The board of YGM Trading Limited (HKG:375) has announced that it will pay a dividend of HK$0.10 per share on the 23rd of October. Based on this payment, the dividend yield on the company's stock will be 9.8%, which is an attractive boost to shareholder returns.

See our latest analysis for YGM Trading

YGM Trading Might Find It Hard To Continue The Dividend

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Even though YGM Trading isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. This gives us some comfort about the level of the dividend payments.

Over the next year, EPS might fall by 25.1% based on recent performance. This means the company will be unprofitable and managers could face the tough choice between continuing to pay the dividend or taking pressure off the balance sheet.

Dividend Volatility

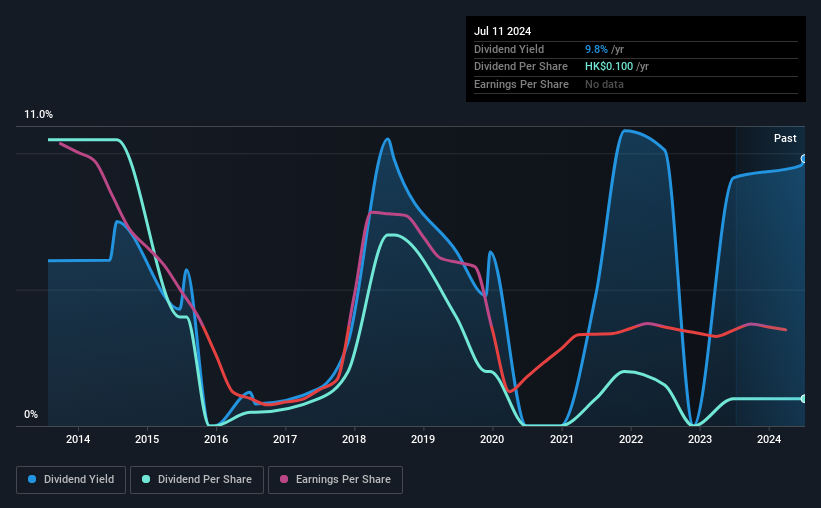

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2014, the annual payment back then was HK$1.05, compared to the most recent full-year payment of HK$0.10. This works out to a decline of approximately 90% over that time. A company that decreases its dividend over time generally isn't what we are looking for.

Dividend Growth Potential Is Shaky

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. YGM Trading's earnings per share has shrunk at 25% a year over the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

The Dividend Could Prove To Be Unreliable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 3 warning signs for YGM Trading you should be aware of, and 1 of them is concerning. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:375

YGM Trading

An investment holding company, engages in the wholesale and retail of garments in Hong Kong, Taiwan, Mainland China, the United Kingdom, and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success