Here's Why We Think Samsonite International (HKG:1910) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Samsonite International (HKG:1910). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Samsonite International with the means to add long-term value to shareholders.

View our latest analysis for Samsonite International

How Fast Is Samsonite International Growing Its Earnings Per Share?

Samsonite International has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Samsonite International's EPS shot up from US$0.22 to US$0.29; a result that's bound to keep shareholders happy. That's a fantastic gain of 31%.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Samsonite International is growing revenues, and EBIT margins improved by 3.3 percentage points to 18%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

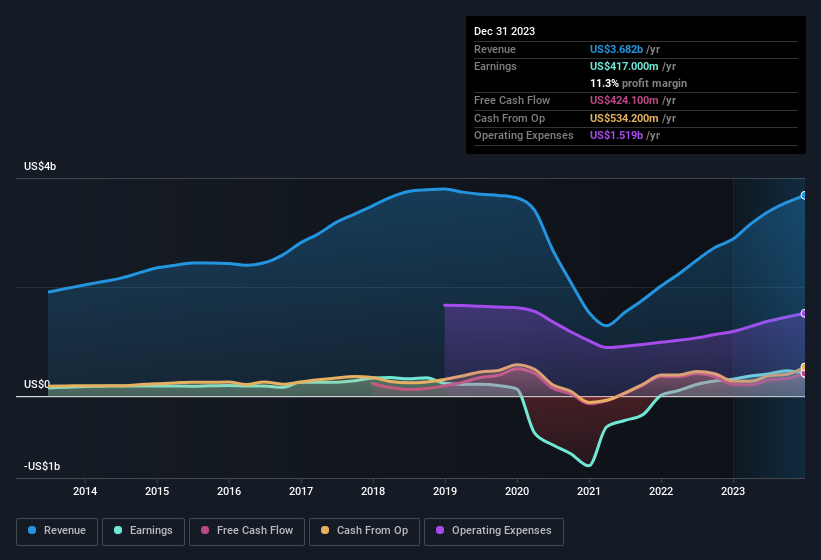

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Samsonite International.

Are Samsonite International Insiders Aligned With All Shareholders?

Owing to the size of Samsonite International, we wouldn't expect insiders to hold a significant proportion of the company. But we do take comfort from the fact that they are investors in the company. Notably, they have an enviable stake in the company, worth US$1.8b. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Is Samsonite International Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Samsonite International's strong EPS growth. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Samsonite International's continuing strength. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Samsonite International that you should be aware of.

Although Samsonite International certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Hong Kong companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1910

Samsonite Group

Engages in the design, manufacture, sourcing, and distribution of luggage, business and computer bags, outdoor and casual bags, and travel accessories in Asia, North America, Europe, and Latin America.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives