How Does National Electronics Holdings' (HKG:213) CEO Pay Compare With Company Performance?

James Lee has been the CEO of National Electronics Holdings Limited (HKG:213) since 2005, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for National Electronics Holdings

How Does Total Compensation For James Lee Compare With Other Companies In The Industry?

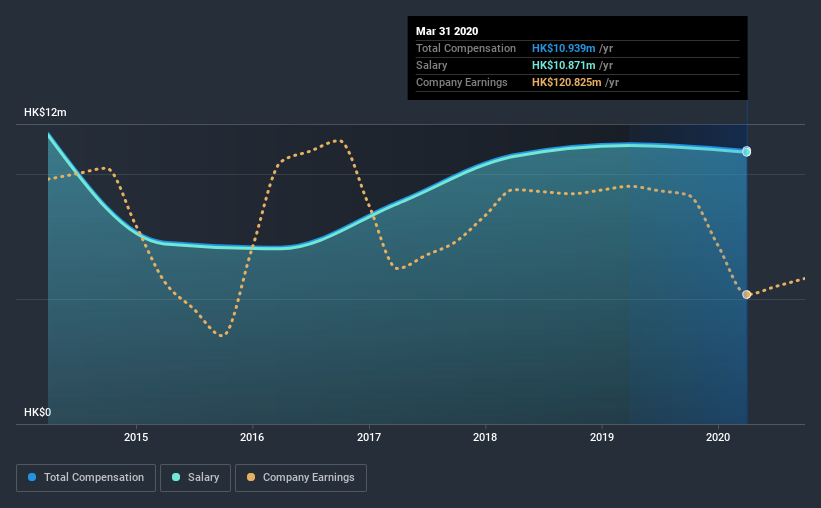

Our data indicates that National Electronics Holdings Limited has a market capitalization of HK$1.0b, and total annual CEO compensation was reported as HK$11m for the year to March 2020. This means that the compensation hasn't changed much from last year. Notably, the salary which is HK$10.9m, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$2.6m. Accordingly, our analysis reveals that National Electronics Holdings Limited pays James Lee north of the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$11m | HK$11m | 99% |

| Other | HK$68k | HK$68k | 1% |

| Total Compensation | HK$11m | HK$11m | 100% |

Talking in terms of the industry, salary represented approximately 93% of total compensation out of all the companies we analyzed, while other remuneration made up 7.2% of the pie. National Electronics Holdings has gone down a largely traditional route, paying James Lee a high salary, giving it preference over non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at National Electronics Holdings Limited's Growth Numbers

Over the last three years, National Electronics Holdings Limited has shrunk its earnings per share by 6.7% per year. It achieved revenue growth of 76% over the last year.

The reduction in EPS, over three years, is arguably concerning. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has National Electronics Holdings Limited Been A Good Investment?

Given the total shareholder loss of 2.6% over three years, many shareholders in National Electronics Holdings Limited are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

National Electronics Holdings pays its CEO a majority of compensation through a salary. As previously discussed, James is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. At the same time, looking at EPS and total shareholder returns, it's tough to say National Electronics Holdings is in a sound position, considering both metrics are down. On a more positive note, the company has produced a more positive revenue growth more recently. Few would argue that it's wise for the company to pay any more, before returns improve.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 5 warning signs for National Electronics Holdings (2 are concerning!) that you should be aware of before investing here.

Switching gears from National Electronics Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade National Electronics Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if National Electronics Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:213

National Electronics Holdings

An investment holding company, manufactures, assembles, and sells electronic watches and watch parts in the People’s Republic of China, Hong Kong, North America, Europe, and internationally.

Slight risk with acceptable track record.

Market Insights

Community Narratives