- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2411

Shenzhen Pagoda Industrial (Group) Corporation Limited (HKG:2411) Shares May Have Slumped 31% But Getting In Cheap Is Still Unlikely

The Shenzhen Pagoda Industrial (Group) Corporation Limited (HKG:2411) share price has softened a substantial 31% over the previous 30 days, handing back much of the gains the stock has made lately. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 11% share price drop.

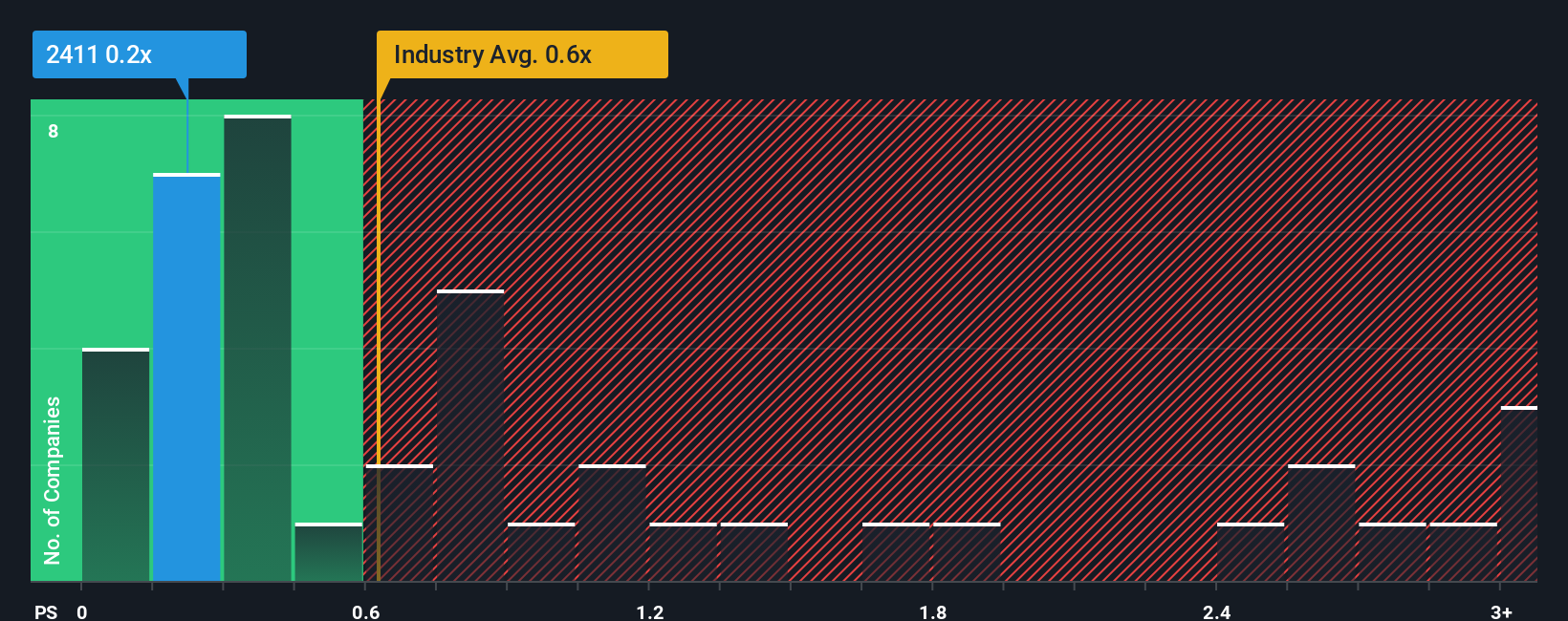

Although its price has dipped substantially, it's still not a stretch to say that Shenzhen Pagoda Industrial (Group)'s price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Consumer Retailing industry in Hong Kong, where the median P/S ratio is around 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Shenzhen Pagoda Industrial (Group)

What Does Shenzhen Pagoda Industrial (Group)'s Recent Performance Look Like?

While the industry has experienced revenue growth lately, Shenzhen Pagoda Industrial (Group)'s revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Shenzhen Pagoda Industrial (Group) will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Shenzhen Pagoda Industrial (Group) would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 9.8%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth is heading into negative territory, declining 11% over the next year. With the industry predicted to deliver 8.6% growth, that's a disappointing outcome.

With this information, we find it concerning that Shenzhen Pagoda Industrial (Group) is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Key Takeaway

Shenzhen Pagoda Industrial (Group)'s plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our check of Shenzhen Pagoda Industrial (Group)'s analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Shenzhen Pagoda Industrial (Group), and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2411

Shenzhen Pagoda Industrial (Group)

Operates as a fruit retailer in China, Indonesia, Singapore, Hong Kong, and internationally.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives