Recent 4.3% pullback isn't enough to hurt long-term Golden Solar New Energy Technology Holdings (HKG:1121) shareholders, they're still up 734% over 5 years

It hasn't been the best quarter for Golden Solar New Energy Technology Holdings Limited (HKG:1121) shareholders, since the share price has fallen 27% in that time. But that does not change the realty that the stock's performance has been terrific, over five years. To be precise, the stock price is 734% higher than it was five years ago, a wonderful performance by any measure. So we don't think the recent decline in the share price means its story is a sad one. Only time will tell if there is still too much optimism currently reflected in the share price. It really delights us to see such great share price performance for investors.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

View our latest analysis for Golden Solar New Energy Technology Holdings

Golden Solar New Energy Technology Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, Golden Solar New Energy Technology Holdings can boast revenue growth at a rate of 18% per year. That's well above most pre-profit companies. Fortunately, the market has not missed this, and has pushed the share price up by 53% per year in that time. Despite the strong run, top performers like Golden Solar New Energy Technology Holdings have been known to go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

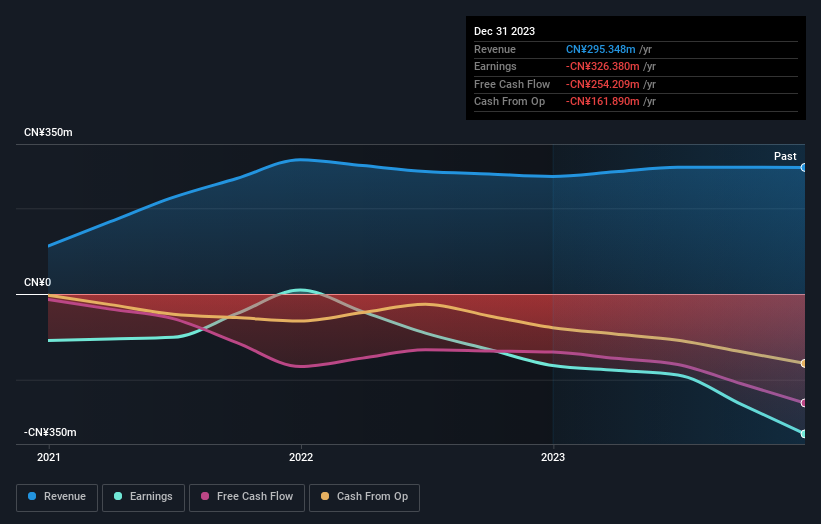

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Golden Solar New Energy Technology Holdings' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Golden Solar New Energy Technology Holdings shareholders are down 26% for the year, but the market itself is up 3.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 53% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Golden Solar New Energy Technology Holdings better, we need to consider many other factors. For instance, we've identified 2 warning signs for Golden Solar New Energy Technology Holdings (1 is a bit concerning) that you should be aware of.

We will like Golden Solar New Energy Technology Holdings better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1121

Golden Solar New Energy Technology Holdings

An investment holding company, manufactures and sells footwear products in the People’s Republic of China, the United States, South America, Europe, South East Asia, and internationally.

Adequate balance sheet low.