- Hong Kong

- /

- Consumer Durables

- /

- SEHK:833

Are Investors Overlooking Returns On Capital At Alltronics Holdings (HKG:833)?

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. So, when we ran our eye over Alltronics Holdings' (HKG:833) trend of ROCE, we really liked what we saw.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Alltronics Holdings, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.27 = HK$116m ÷ (HK$1.2b - HK$775m) (Based on the trailing twelve months to June 2020).

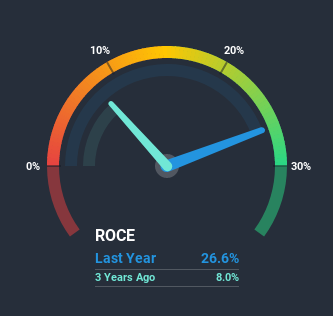

Thus, Alltronics Holdings has an ROCE of 27%. In absolute terms that's a great return and it's even better than the Consumer Durables industry average of 16%.

View our latest analysis for Alltronics Holdings

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Alltronics Holdings' past further, check out this free graph of past earnings, revenue and cash flow.

What Does the ROCE Trend For Alltronics Holdings Tell Us?

In terms of Alltronics Holdings' history of ROCE, it's quite impressive. The company has employed 75% more capital in the last five years, and the returns on that capital have remained stable at 27%. Returns like this are the envy of most businesses and given it has repeatedly reinvested at these rates, that's even better. You'll see this when looking at well operated businesses or favorable business models.

On a side note, Alltronics Holdings' current liabilities are still rather high at 64% of total assets. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

The Bottom Line

Alltronics Holdings has demonstrated its proficiency by generating high returns on increasing amounts of capital employed, which we're thrilled about. However, despite the favorable fundamentals, the stock has fallen 59% over the last five years, so there might be an opportunity here for astute investors. That's why we think it'd be worthwhile to look further into this stock given the fundamentals are appealing.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 5 warning signs for Alltronics Holdings (of which 2 make us uncomfortable!) that you should know about.

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

When trading Alltronics Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:833

Alltronics Holdings

An investment holding company, manufactures and trades in electronic products, plastic molds, and plastic and other components for electronic products in the United States, Hong Kong, Europe, the People’s Republic of China, and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives