Laopu Gold (SEHK:6181): Assessing Valuation Following Major Equity Offering and Capital Restructuring

Reviewed by Simply Wall St

Laopu Gold (SEHK:6181) just raised about HKD 2.72 billion through a follow-on equity offering. At the same time, the company amended its Articles of Association to update its registered and total share capital. These moves reshape its capital base.

See our latest analysis for Laopu Gold.

Laopu Gold’s completion of the follow-on equity offering drew plenty of market attention, with the share price jumping 5.16% in one day. While the short-term momentum has been a bit choppy, the year-to-date share price return is an eye-catching 142.81%, and total shareholder return over the past twelve months sits even higher at 216.25%. This kind of performance suggests investors are noticing the growth story, with recent capital moves potentially positioning the company for its next phase.

If capital flows and fresh strategies in the gold sector have sparked your interest, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

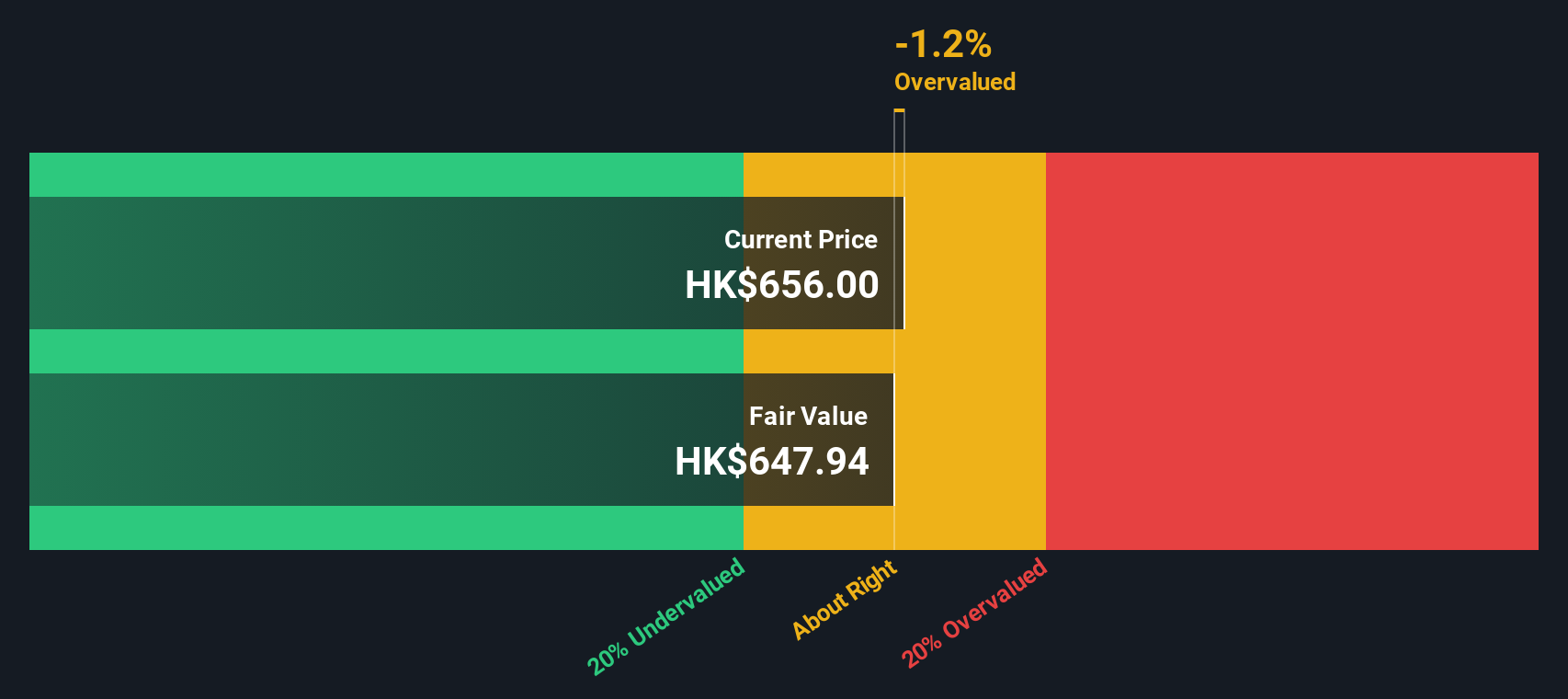

After such a rapid climb, investors may be wondering if Laopu Gold is still undervalued or if the market has already factored in all the expected growth. This could mean there is little room for upside from here.

Price-to-Earnings of 32.9x: Is it justified?

Laopu Gold trades at a price-to-earnings (PE) ratio of 32.9x, which is significantly higher than both its Hong Kong luxury industry peers and the broader market. The last close price was HK$641.5.

The PE ratio measures how much investors are willing to pay today for each dollar of a company’s earnings. For consumer luxury stocks like Laopu Gold, a higher multiple can signal expectations of sustained earnings growth and strong brand demand. However, it may also reflect market optimism that is not always matched by fundamentals.

This 32.9x PE multiple is more than three times higher than the sector average of 9.7x, and also much steeper than the peer group average of 14.8x. It exceeds the estimated fair price-to-earnings ratio of 20.3x, suggesting investors are paying a premium well above what typical models might justify in this market.

Explore the SWS fair ratio for Laopu Gold

Result: Price-to-Earnings of 32.9x (OVERVALUED)

However, slowing revenue growth or shifts in market sentiment could quickly challenge the current optimism surrounding Laopu Gold’s valuation.

Find out about the key risks to this Laopu Gold narrative.

Another View: What Does Our DCF Model Suggest?

While Laopu Gold’s share price looks expensive against earnings multiples, our SWS DCF model paints a slightly different picture. According to this model, the shares are trading just below fair value, about 1.1% under, implying the price could be reasonable if growth plays out. But does the DCF capture risks that the market’s high multiple might overlook?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Laopu Gold for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 869 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Laopu Gold Narrative

If these conclusions do not fit your outlook or you want to drill into the details yourself, you can easily build your own perspective in just a few minutes, so consider giving it a go. Do it your way

A great starting point for your Laopu Gold research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Smart investors always have their eyes on the next opportunity. Don’t let today’s gains be the end of your journey. There are more growth stories waiting for you to uncover.

- Tap into powerful recurring income by checking out these 16 dividend stocks with yields > 3% with yields that can strengthen your portfolio’s cash flow.

- Ride the AI boom and stay ahead in tech innovation by exploring these 25 AI penny stocks at the forefront of artificial intelligence solutions.

- Boost your portfolio’s potential by searching for value through these 869 undervalued stocks based on cash flows, perfect for finding opportunities the crowd may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6181

Laopu Gold

Designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives