- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:1833

Ping An Healthcare and Technology (HKG:1833 investor three-year losses grow to 82% as the stock sheds HK$604m this past week

As every investor would know, not every swing hits the sweet spot. But you want to avoid the really big losses like the plague. So take a moment to sympathize with the long term shareholders of Ping An Healthcare and Technology Company Limited (HKG:1833), who have seen the share price tank a massive 82% over a three year period. That would be a disturbing experience. And more recent buyers are having a tough time too, with a drop of 35% in the last year. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

After losing 4.7% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Ping An Healthcare and Technology

Given that Ping An Healthcare and Technology didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years Ping An Healthcare and Technology saw its revenue shrink by 14% per year. That's not what investors generally want to see. The share price fall of 22% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. There's no more than a snowball's chance in hell that share price will head back to its old highs, in the short term.

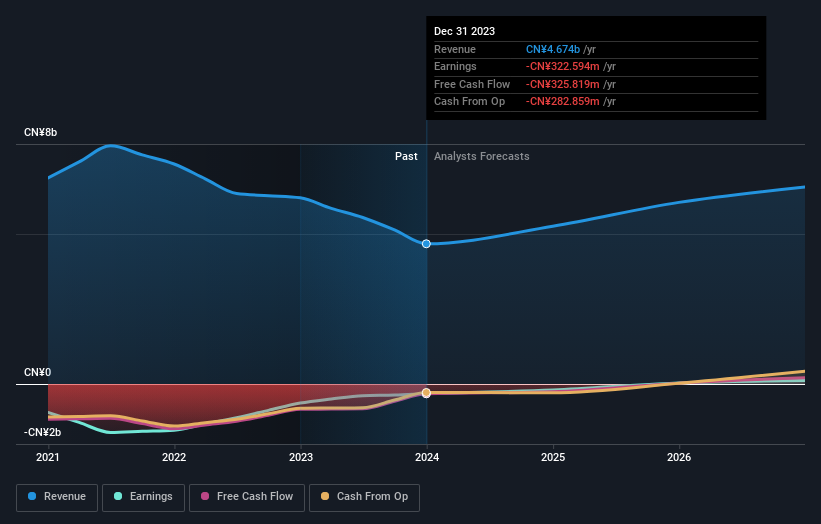

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Ping An Healthcare and Technology is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Ping An Healthcare and Technology shareholders are down 35% for the year, but the market itself is up 8.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You could get a better understanding of Ping An Healthcare and Technology's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1833

Ping An Healthcare and Technology

Operates an online healthcare services platform in China.

Adequate balance sheet with moderate growth potential.