- Japan

- /

- Construction

- /

- TSE:1885

Undiscovered Gems in Asia to Explore This November 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances and cautious monetary policies, small-cap stocks in Asia present intriguing opportunities for investors looking to explore under-the-radar assets. In the context of fluctuating interest rates and economic shifts, identifying stocks with robust fundamentals and resilience to market volatility can be key to uncovering potential gems in this dynamic region.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Asian Terminals | 25.82% | 12.05% | 17.00% | ★★★★★★ |

| YagiLtd | 27.83% | -6.06% | 32.03% | ★★★★★★ |

| Lumax International | NA | 5.90% | 5.96% | ★★★★★★ |

| Nantong Guosheng Intelligence Technology Group | NA | 5.01% | -3.27% | ★★★★★★ |

| Shenzhen Coship Electronics | NA | 34.28% | 60.52% | ★★★★★★ |

| Xiamen Jiarong TechnologyLtd | 8.54% | -5.04% | -25.38% | ★★★★★★ |

| Shenzhen iN-Cube Automation | NA | 6.40% | -11.91% | ★★★★★★ |

| Jiangsu Lianfa TextileLtd | 16.06% | 0.19% | -13.07% | ★★★★★☆ |

| Shenzhen China Micro Semicon | 6.54% | 5.94% | -43.71% | ★★★★★☆ |

| Shanghai SK Automation TechnologyLtd | 26.22% | 27.36% | 28.69% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Home Control International (SEHK:1747)

Simply Wall St Value Rating: ★★★★★★

Overview: Home Control International Limited is an investment holding company that offers home control solutions across North America, Europe, Asia, and Latin America with a market capitalization of HK$2.90 billion.

Operations: Home Control International generates revenue primarily from its electronic components and parts segment, which amounted to $114.91 million. The company has a market capitalization of HK$2.90 billion.

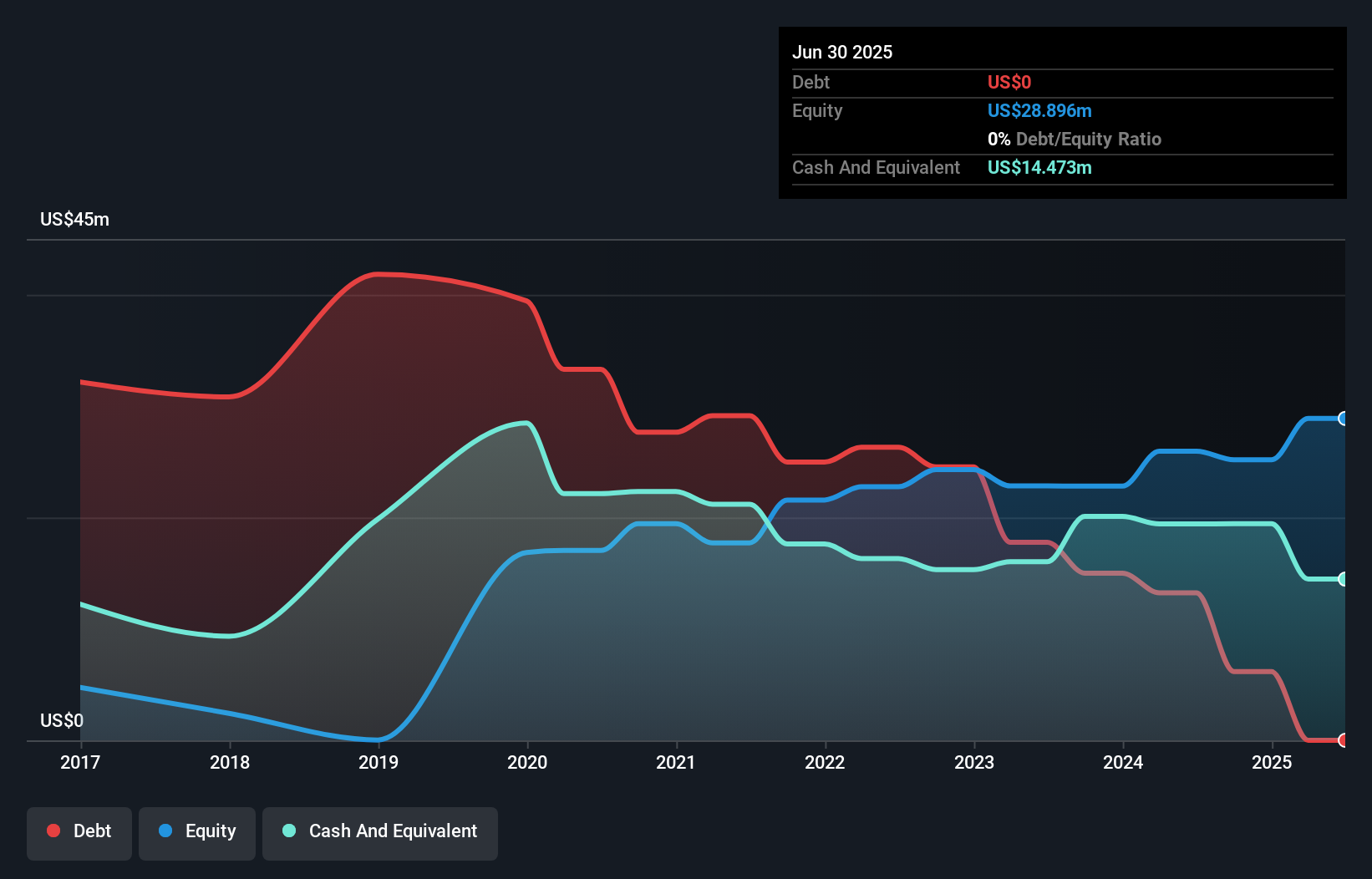

Home Control International, a nimble player in the Asian market, is making strategic moves into healthcare with its new subsidiary, Orbiva Limited. The company has no debt and saw earnings growth of 40.8% last year, outpacing the Consumer Durables industry. However, a one-off loss of US$3.4M impacted recent results. Despite this setback, revenue is projected to grow at 29.87% annually as they expand into AIoT-enabled healthcare solutions and services through Orbiva Limited. The company's share price has been volatile recently but remains free cash flow positive while leveraging its expertise in smart control technology for future growth opportunities.

- Dive into the specifics of Home Control International here with our thorough health report.

Learn about Home Control International's historical performance.

Fujian Yuanxiang New MaterialsLtd (SZSE:301300)

Simply Wall St Value Rating: ★★★★★★

Overview: Fujian Yuanxiang New Materials Co., Ltd is involved in the research, development, production, and sale of silica both domestically and internationally, with a market capitalization of approximately CN¥3.29 billion.

Operations: Yuanxiang generates revenue primarily from its chemical products segment, amounting to CN¥486.22 million.

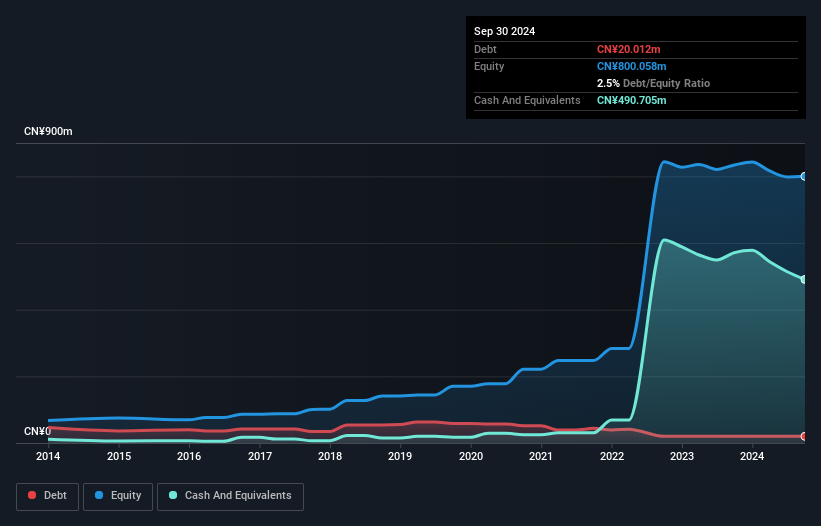

Fujian Yuanxiang New Materials, a nimble player in the chemicals sector, has shown impressive financial strides. Its earnings grew by 105% over the past year, outpacing the industry's 6.8% growth rate. The company's net income for the first nine months of 2025 was CNY 65.15 million, nearly doubling from CNY 33.31 million last year, with basic earnings per share rising to CNY 1.04 from CNY 0.53 previously. Despite a history of declining earnings at an annual rate of 8.1% over five years, its debt-to-equity ratio improved significantly from 23.5% to just 1.2%, demonstrating effective financial management and resilience amidst industry challenges.

TOA (TSE:1885)

Simply Wall St Value Rating: ★★★★★★

Overview: TOA Corporation offers construction and engineering services in Japan, with a market cap of ¥206.45 billion.

Operations: The company generates revenue primarily from construction and engineering services. The revenue model focuses on these segments, contributing significantly to its financial performance. Gross profit margin has shown variation, reflecting changes in cost structure or pricing strategies over time.

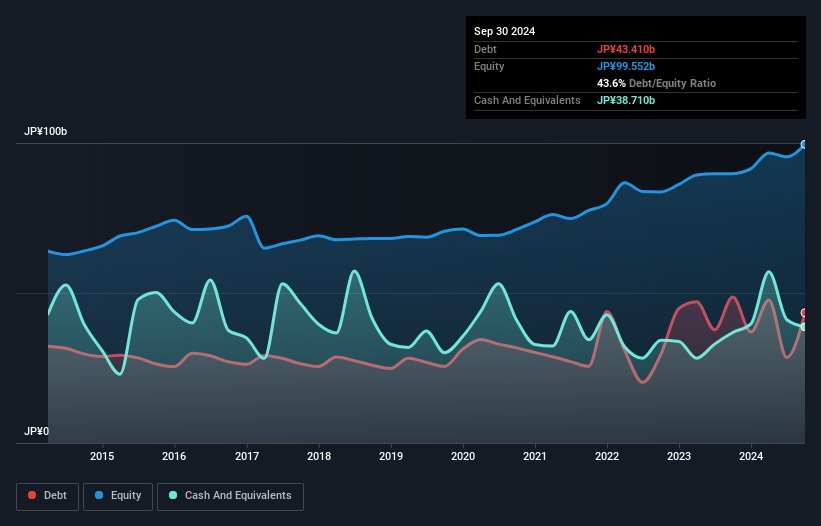

TOA Corporation, a relatively small player in the construction industry, has shown resilience with earnings growing at 22.7% annually over five years. Despite not outpacing the industry's 33.4% growth last year, TOA's net debt to equity ratio of 1.8% is deemed satisfactory and its interest payments are well covered by EBIT at 173 times. Recent updates reveal an upward revision in financial forecasts for fiscal year ending March 2026, with expected net sales of ¥342 billion and operating profit of ¥21.5 billion due to strong domestic and international project execution. Additionally, TOA repurchased shares worth ¥3.13 billion recently, reflecting confidence in its value proposition.

- Click here to discover the nuances of TOA with our detailed analytical health report.

Gain insights into TOA's past trends and performance with our Past report.

Make It Happen

- Gain an insight into the universe of 2486 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1885

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives