- Hong Kong

- /

- Consumer Durables

- /

- SEHK:8005

We Think That There Are More Issues For Yuxing InfoTech Investment Holdings (HKG:8005) Than Just Sluggish Earnings

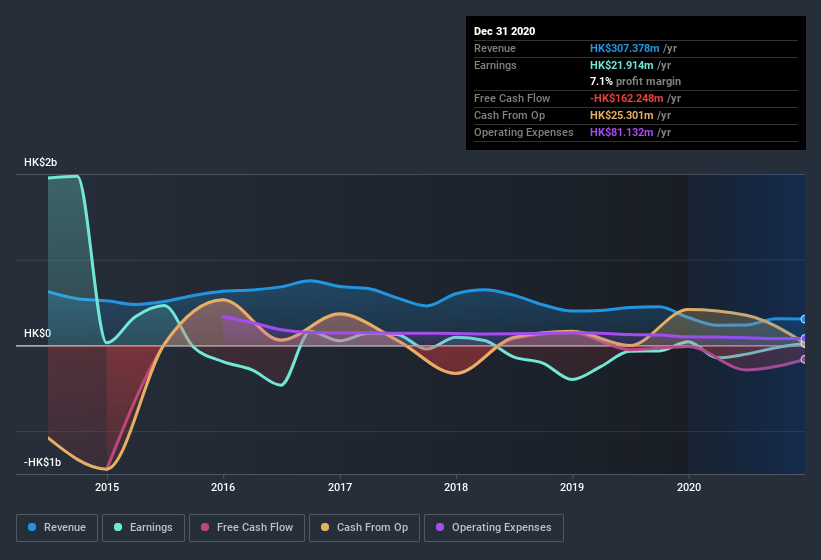

The market shrugged off Yuxing InfoTech Investment Holdings Limited's (HKG:8005) weak earnings report. Despite the market responding positively, we think that there are several concerning factors that investors should be aware of.

Check out our latest analysis for Yuxing InfoTech Investment Holdings

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, Yuxing InfoTech Investment Holdings issued 20% more new shares over the last year. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Yuxing InfoTech Investment Holdings' EPS by clicking here.

A Look At The Impact Of Yuxing InfoTech Investment Holdings' Dilution on Its Earnings Per Share (EPS).

As it happens, we don't know how much the company made or lost three years ago, because we don't have the data. And even focusing only on the last twelve months, we see profit is down 44%. Sadly, earnings per share fell further, down a full 49% in that time. Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, if Yuxing InfoTech Investment Holdings' earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Yuxing InfoTech Investment Holdings.

How Do Unusual Items Influence Profit?

Finally, we should also consider the fact that unusual items boosted Yuxing InfoTech Investment Holdings' net profit by HK$29m over the last year. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. Which is hardly surprising, given the name. Yuxing InfoTech Investment Holdings had a rather significant contribution from unusual items relative to its profit to December 2020. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Yuxing InfoTech Investment Holdings' Profit Performance

In its last report Yuxing InfoTech Investment Holdings benefitted from unusual items which boosted its profit, which could make the profit seem better than it really is on a sustainable basis. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. Considering all this we'd argue Yuxing InfoTech Investment Holdings' profits probably give an overly generous impression of its sustainable level of profitability. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. At Simply Wall St, we found 4 warning signs for Yuxing InfoTech Investment Holdings and we think they deserve your attention.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade Yuxing InfoTech Investment Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8005

Yuxing InfoTech Investment Holdings

An investment holding company, primarily engages in the manufacture, distribution, and sale of information home appliances and complementary products to consumer markets.

Flawless balance sheet with low risk.

Market Insights

Community Narratives