Stock Analysis

- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:1797

Earnings growth of 1.0% over 1 year hasn't been enough to translate into positive returns for East Buy Holding (HKG:1797) shareholders

Taking the occasional loss comes part and parcel with investing on the stock market. And unfortunately for East Buy Holding Limited (HKG:1797) shareholders, the stock is a lot lower today than it was a year ago. The share price has slid 60% in that time. Longer term investors have fared much better, since the share price is up 36% in three years. Shareholders have had an even rougher run lately, with the share price down 41% in the last 90 days.

With the stock having lost 5.2% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for East Buy Holding

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate twelve months during which the East Buy Holding share price fell, it actually saw its earnings per share (EPS) improve by 1.0%. Of course, the situation might betray previous over-optimism about growth.

It seems quite likely that the market was expecting higher growth from the stock. But looking to other metrics might better explain the share price change.

East Buy Holding managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

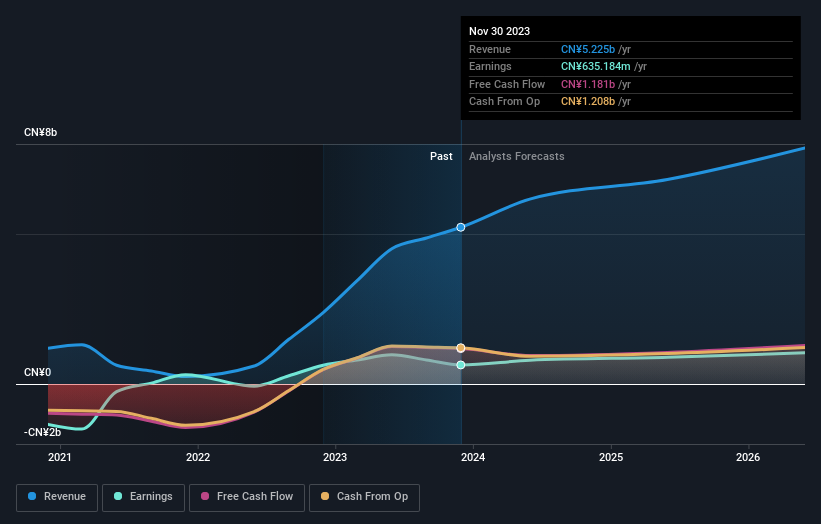

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling East Buy Holding stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While the broader market gained around 4.4% in the last year, East Buy Holding shareholders lost 60%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 8% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand East Buy Holding better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for East Buy Holding you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether East Buy Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether East Buy Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1797

East Buy Holding

An investment holding company, primarily engages in the provision of online education services in China.

Flawless balance sheet with reasonable growth potential.