- Hong Kong

- /

- Transportation

- /

- SEHK:62

Wasion Holdings And 2 More Undervalued Small Caps With Insider Buying In Hong Kong

Reviewed by Simply Wall St

Amid a backdrop of global market shifts and a notable pivot towards value and small-cap stocks in various regions, the Hong Kong market presents unique opportunities for investors looking to explore potentially undervalued assets. Recent insider buying trends in certain small-cap companies suggest that there may be hidden gems ripe for consideration under the current economic conditions.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ferretti | 11.4x | 0.8x | 45.84% | ★★★★★☆ |

| China Overseas Grand Oceans Group | 2.3x | 0.1x | 15.42% | ★★★★★☆ |

| Ever Sunshine Services Group | 5.5x | 0.4x | 22.87% | ★★★★★☆ |

| Wasion Holdings | 10.9x | 0.8x | 35.49% | ★★★★☆☆ |

| Nissin Foods | 14.3x | 1.3x | 41.66% | ★★★★☆☆ |

| China Leon Inspection Holding | 9.9x | 0.7x | 26.67% | ★★★★☆☆ |

| Kinetic Development Group | 3.8x | 1.7x | 22.87% | ★★★★☆☆ |

| Transport International Holdings | 11.6x | 0.6x | 43.91% | ★★★★☆☆ |

| Skyworth Group | 5.5x | 0.1x | -298.87% | ★★★☆☆☆ |

| Shenzhen International Holdings | 7.9x | 0.7x | 14.69% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

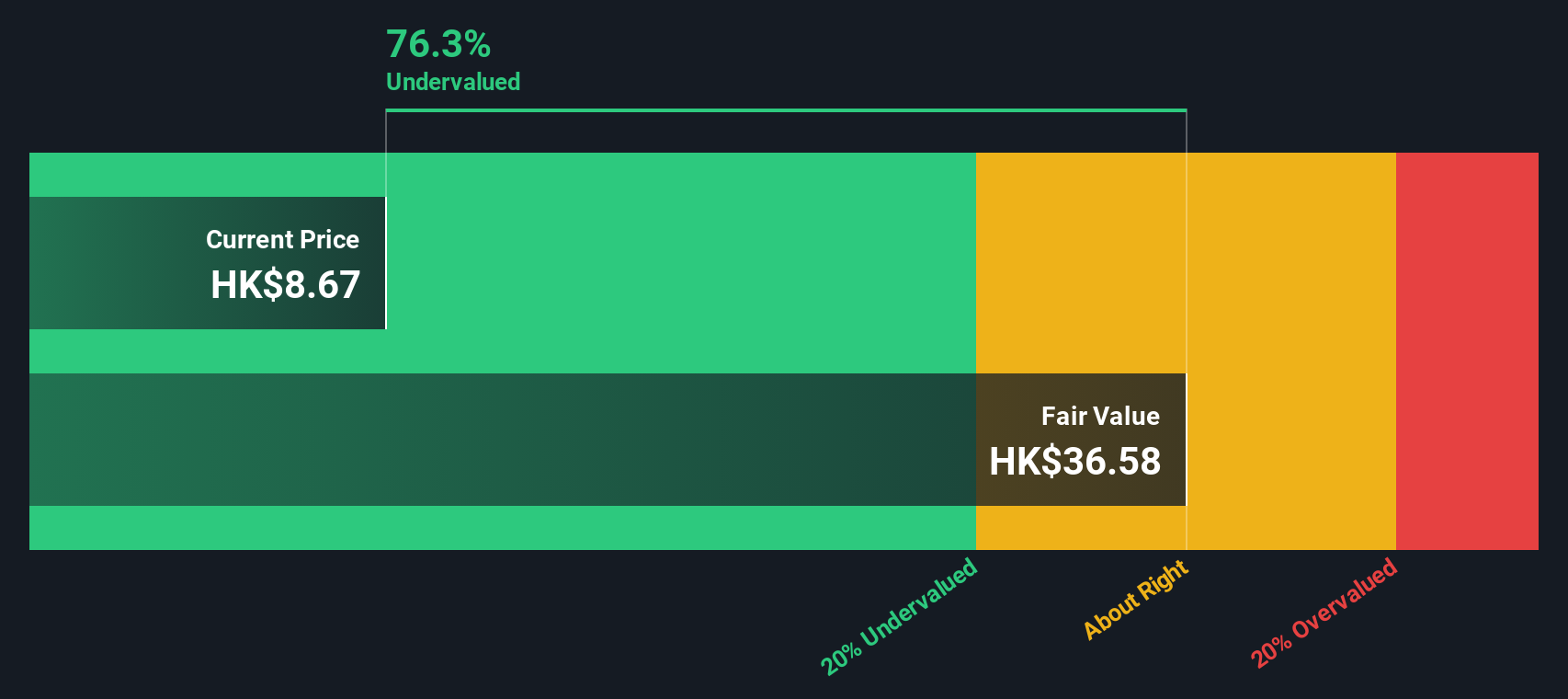

Wasion Holdings (SEHK:3393)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wasion Holdings is a company specializing in the manufacturing and distribution of advanced metering products for the power and utilities sector, with a market capitalization of approximately CN¥2.37 billion.

Operations: Advanced Distribution Operations, Power Advanced Metering Infrastructure, and Communication and Fluid Advanced Metering Infrastructure collectively generated revenues of CN¥7.37 billion. The gross profit margin in the latest reported period was 35.59%.

PE: 10.9x

Recently, Wasion Holdings Limited has shown promising signs of growth, with earnings expected to increase by 25.8% annually. This projection, coupled with a substantial insider confidence boost through Wei Ji's recent purchase of 500,000 shares for HK$3.17 million on May 10, 2024, underscores a strong belief in the company's future. Additionally, the firm demonstrated its financial health at the latest AGM by declaring a final dividend of HK$0.28 per share for the year ended December 31, 2023. These factors collectively spotlight Wasion as an intriguing entity within Hong Kong’s smaller market players.

- Delve into the full analysis valuation report here for a deeper understanding of Wasion Holdings.

Explore historical data to track Wasion Holdings' performance over time in our Past section.

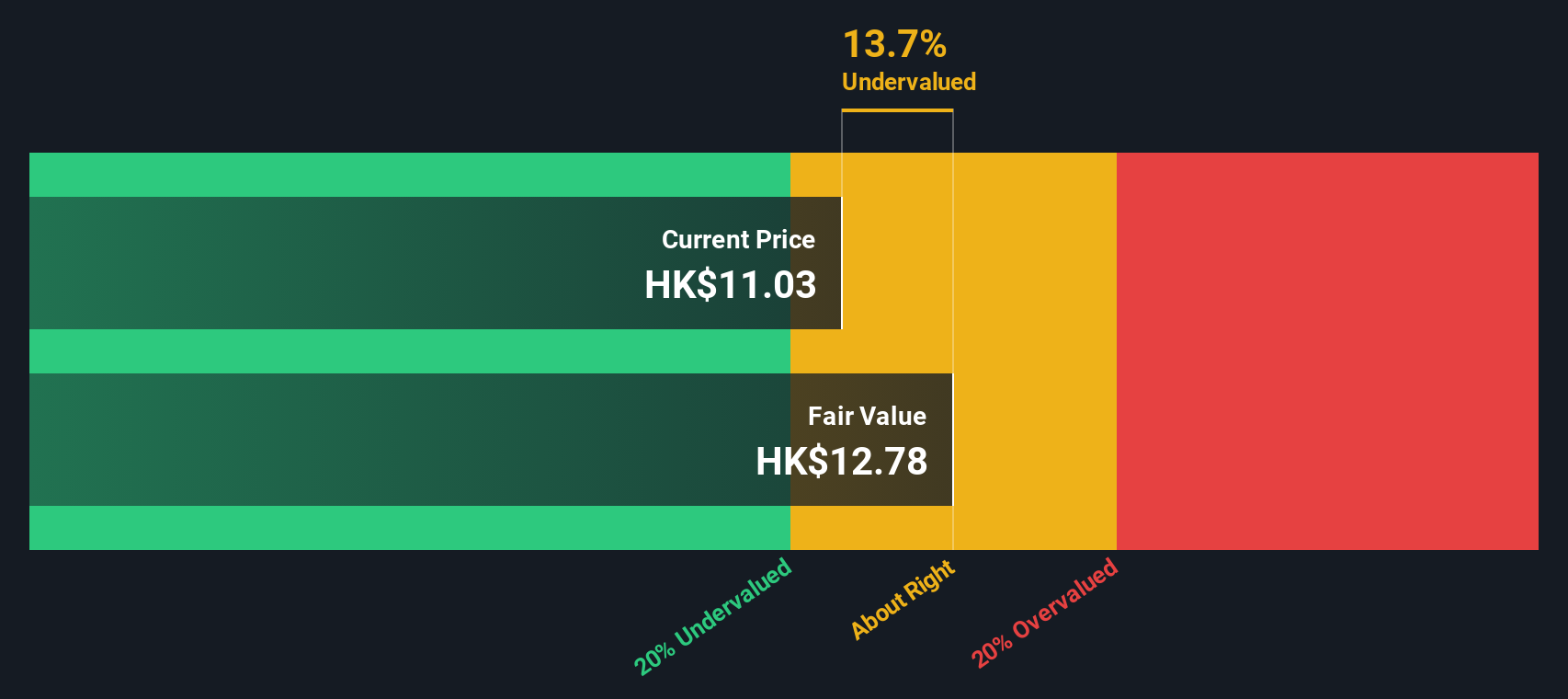

Transport International Holdings (SEHK:62)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Transport International Holdings operates primarily in franchised bus operations, supplemented by activities in property holdings and development, with a minor segment in other diversified investments.

Operations: The company's primary revenue is derived from franchised bus operations, which generated HK$7.57 billion, complemented by smaller contributions from property holdings and development at HK$87.36 million. Over recent periods, the gross profit margin has shown an upward trend, increasing to 27.93% as of the latest data point.

PE: 11.6x

Recently, Transport International Holdings showcased insider confidence as Winnie J. Ng acquired 124,000 shares, signaling strong belief in the company's potential. This move aligns with broader shifts in leadership and strategic direction, highlighted by the appointment of Ms. LAU Man-Kwan as an alternate director, bringing extensive experience in urban planning to the table. Despite a challenging backdrop with earnings declining annually over the past five years and lower profit margins compared to last year, these internal investments and leadership enhancements could hint at a turnaround trajectory for this underappreciated entity in Hong Kong’s market landscape.

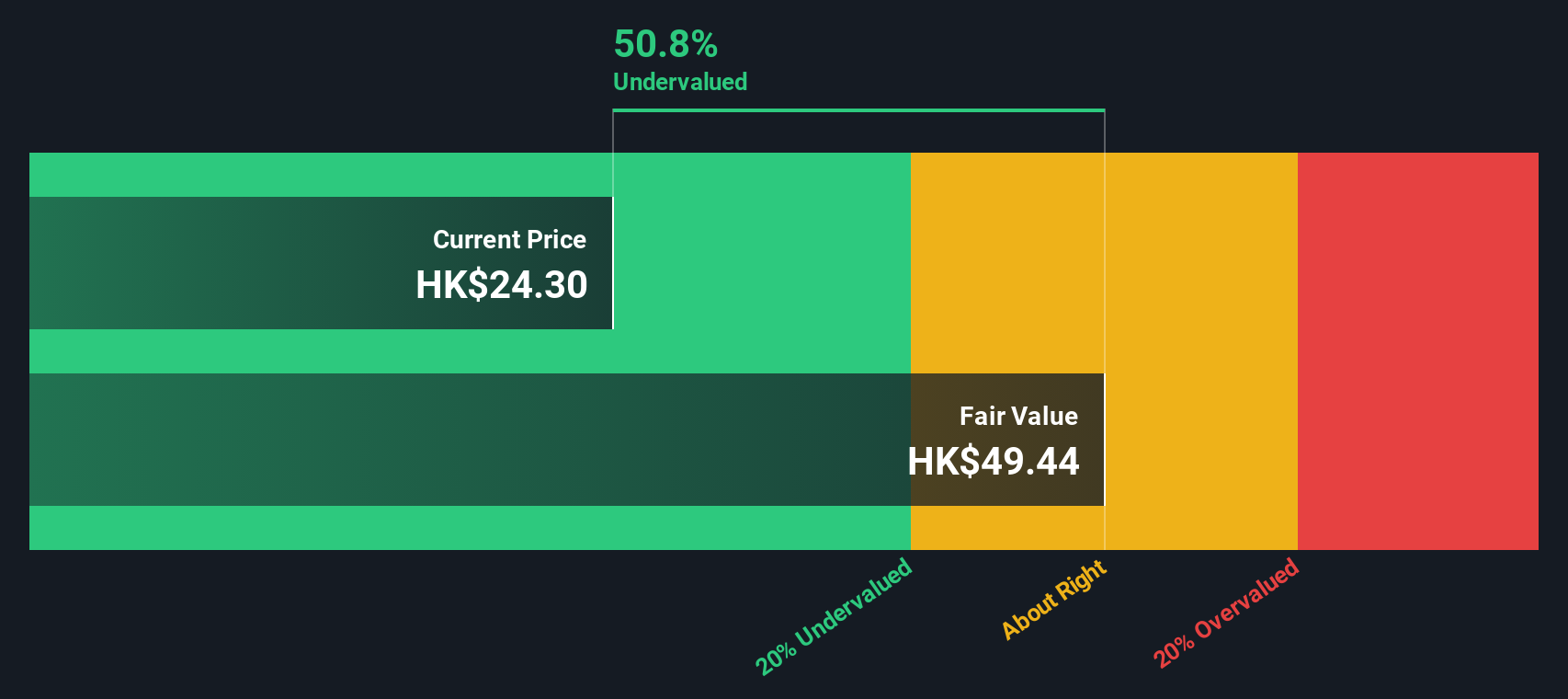

Ferretti (SEHK:9638)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ferretti specializes in the design, construction, and marketing of yachts and recreational boats.

Operations: In 2023, the company generated €1.23 billion in revenue, primarily from the design, construction, and marketing of yachts and recreational boats. Its gross profit was €455.82 million with a gross profit margin of 37.08%.

PE: 11.4x

Ferretti, a notable player among Hong Kong's smaller companies, recently projected its 2024 revenues to reach between €1.22 billion and €1.24 billion, marking up to an 11.6% increase. This forecast aligns with their robust Q1 performance and insider confidence is evident as they have recently purchased shares, signaling belief in the company's prospects. With a reliance on external borrowing over customer deposits, Ferretti maintains high non-cash earnings, suggesting strong underlying financial health despite the higher risk funding structure.

- Dive into the specifics of Ferretti here with our thorough valuation report.

Gain insights into Ferretti's past trends and performance with our Past report.

Where To Now?

- Navigate through the entire inventory of 17 Undervalued SEHK Small Caps With Insider Buying here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Transport International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:62

Transport International Holdings

An investment holding company, provides franchised and non-franchised public transportation services in the People’s Republic of China.

Adequate balance sheet low.