China Anchu Energy Storage Group (HKG:2399 investor three-year losses grow to 88% as the stock sheds HK$522m this past week

As an investor, mistakes are inevitable. But really bad investments should be rare. So consider, for a moment, the misfortune of China Anchu Energy Storage Group Limited (HKG:2399) investors who have held the stock for three years as it declined a whopping 88%. That would be a disturbing experience. More recently, the share price has dropped a further 36% in a month. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for China Anchu Energy Storage Group

China Anchu Energy Storage Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, China Anchu Energy Storage Group grew revenue at 34% per year. That is faster than most pre-profit companies. So why has the share priced crashed 23% per year, in the same time? The share price makes us wonder if there is an issue with profitability. Sometimes fast revenue growth doesn't lead to profits. Unless the balance sheet is strong, the company might have to raise capital.

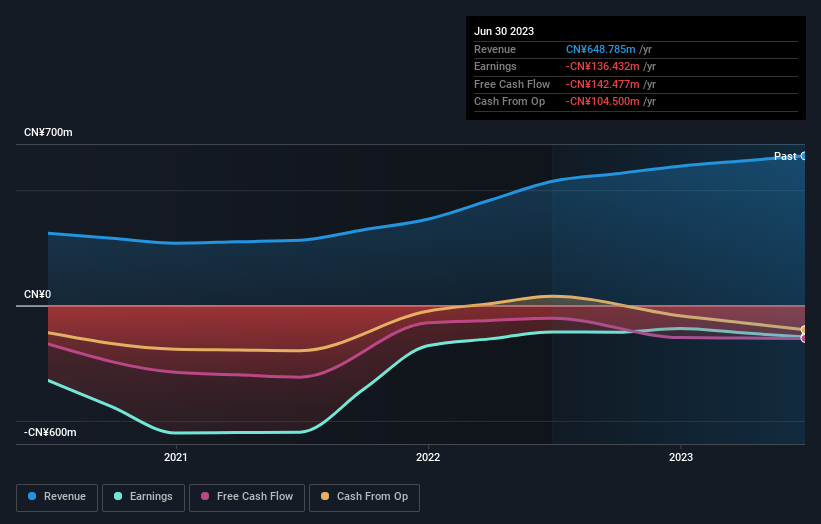

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Dive deeper into the earnings by checking this interactive graph of China Anchu Energy Storage Group's earnings, revenue and cash flow.

A Different Perspective

While it's never nice to take a loss, China Anchu Energy Storage Group shareholders can take comfort that their trailing twelve month loss of 1.9% wasn't as bad as the market loss of around 11%. Of far more concern is the 12% p.a. loss served to shareholders over the last five years. While the losses are slowing we doubt many shareholders are happy with the stock. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with China Anchu Energy Storage Group (at least 2 which are concerning) , and understanding them should be part of your investment process.

China Anchu Energy Storage Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2399

China Anchu Energy Storage Group

Designs, an investment holding company, manufactures and wholesales a range of menswear products under the FORDOO brand in the People’s Republic of China, Saudi Arabia, and other Middle Eastern countries.

Mediocre balance sheet minimal.