ANTA Sports (SEHK:2020): Evaluating Valuation After High-Profile Paris Fashion Launch and Global Brand Push

Reviewed by Simply Wall St

ANTA Sports Products (SEHK:2020) made waves this week by unveiling its ANTAZERO X KRIS VAN ASSCHE collection at Dover Street Market Paris. This move signals a strategic push into the global fashion landscape through a unique blend of sustainability and high-profile collaboration.

See our latest analysis for ANTA Sports Products.

The global collaboration buzz appears to have rekindled investor enthusiasm for ANTA Sports, with a 1.95% one-day share price return and 3.47% gain over the past week helping to offset recent weakness. While the stock weathered a 19.15% decline over the past three months, its total shareholder return for the year remains a solid 11.7% as the brand’s international moves suggest that fresh long-term momentum may be building.

If ANTA's leap into global fashion has you watching for emerging leaders, you may want to broaden your search and discover fast growing stocks with high insider ownership

With such a highly anticipated collection launch and improving global narrative, is ANTA Sports now trading at a discount for future growth, or has the recent rally already priced in the opportunity for investors?

Most Popular Narrative: 26.8% Undervalued

ANTA Sports Products’ last close of HK$83.6 sits well below the narrative's fair value estimate of HK$114.14, suggesting a strong disconnect between current market price and projected fundamentals. The difference is driven by confidence in both the global expansion strategy and multi-year growth initiatives, according to the most widely followed narrative.

Strategic focus on multi-brand management and globalization efforts, including replicating success in China to international markets, aims to expand market reach and revenue streams outside of Greater China. This positively influences overall company revenue.

Curious how bold international ambitions and high double-digit growth projections come together for such a decisive valuation call? The expectations for margin evolution, share repurchases, and ambitious global sales targets are just the start. What specific assumptions justify this fair value? And what if one of them breaks down? Unlock the full story to see how these forecasts could reshape your view on ANTA Sports.

Result: Fair Value of $114.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened competition and rising operational costs could diminish ANTA Sports’ growth prospects. These factors could potentially challenge the upbeat valuation outlook if left unchecked.

Find out about the key risks to this ANTA Sports Products narrative.

Another View: The Multiples Tell a Different Story

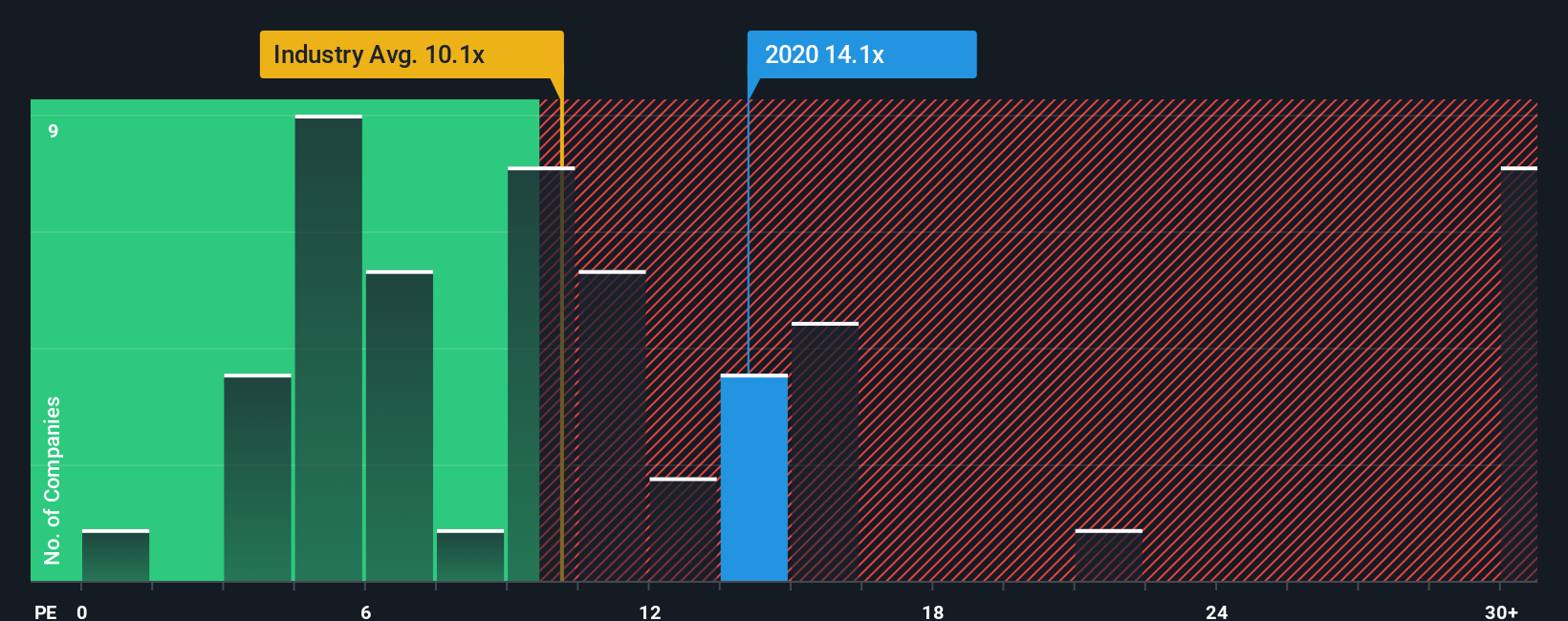

While the fair value narrative suggests ANTA Sports shares are undervalued, the price-to-earnings ratio tells a more cautious tale. At 14.3x earnings, the company trades above the fair ratio of 12.6x. It is also more expensive than the Hong Kong Luxury industry’s 10x average, signaling some valuation risk if market expectations shift.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ANTA Sports Products Narrative

If you see this story differently, or want to dive into the fundamentals yourself, you can craft a fresh perspective in just minutes. Do it your way

A great starting point for your ANTA Sports Products research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop at just one opportunity. Step up your strategy now by tapping into powerful stock ideas that could shape your next winning move:

- Uncover new income streams and stability when you browse these 15 dividend stocks with yields > 3% with strong yields and consistent payouts.

- Accelerate your tech portfolio by examining these 26 AI penny stocks at the forefront of artificial intelligence innovation and future-ready business models.

- Stay ahead of the curve by targeting growth potential among these 3588 penny stocks with strong financials. These could become tomorrow’s market leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2020

ANTA Sports Products

Engages in the research, design, development, manufacture, market, and sale of professional sports footwear, apparel, and accessories in China and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success