Earnings Working Against Kingdom Holdings Limited's (HKG:528) Share Price

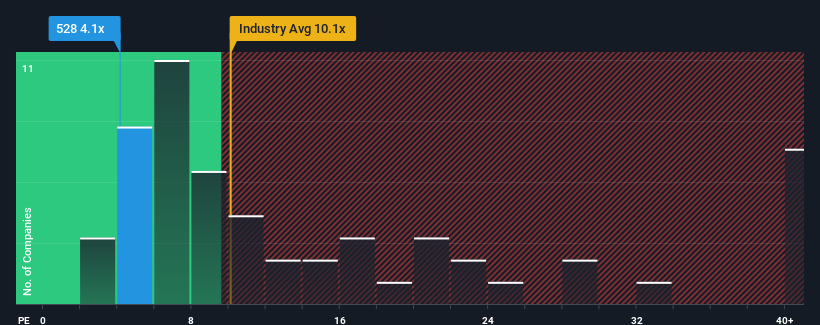

Kingdom Holdings Limited's (HKG:528) price-to-earnings (or "P/E") ratio of 4.1x might make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 10x and even P/E's above 18x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Kingdom Holdings over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Kingdom Holdings

Is There Any Growth For Kingdom Holdings?

The only time you'd be truly comfortable seeing a P/E as depressed as Kingdom Holdings' is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered a frustrating 6.9% decrease to the company's bottom line. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 19% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Kingdom Holdings is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Bottom Line On Kingdom Holdings' P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Kingdom Holdings maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Kingdom Holdings that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Kingdom Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:528

Kingdom Holdings

An investment holding company, engages in the manufacture and sale of linen yarns in Mainland China, the European Union, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives