Strong week for Citychamp Watch & Jewellery Group (HKG:256) shareholders doesn't alleviate pain of five-year loss

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in Citychamp Watch & Jewellery Group Limited (HKG:256), since the last five years saw the share price fall 33%. But it's up 8.8% in the last week.

While the stock has risen 8.8% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Citychamp Watch & Jewellery Group

Citychamp Watch & Jewellery Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over half a decade Citychamp Watch & Jewellery Group reduced its trailing twelve month revenue by 15% for each year. That's definitely a weaker result than most pre-profit companies report. It seems pretty reasonable to us that the share price dipped 6% per year in that time. This loss means the stock shareholders are probably pretty annoyed. Risk averse investors probably wouldn't like this one much.

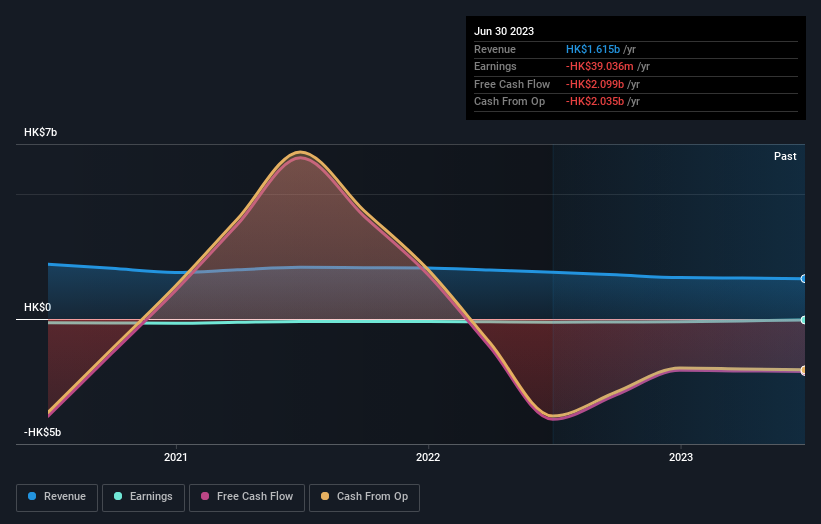

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Citychamp Watch & Jewellery Group's earnings, revenue and cash flow.

A Different Perspective

While it's never nice to take a loss, Citychamp Watch & Jewellery Group shareholders can take comfort that their trailing twelve month loss of 15% wasn't as bad as the market loss of around 16%. Given the total loss of 6% per year over five years, it seems returns have deteriorated in the last twelve months. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. It's always interesting to track share price performance over the longer term. But to understand Citychamp Watch & Jewellery Group better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Citychamp Watch & Jewellery Group .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:256

Citychamp Watch & Jewellery Group

An investment holding company, manufactures, sells, and distributes watches and timepieces in Hong Kong, the People’s Republic of China, Switzerland, the United Kingdom, Liechtenstein, and internationally.

Adequate balance sheet very low.