Stock Analysis

Amidst a backdrop of fluctuating global markets, Hong Kong's Hang Seng Index has shown resilience, marking a notable increase. This environment sets an intriguing stage for investors interested in growth companies with high insider ownership, which often signals confidence in the company's prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| iDreamSky Technology Holdings (SEHK:1119) | 20.2% | 104.1% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Fenbi (SEHK:2469) | 32.8% | 43% |

| Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

| Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

| DPC Dash (SEHK:1405) | 38.2% | 90.2% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

| Beijing Airdoc Technology (SEHK:2251) | 28.7% | 83.9% |

| Ocumension Therapeutics (SEHK:1477) | 23.1% | 93.7% |

Here's a peek at a few of the choices from the screener.

BYD (SEHK:1211)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$781.48 billion.

Operations: The company operates primarily in the automobile and battery sectors, generating revenues across various international markets.

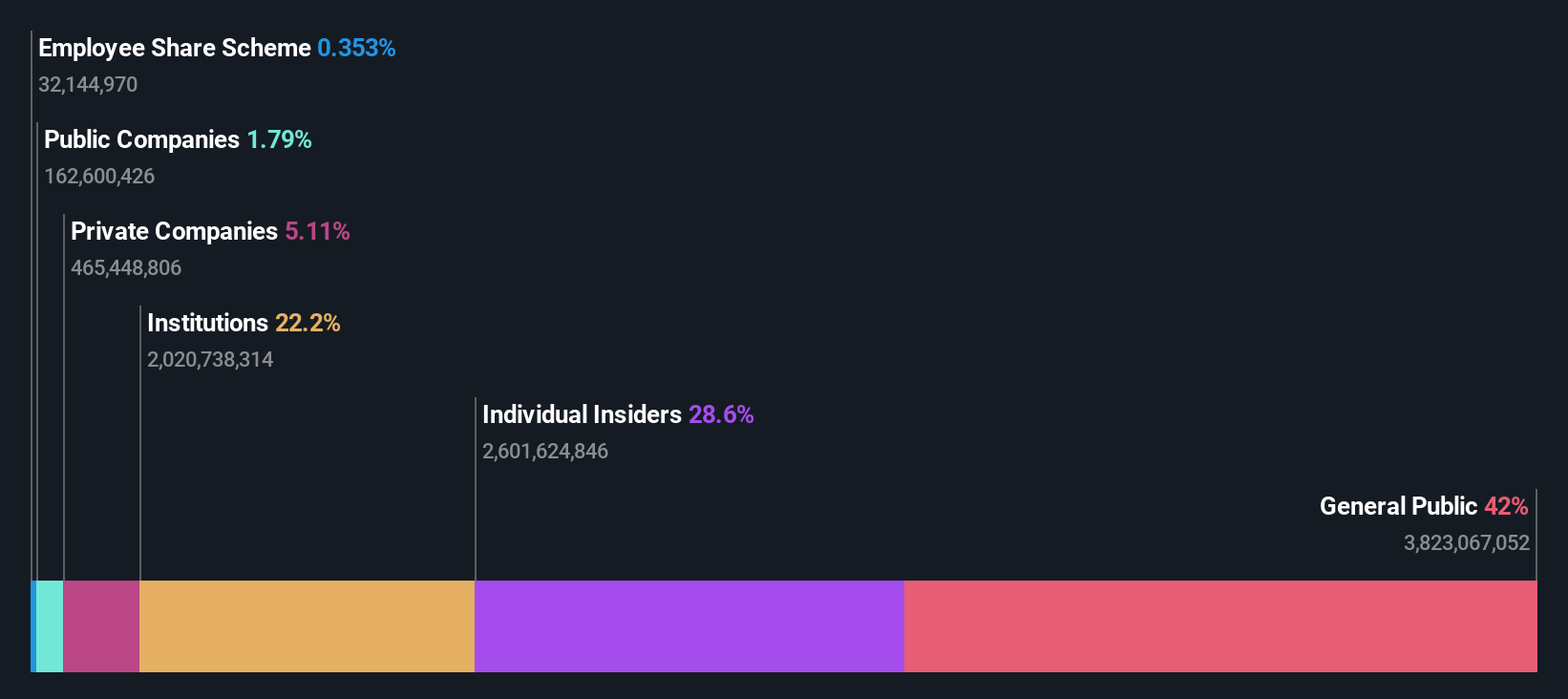

Insider Ownership: 30.1%

BYD, a prominent player in Hong Kong's growth companies with substantial insider ownership, has demonstrated robust performance and strategic advancements. The company's revenue is projected to grow at 14.1% annually, outpacing the Hong Kong market average of 7.7%. Additionally, BYD's earnings are expected to increase by 15.3% per year, also exceeding local market trends. Recent operational data highlights significant year-over-year increases in both production and sales volumes for June 2024, underscoring strong market demand and operational efficiency. Despite these positives, the stock is currently trading at a considerable discount of 46.6% below its estimated fair value, suggesting potential undervaluation issues or market misperceptions that could influence investor sentiment.

- Click here to discover the nuances of BYD with our detailed analytical future growth report.

- Our expertly prepared valuation report BYD implies its share price may be too high.

Pacific Textiles Holdings (SEHK:1382)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pacific Textiles Holdings Limited is a company engaged in the manufacturing and trading of textile products, with a market capitalization of approximately HK$2.46 billion.

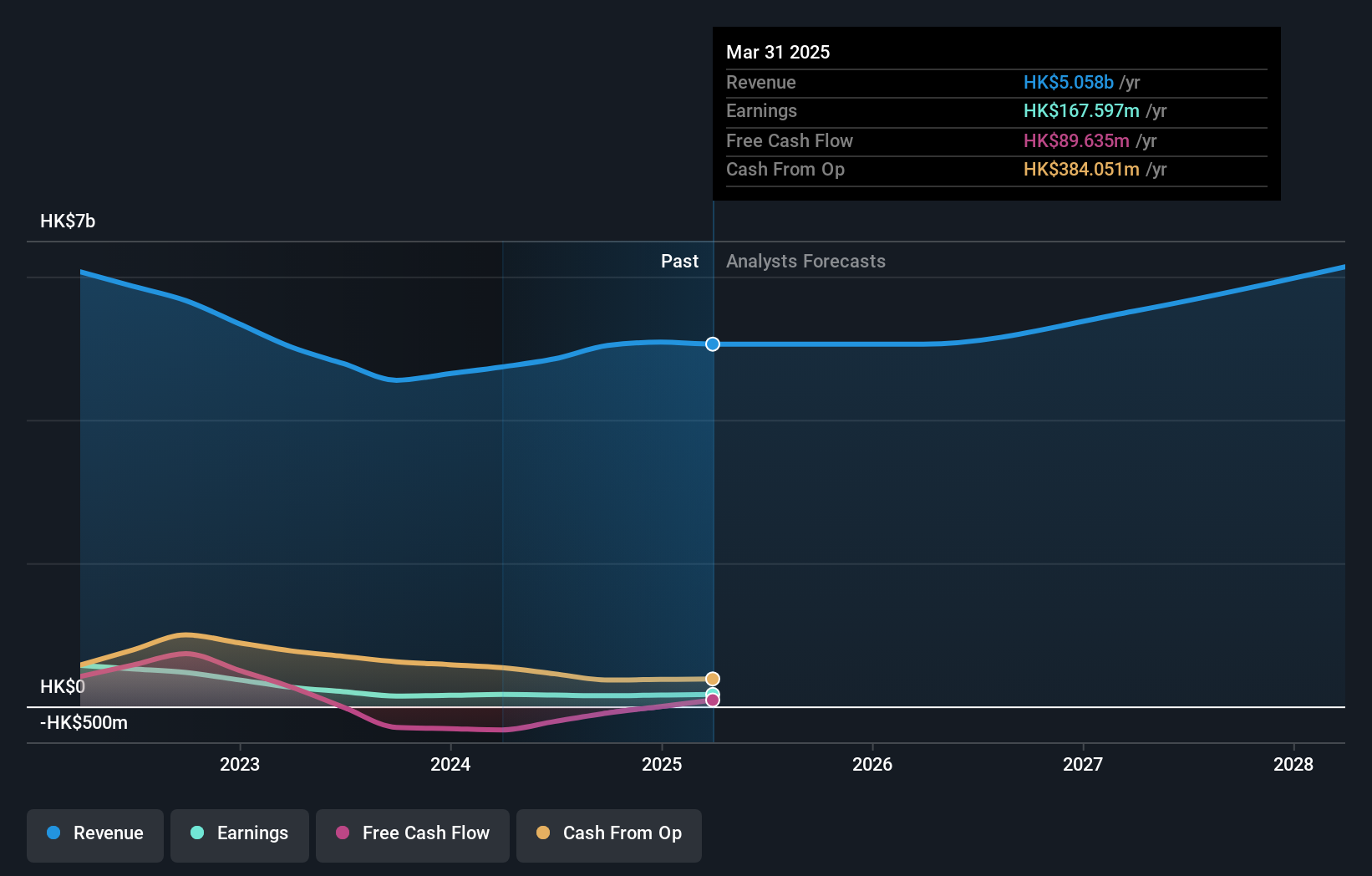

Operations: The company generates revenue primarily from the manufacturing and trading of textile products, totaling approximately HK$4.67 billion.

Insider Ownership: 11.2%

Pacific Textiles Holdings, a key entity in Hong Kong's growth landscape with significant insider ownership, is navigating through a challenging phase. The company's earnings are forecasted to grow by 37.67% annually over the next three years, outstripping the local market's average. However, recent financial reports show a decline in sales and net income compared to the previous year, alongside unstable dividend records and substantial one-off items affecting earnings quality. Despite these hurdles, Pacific Textiles remains poised for above-market revenue growth at 11.8% annually.

- Take a closer look at Pacific Textiles Holdings' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Pacific Textiles Holdings is trading beyond its estimated value.

Zylox-Tonbridge Medical Technology (SEHK:2190)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zylox-Tonbridge Medical Technology Co., Ltd. is a medical device company specializing in neuro- and peripheral-vascular interventional devices, operating both in the People’s Republic of China and internationally, with a market capitalization of approximately HK$3.62 billion.

Operations: The company's revenue from the sale of neurovascular and peripheral-vascular interventional surgical devices amounted to CN¥527.75 million.

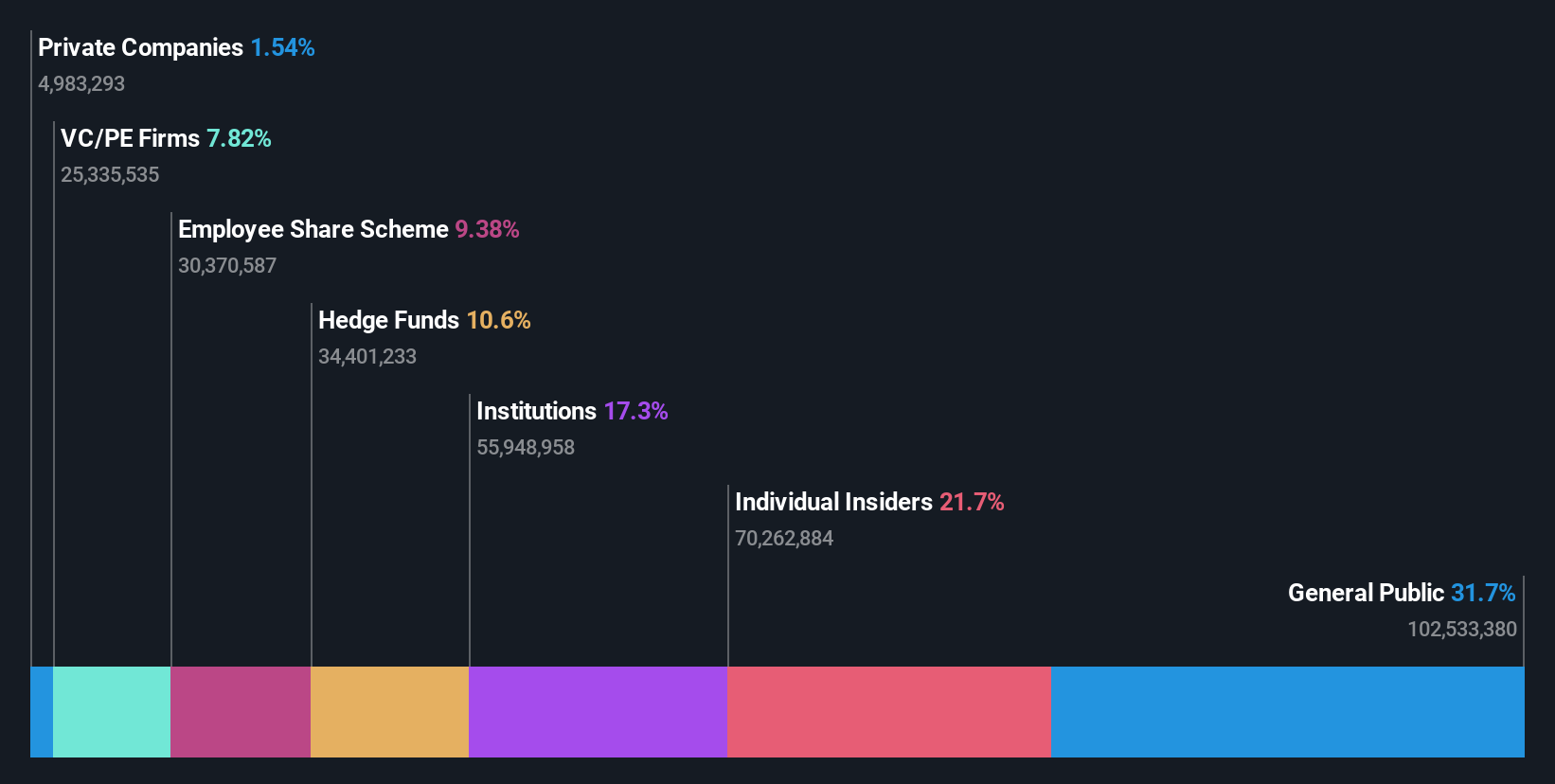

Insider Ownership: 18.7%

Zylox-Tonbridge Medical Technology Co., Ltd. is set to experience robust growth, with its revenue forecasted to expand at 24.1% annually, significantly outpacing the Hong Kong market's 7.7%. Despite a low projected return on equity of 7.6% in three years, the company is trading at a substantial discount of 49.3% below its estimated fair value and earnings are expected to surge by 79.31% per year. Recent approvals for their ZYLOX Unicorn® Suture-mediated Closure System highlight strong innovation, enhancing their market presence amid high insider ownership but no recent insider trading reported.

- Click to explore a detailed breakdown of our findings in Zylox-Tonbridge Medical Technology's earnings growth report.

- Our expertly prepared valuation report Zylox-Tonbridge Medical Technology implies its share price may be lower than expected.

Summing It All Up

- Delve into our full catalog of 54 Fast Growing SEHK Companies With High Insider Ownership here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1382

Pacific Textiles Holdings

Manufactures and trades in textile products in the People’s Republic of China, Vietnam, Bangladesh, Hong Kong, Indonesia, Sri Lanka, Cambodia, the United States, Jordan, Africa, Haiti, India, rest of Asia, and internationally.

High growth potential with excellent balance sheet.