Stock Analysis

- Hong Kong

- /

- Consumer Durables

- /

- SEHK:2358

Jiu Rong Holdings Full Year 2023 Earnings: HK$0.07 loss per share (vs HK$0.016 loss in FY 2022)

Jiu Rong Holdings (HKG:2358) Full Year 2023 Results

Key Financial Results

- Revenue: HK$471.8m (down 44% from FY 2022).

- Net loss: HK$383.3m (loss widened by 325% from FY 2022).

- HK$0.07 loss per share (further deteriorated from HK$0.016 loss in FY 2022).

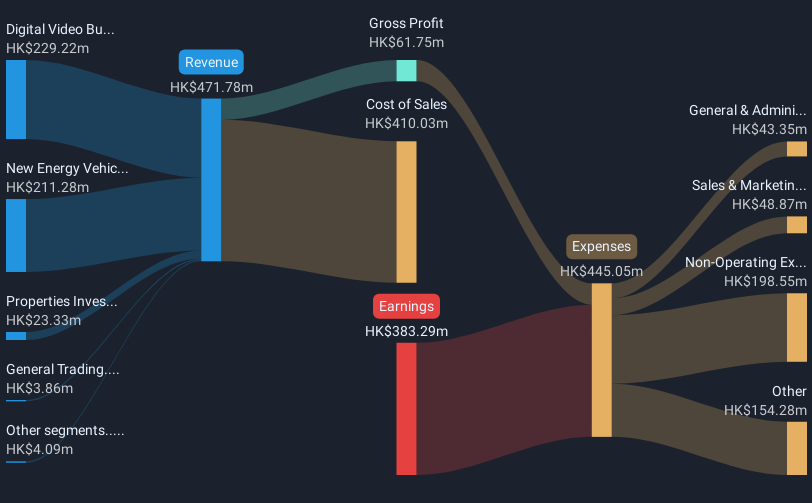

All figures shown in the chart above are for the trailing 12 month (TTM) period

The primary driver behind last 12 months revenue was the Digital Video Business segment contributing a total revenue of HK$229.2m (49% of total revenue). Notably, cost of sales worth HK$410.0m amounted to 87% of total revenue thereby underscoring the impact on earnings. The most substantial expense, totaling HK$198.5m were related to Non-Operating costs. This indicates that a significant portion of the company's costs is related to non-core activities. Explore how 2358's revenue and expenses shape its earnings.

Jiu Rong Holdings shares are up 44% from a week ago.

Risk Analysis

It is worth noting though that we have found 4 warning signs for Jiu Rong Holdings (3 are potentially serious!) that you need to take into consideration.

Valuation is complex, but we're helping make it simple.

Find out whether Jiu Rong Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Jiu Rong Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2358

Jiu Rong Holdings

An investment holding company, researches for, develops, manufactures, and sells digital televisions (TVs), high definition liquid crystal display TVs, and set-top boxes in the People’s Republic of China and Hong Kong.

Low and slightly overvalued.