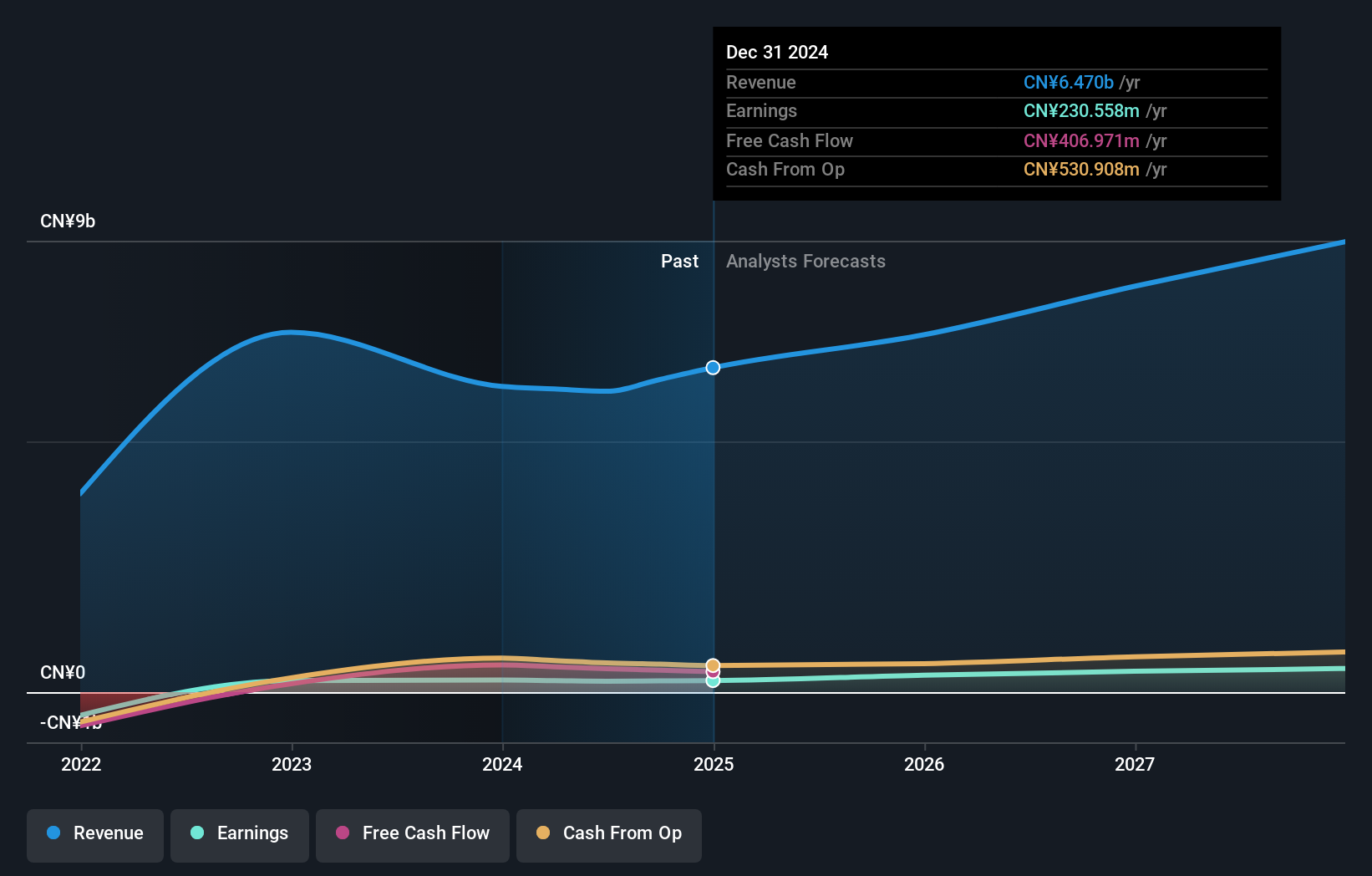

Operations: First Tractor generates revenue primarily from the sale of agricultural and power machinery, as well as related spare parts. The company's net profit margin is 2.5%.

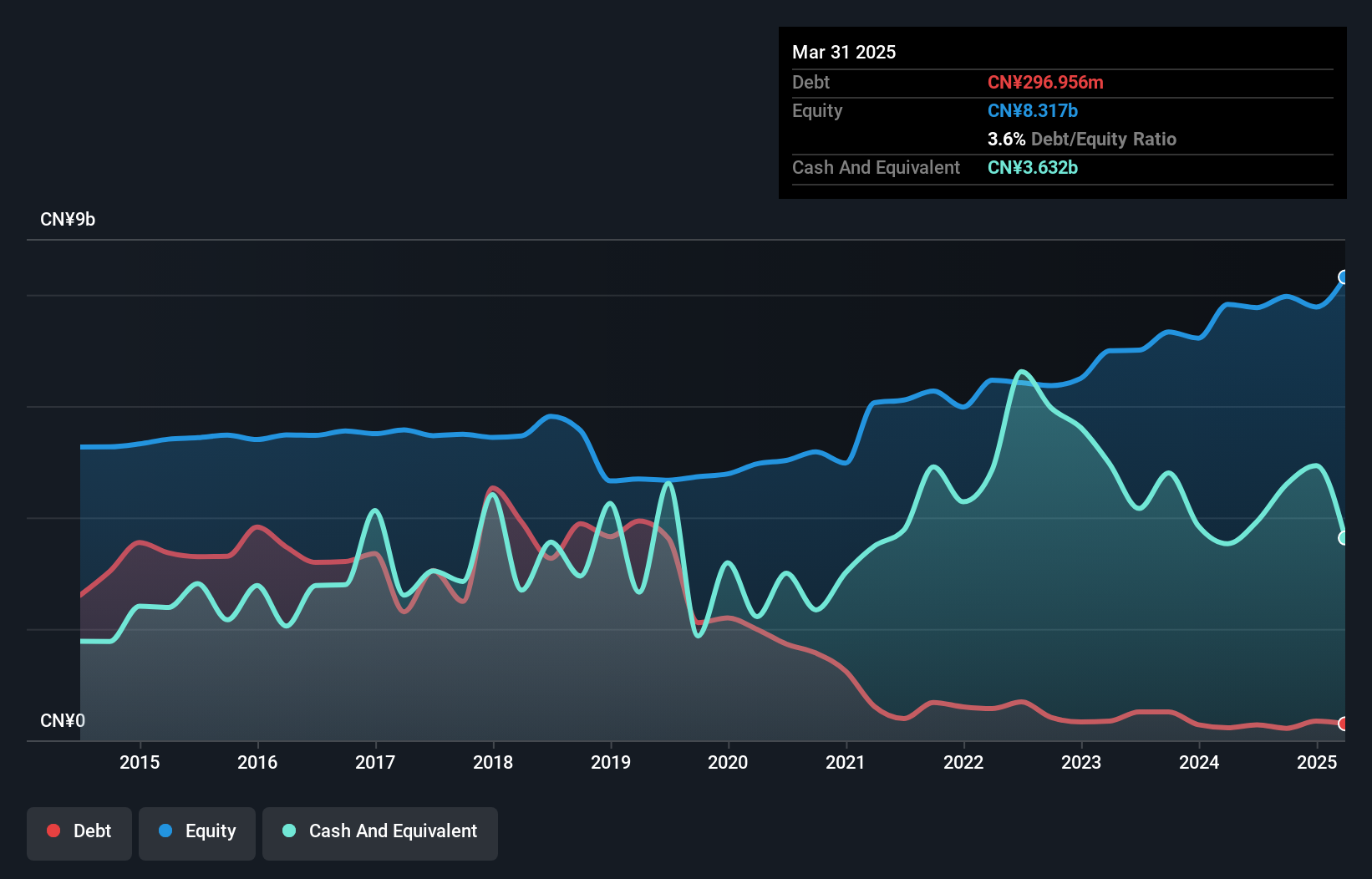

First Tractor, a notable player in Hong Kong's machinery sector, has seen its debt-to-equity ratio drop from 84% to 2.9% over five years. Its earnings growth of 61.9% last year outpaced the industry average of 1.5%. The company’s P/E ratio stands at an attractive 6.3x compared to the market's 9.1x, and it remains free cash flow positive. Recent board changes include the resignation of three directors due to age and work re-arrangement as of July 2024.

- Get an in-depth perspective on First Tractor's performance by reading our health report here.

Evaluate First Tractor's historical performance by accessing our past performance report.

Where To Now?

- Investigate our full lineup of 179 SEHK Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2517

Guoquan Food (Shanghai)

Operates as a home meal products company in China.

Excellent balance sheet with proven track record.