David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Texhong Textile Group Limited (HKG:2678) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Texhong Textile Group

How Much Debt Does Texhong Textile Group Carry?

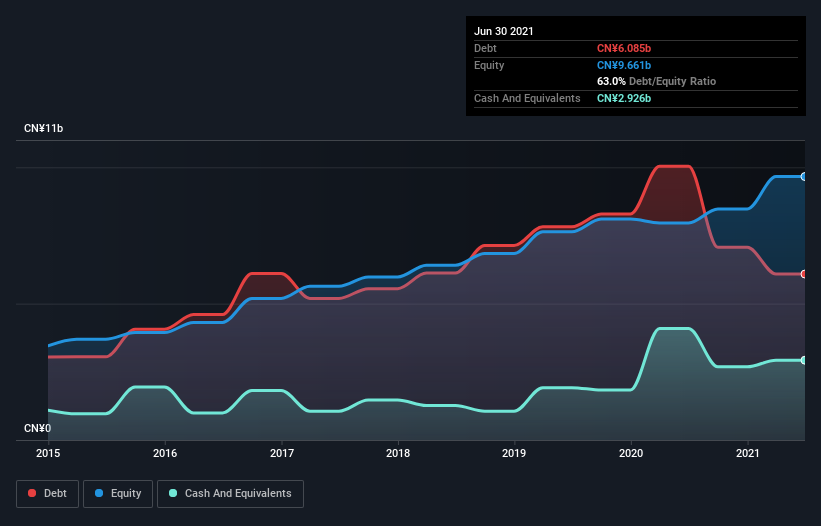

As you can see below, Texhong Textile Group had CN¥6.09b of debt at June 2021, down from CN¥10.0b a year prior. On the flip side, it has CN¥2.93b in cash leading to net debt of about CN¥3.16b.

How Strong Is Texhong Textile Group's Balance Sheet?

We can see from the most recent balance sheet that Texhong Textile Group had liabilities of CN¥9.10b falling due within a year, and liabilities of CN¥3.50b due beyond that. Offsetting these obligations, it had cash of CN¥2.93b as well as receivables valued at CN¥2.39b due within 12 months. So it has liabilities totalling CN¥7.29b more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of CN¥8.30b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Texhong Textile Group's net debt is only 0.99 times its EBITDA. And its EBIT covers its interest expense a whopping 10.8 times over. So we're pretty relaxed about its super-conservative use of debt. In addition to that, we're happy to report that Texhong Textile Group has boosted its EBIT by 99%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Texhong Textile Group can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Texhong Textile Group generated free cash flow amounting to a very robust 81% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

The good news is that Texhong Textile Group's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. But, on a more sombre note, we are a little concerned by its level of total liabilities. When we consider the range of factors above, it looks like Texhong Textile Group is pretty sensible with its use of debt. While that brings some risk, it can also enhance returns for shareholders. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Texhong Textile Group you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Texhong International Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2678

Texhong International Group

An investment holding company, primarily manufactures and sells yarns, grey fabrics, and non-woven and garment fabrics.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives