Billion Industrial Holdings Limited's (HKG:2299) Shares May Have Run Too Fast Too Soon

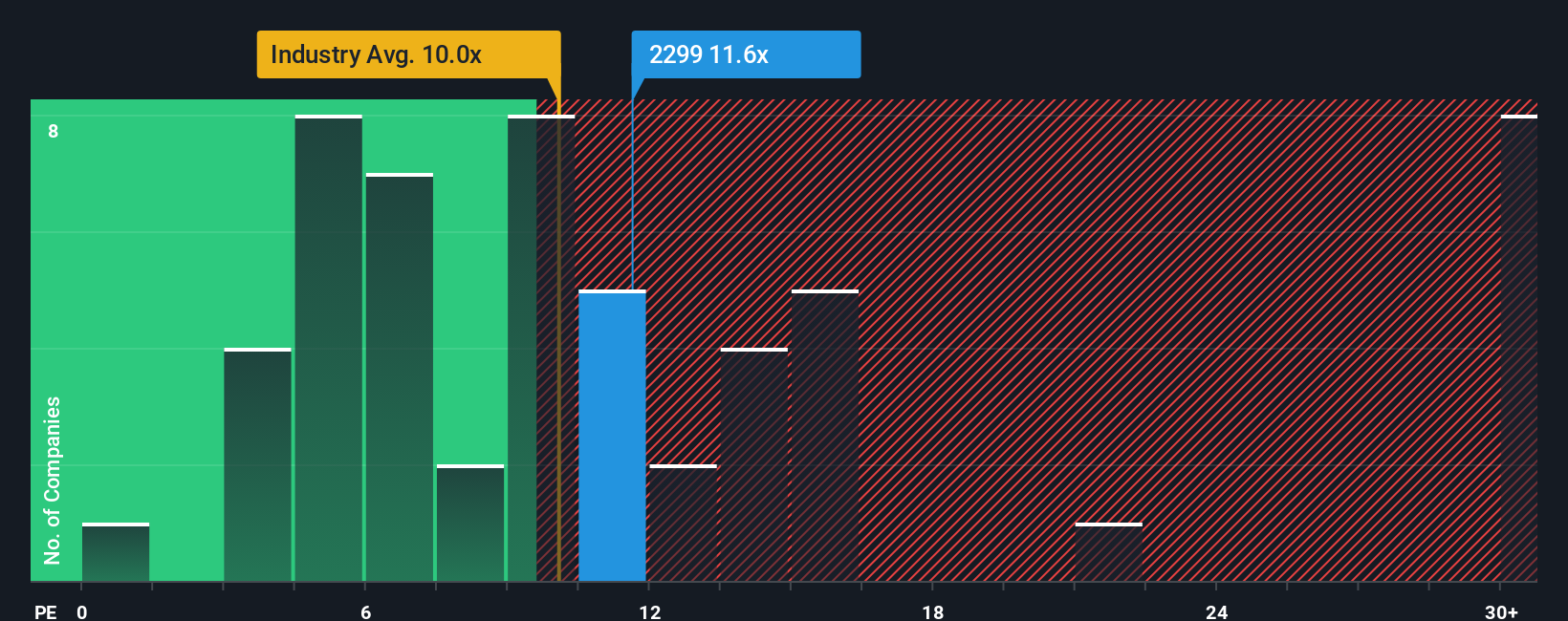

It's not a stretch to say that Billion Industrial Holdings Limited's (HKG:2299) price-to-earnings (or "P/E") ratio of 11.6x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 12x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been quite advantageous for Billion Industrial Holdings as its earnings have been rising very briskly. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Billion Industrial Holdings

How Is Billion Industrial Holdings' Growth Trending?

Billion Industrial Holdings' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a terrific increase of 67%. However, this wasn't enough as the latest three year period has seen a very unpleasant 50% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 20% shows it's an unpleasant look.

With this information, we find it concerning that Billion Industrial Holdings is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

What We Can Learn From Billion Industrial Holdings' P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Billion Industrial Holdings currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 2 warning signs for Billion Industrial Holdings that we have uncovered.

If you're unsure about the strength of Billion Industrial Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Billion Industrial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2299

Billion Industrial Holdings

Engages in manufacturing and sales of polyester filament yarns, polyester, polyester industrial yarns, and ES fiber products in the People’s Republic of China and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives