As global markets navigate trade policy uncertainties and inflation trends, investors are keenly observing opportunities across various sectors. Penny stocks, while often considered a niche investment category, continue to offer potential growth prospects for those willing to explore smaller or newer companies. These stocks can provide a mix of affordability and growth potential when paired with strong financials, making them an intriguing option for uncovering hidden value in quality companies.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Halcyon Technology (SET:HTECH) | THB2.66 | THB798M | ✅ 2 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 3 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.096 | SGD40.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.18 | SGD35.86M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.12 | SGD8.34B | ✅ 5 ⚠️ 0 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.90 | HK$3.28B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.40 | HK$50.37B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.18 | HK$744.52M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.23 | HK$2.05B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.91 | HK$1.59B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,162 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Golden Solar New Energy Technology Holdings (SEHK:1121)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Golden Solar New Energy Technology Holdings Limited is an investment holding company that manufactures and sells footwear products across various regions including the People’s Republic of China, the United States, South America, Europe, and South East Asia, with a market cap of approximately HK$2.96 billion.

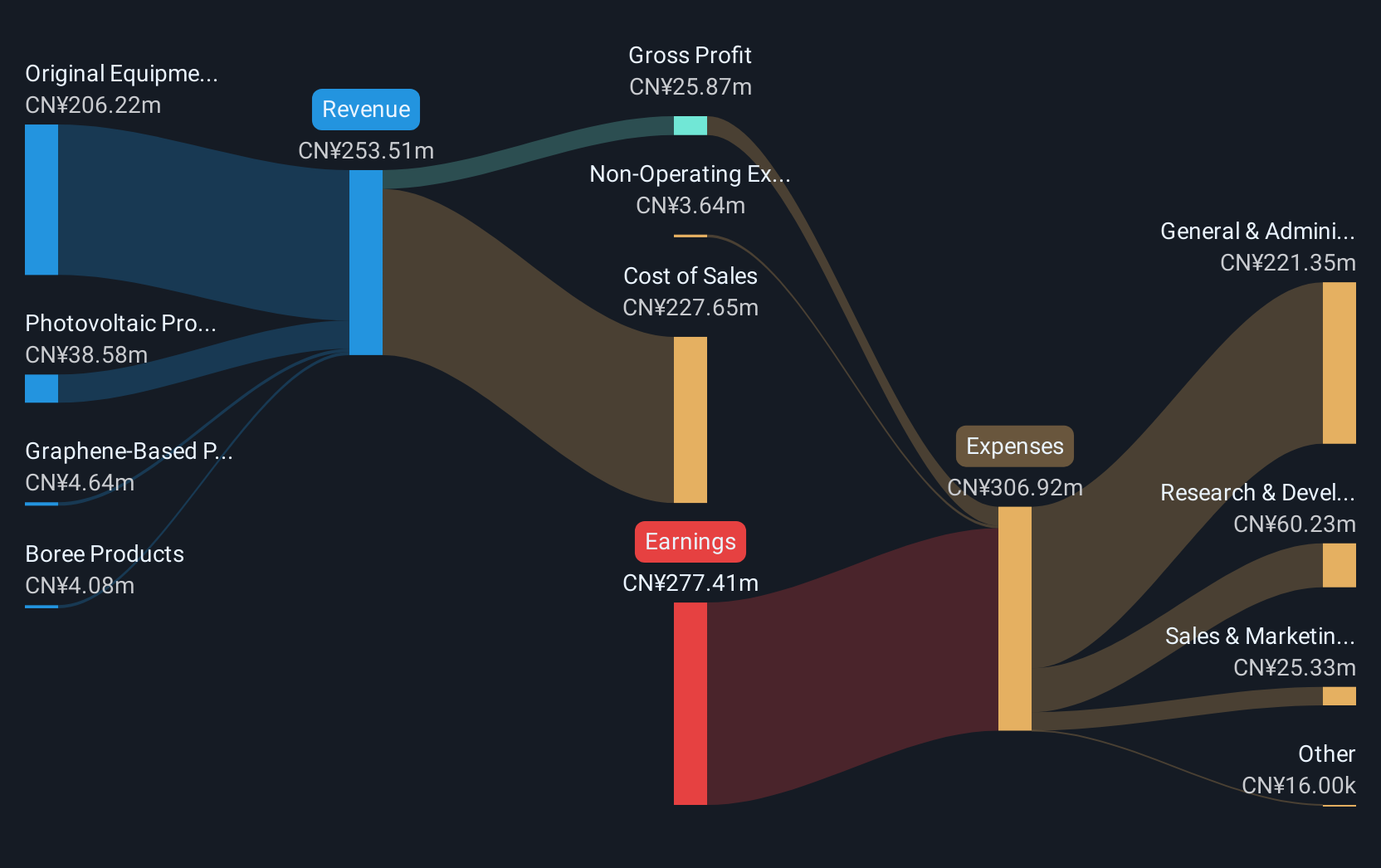

Operations: Golden Solar New Energy Technology Holdings Limited generates revenue from several segments, including CN¥4.08 million from Boree Products, CN¥38.58 million from Photovoltaic Products, CN¥4.64 million from Graphene-Based Products, and CN¥206.22 million from Original Equipment Manufacturer (OEM) services.

Market Cap: HK$2.96B

Golden Solar New Energy Technology Holdings Limited has strategically shifted its focus towards photovoltaic products, leveraging its patented hybrid passivated back contact (HBC) solar cell technology. Recent developments include a licensing agreement with a joint venture for the production of 4GW HBC solar cells, potentially providing a new revenue stream through royalties. Despite this strategic pivot, the company remains unprofitable, with declining sales and net losses reported for 2024. Short-term assets exceed liabilities, but cash runway concerns persist due to negative free cash flow trends. The company's debt levels have improved significantly over recent years.

- Get an in-depth perspective on Golden Solar New Energy Technology Holdings' performance by reading our balance sheet health report here.

- Gain insights into Golden Solar New Energy Technology Holdings' past trends and performance with our report on the company's historical track record.

Yangzijiang Financial Holding (SGX:YF8)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yangzijiang Financial Holding Ltd. is an investment holding company involved in investment-related activities in China and Singapore, with a market cap of SGD2.52 billion.

Operations: The company generates revenue of SGD326.23 million from its investment business segment.

Market Cap: SGD2.52B

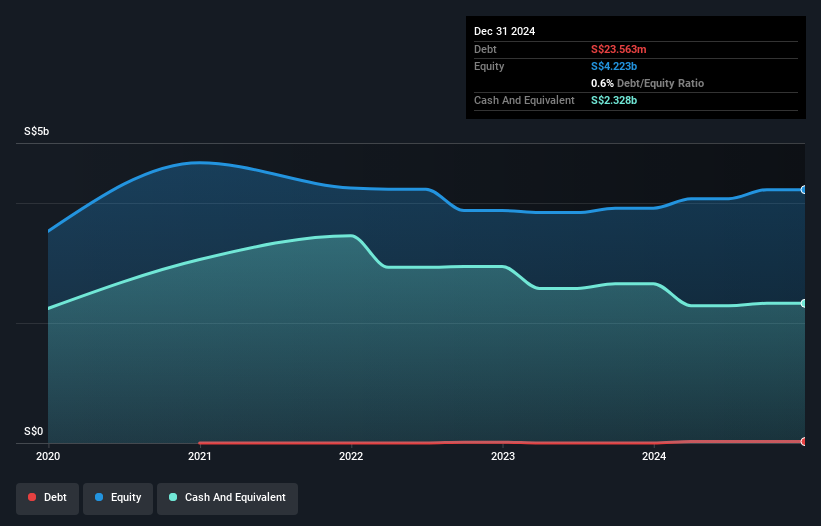

Yangzijiang Financial Holding Ltd. has shown robust financial health, with cash exceeding total debt and strong operating cash flow coverage. The firm is exploring a strategic spin-off of its maritime investments to unlock growth potential, aiming for greater agility and efficient capital allocation. This move aligns with their strategy to focus on diversified asset management in Southeast Asia's emerging markets. Recent dividend approvals highlight shareholder value commitment, while earnings have grown significantly over the past year despite previous declines. However, the board's relatively short tenure may suggest limited experience in navigating complex market dynamics.

- Navigate through the intricacies of Yangzijiang Financial Holding with our comprehensive balance sheet health report here.

- Examine Yangzijiang Financial Holding's earnings growth report to understand how analysts expect it to perform.

Beijing VRV Software (SZSE:300352)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beijing VRV Software Corporation Limited offers network and information security solutions in China, with a market cap of CN¥7.12 billion.

Operations: There are no specific revenue segments reported for this company.

Market Cap: CN¥7.12B

Beijing VRV Software Corporation Limited is currently unprofitable, with earnings declining by 13.7% annually over the past five years. Despite this, it maintains a satisfactory net debt to equity ratio of 10.6%, indicating manageable debt levels. The company reported a significant decrease in revenue to CN¥61.64 million for Q1 2025 from CN¥130.35 million the previous year, alongside a net loss of CN¥52.82 million compared to prior profits. A private placement aims to raise up to CN¥477 million, potentially strengthening its financial position and supporting future initiatives amidst ongoing volatility and strategic challenges in the software sector.

- Unlock comprehensive insights into our analysis of Beijing VRV Software stock in this financial health report.

- Understand Beijing VRV Software's track record by examining our performance history report.

Summing It All Up

- Jump into our full catalog of 1,162 Asian Penny Stocks here.

- Searching for a Fresh Perspective? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing VRV Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300352

Beijing VRV Software

Provides network and information security solutions in China.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives